Summary:

- China promised massive agricultural purchases

- US can struggle to produce enough of soybeans

- Could this be the chance for depressed corn?

Can China live up to the promise?

The main point of the trade deal is a massive increase of the Chinese imports from US with focus on agricultural goods. It’s supposed to rise by $200 bn over two years which means that by the end of 2021 it would more than double. It’d be a gross understatement to say it’s ambitious. US share in the Chinese imports hovered in a close range around 8% before the Trade War started and then dipped to some 6.5%. Recovering the lost ground is one thing but the deal would require this share to grow above 12% within two years.

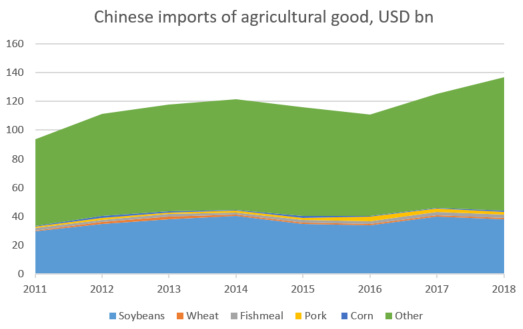

Beyond soybeans, Chinese imports of agricultural goods is very fragmented. Source: Bloomberg, XTB Research

Beyond soybeans, Chinese imports of agricultural goods is very fragmented. Source: Bloomberg, XTB Research

The main focus is imports of agricultural goods that stood around $20 bn a year before the TradeWar erupted and decimated it. China has promised to import around $40 bn a year with intention to add another $5 bn if possible. But is $40 bn even technically possible? Let’s have a look. China is buying agricultural goods worth around $120bn a year so it looks like there’s plenty of space. However, US exports in this area has been dominated by soybeans (at around 55-60% rate). At present prices China is importing soybeans worth around $33 bn a year and the US is responsible for just 15% of that amount (because of tariffs), down from a standard of 45-50%. Let’s assume that China imports as much as 65% (higher number is implausible because of harvest season overlap with that in South America) of their purchases to the US and that leads to 20% price increase. That results in less than $26bn of imports and if other goods made up for the 40% of the total imports, the total would be close to $43bn. So technically the promise is deliverable but only under the most optimistic assumptions: 1) China forcing firms to buy more expensive soybeans from the US 2) imports leading to a major price rally in soybeans 3) significant increase in imports of other goods which is very fragmented and could be hard to stimulate (beef is the second largest good at around $1bn annually amid meat crisis in China). Even if China cleared all those hurdles and delivered such a massive increase in demand, would the US output adjust?

Can the US produce enough soybeans?

The 2019 season was hit by both Trade Wars and weather but the next season should bring an improvement. Assuming a return to average acreage and yields from previous years output should total about 115MT and exports 55MT. If China were to buy the amounts we pointed out above at prices 20% higher than today, exports to China ALONE would need to stand at 59MT. Using average price from 2016 (a year of record China soybean imports from US) that amount would need to rise to 66MT. Given domestic consumption of about 60MT that would already be above the capacity and there’s still exports to other countries that hovers around 20MT.

Impact on SOYBEAN, CORN

Soybean prices have bounced back sharply recently in response to the phase-one trade deal struck between Washington and Beijing. We think that the ongoing rally could continue once the US exports a huge amount of grains to China in the coming quarters. In theory, a move through the highs from 2018 could occur. Source: xStation5

Soybean prices have bounced back sharply recently in response to the phase-one trade deal struck between Washington and Beijing. We think that the ongoing rally could continue once the US exports a huge amount of grains to China in the coming quarters. In theory, a move through the highs from 2018 could occur. Source: xStation5

As far as corn prices are concerned, we have not seen any major price moves of late. However, in this case we also see some upside should China start buying ethanol from the US. Under these circumstances (the most bullish case in our view) we estimate that US corn stocks could depleted as much as 30%. If so, corn could also see increased buyers’ interest. Source: xStation5

As far as corn prices are concerned, we have not seen any major price moves of late. However, in this case we also see some upside should China start buying ethanol from the US. Under these circumstances (the most bullish case in our view) we estimate that US corn stocks could depleted as much as 30%. If so, corn could also see increased buyers’ interest. Source: xStation5

US100 gains 1% before Nvidia earnings📈

Will Powell remain hawkish❓

Market story: Valentine's Day has never been so expensive? The prices of coffee, chocolate and gold are at an all-time high

Will the ECB be forced to follow the Fed?