-

Historic Supply Glut: Crude oil (WTI lowest since May) is pressured by IEA forecasts of a record 4 mb/d surplus in 2026, suggesting the longest period of oversupply in over a decade.

-

Geopolitical Easing: Prices declined due to de-escalation in the Middle East and renewed risk aversion stemming from US-China trade tensions.

-

Iran/Trade: Increased visibility of Iranian oil exports to China (with transponders on) adds supply pressure, while the market largely disregards Russian output risks.

-

Historic Supply Glut: Crude oil (WTI lowest since May) is pressured by IEA forecasts of a record 4 mb/d surplus in 2026, suggesting the longest period of oversupply in over a decade.

-

Geopolitical Easing: Prices declined due to de-escalation in the Middle East and renewed risk aversion stemming from US-China trade tensions.

-

Iran/Trade: Increased visibility of Iranian oil exports to China (with transponders on) adds supply pressure, while the market largely disregards Russian output risks.

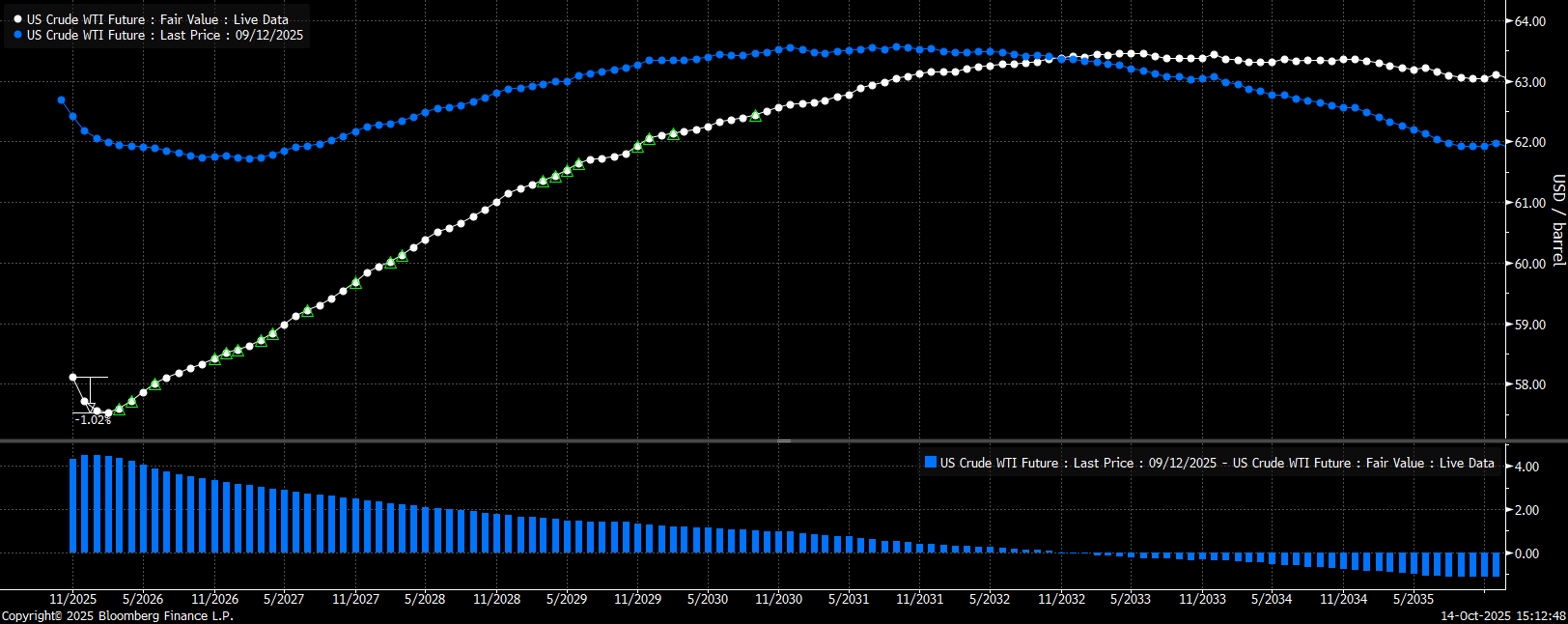

Crude oil has experienced marked declines since the end of September, with Brent dropping to around $62 and WTI hitting $58 per barrel. After months of pressure, Brent has lost approximately 15% of its value year-to-date, primarily driven by concerns over a potential global supply glut. The International Energy Agency (IEA) has raised its surplus forecast for 2026 to a record 4 million barrels per day (mb/d), which would mark the largest annual "excess" in history. While a surplus of this magnitude seems unimaginable, the combination of the OPEC+ production restoration policy and the lack of strong global demand growth could lead 2026 to bring the longest period of oversupply in over a decade.

Factors Driving the Market Downturn

The decline in oil prices is the result of several parallel phenomena:

- Renewed US-China Tensions: Beijing announced restrictions on several US entities and declared the possibility of further retaliation, prompting a rise in market risk aversion.

- Geopolitical De-escalation: The Israel-Hamas agreement has reduced fears associated with a possible escalation of the conflict in the Middle East.

- Growing Supply Pressure: OPEC+ continues to rebuild its output, and the IEA forecasts that global rivals to the cartel will contribute significantly to the record projected surplus.

The Iran Context and Tanker Traffic to China

A critical underlying factor in the oil price decline is the thread concerning Iran, which, after years of restrictions, is seeking to increase exports to China. A notable development in recent months has been the transport of Iranian crude to China with transponders (AIS systems) switched on, highlighting growing confidence but simultaneously increasing political tension with the US. The United States is threatening to escalate sanctions and inspect cargo, particularly after the re-imposition of certain international restrictions.

Iran has stated that any attempt by the US to interfere with its shipments will be met with immediate reciprocity. This deepens uncertainty and complicates the pricing of political risk, although the increased visibility of shipments to China (transponders on) contributes to greater transparency and indirectly pressures commodity markets.

Concurrently, the market appears to be largely ignoring the supply risk associated with Russia, following a series of Ukrainian attacks on oil infrastructure that led to the disabling of up to 40% of the country’s processing capacity.

The market appears convinced of a major oversupply in the coming year and beyond. We are currently observing a relatively clear contango in the forward curve from next February. Up until February, there is only a slight backwardation of just 1%. The price is also approaching a minor roll-over point, which should bring the price closer to $57.5 per barrel.

Source: Bloomberg Finance LP

The price is currently in an important demand zone above $55 per barrel. Goldman Sachs suggests that the price has a chance to drop below this level next year, though the key will be whether the projected large surplus actually materializes. At this moment, this massive surplus is not yet reflected in the data. US crude inventories remain low, although strategic reserves are simultaneously being rebuilt.

Source: xStation5

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

India: New battleground of the trade war?

Another US Gov. Shutdown: What can it mean this time?

Mercosur: Farmers’ fears are exaggerated, industry triumphs - facts vs. myths