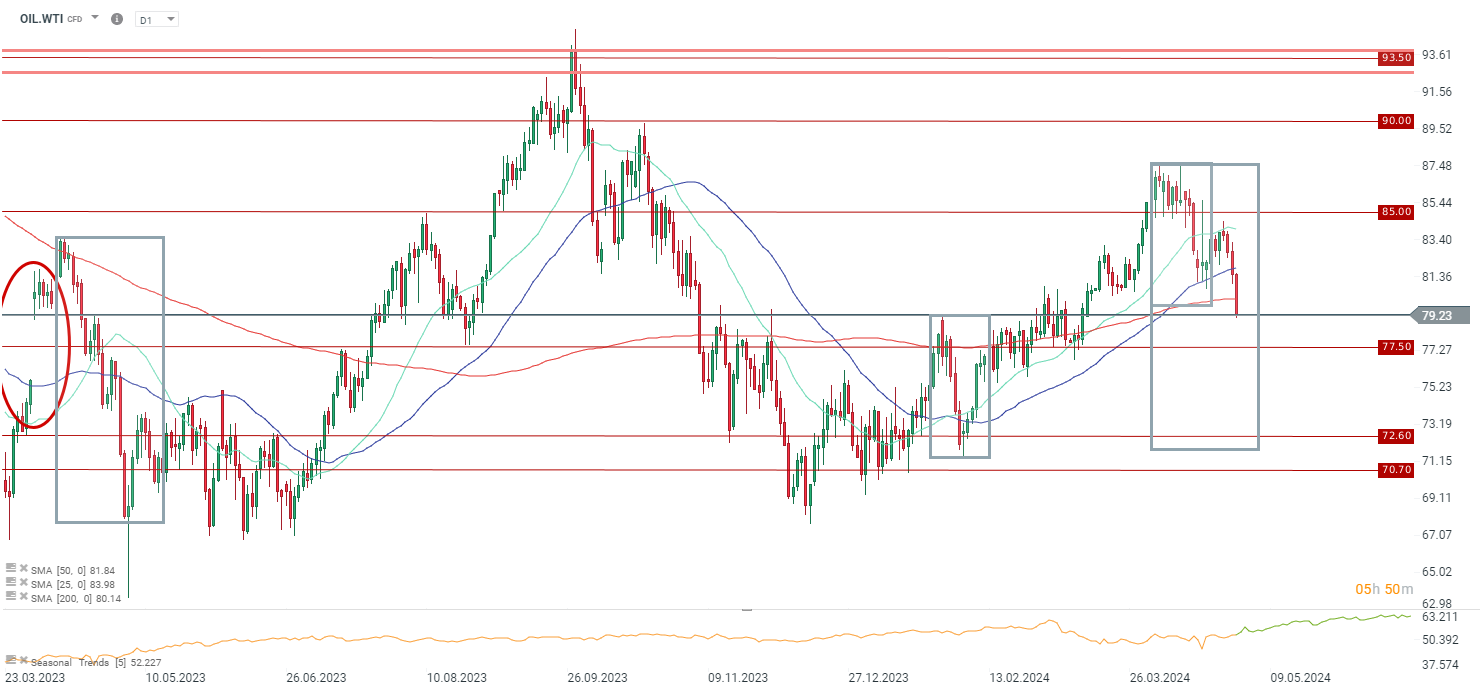

WTI oil is losing nearly 3% today, testing around $79 per barrel, following the release of a DOE report showing a 7.26 million bbl inventory build, against expectations for a draw of over 2 million bbl. While the data is for the previous week, it's worth noting that May is typically a period when oil inventory builds start to dwindle due to increased demand for fuels. Additionally, the ISM manufacturing report showed a reading below 50, which could signal a weaker economy and potentially lower fuel demand in the near future.

WTI oil is breaking below $80 per barrel today, its 100 and 200-day moving averages, and breaching the range of its largest retracement of the trend, trading near $79 per barrel, its lowest level in 6 weeks. Oil is down nearly 10% from its recent highs.

Daily summary: A historic day for precious metals; SILVER loses 30%; USD gains 💡

Has the precious metals bubble burst❓ SILVER dips over 33% in a single day 🚨

Three Markets to Watch Next Week (30.01.2026)

⏬Silver below $100, Gold breaches $5000