Anyone trading cocoa right now will be holding onto the edge of their seats. Cocoa surged to a record high earlier this month and broke the $10,000 a tonne level. At one point it was worth more per tonne than copper, which is vita for global growth and the green energy transition.

However, it’s fortunes have shifted in recent weeks. The cocoa price fell 10% on Monday, the largest daily drop since 2008, and it is by far the weakest performer in the global commodity space.

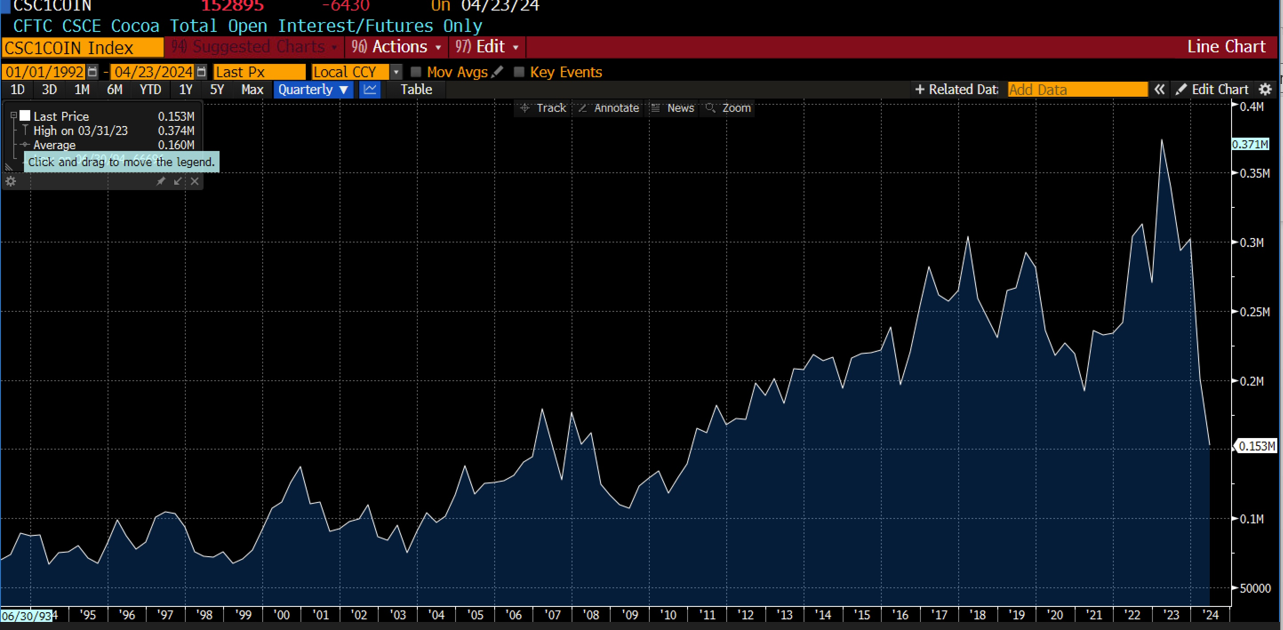

The reason for the volatility is not down to fundamentals, but rather traders exiting their positions. Higher margin calls, as the price has fallen back from $10,000 per tonne, along with a sharp decline in open interest futures positions, which are at their lowest level since 2010, as you can see in the chart below, have driven these extreme price moves. This does not suggest that the price of cocoa will be able to recover any time soon, and it could exacerbate the downside pressure. Thus, for now, cocoa is a sharp toy to play with.

Chart 1:

Source: XTB and Bloomberg

Although the shortage in cocoa beans remains, there has been some relief from the weather, which is giving some hope for the future. Rains in west Africa could benefit the upcoming crop harvest. However, there is still tight supply in the cocoa market and the fundamentals are not driving this sell off and wave of volatility.

Overall, the price volatility is caused by market dynamics and is due to the stretched positioning in cocoa that drove the price to a record high. The unwind could take some time and the cocoa price could stay volatile for some time.

Chart 2:

Source: XTB XStation

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30