EURUSD is pulling back today, following a steep rally that took place last week. Last week's advance was driven by ECB rate hike on Thursday. ECB President said at a post-meeting press conference that further tightening will likely be needed.

According to Gediminas Simkus, chief of Lithuanian central bank and ECB member, a rate hike in July should be delivered and it is not a matter of discussion. However, Simkus also said that ECB is nearing rate peak and it is too early to declare what decision will the Bank make at a meeting in September.

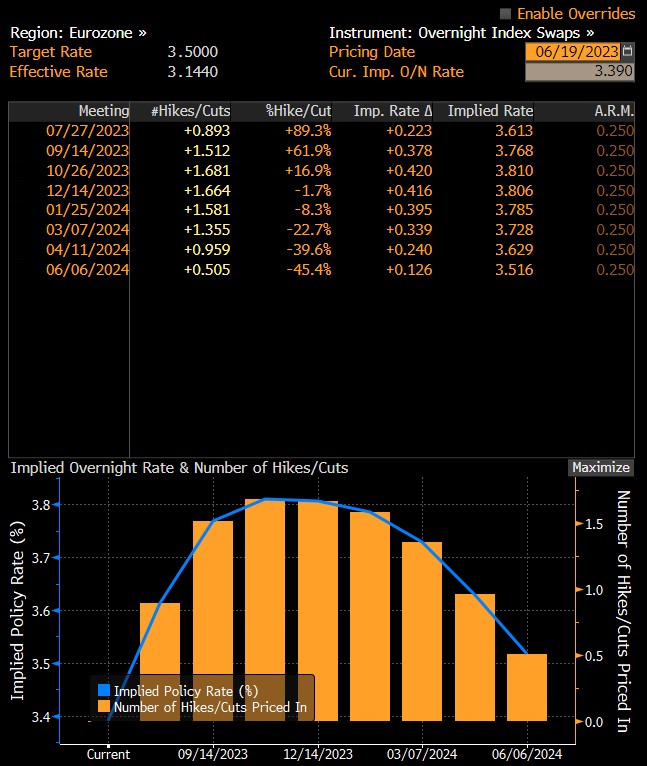

Money markets are almost fully pricing-in a July rate hike and an over-60% chance of a similar move in September. Source: Bloomberg

EURUSD is pulling back noticeably today and is looking towards an important support zone, marked with 61.8% retracement of the last major downward impulse. This area was tested on Friday already but bears failed to break below. Moreover, a lower limit of the Overbalance structure can be found slightly below and further strengthens a support in the area. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)