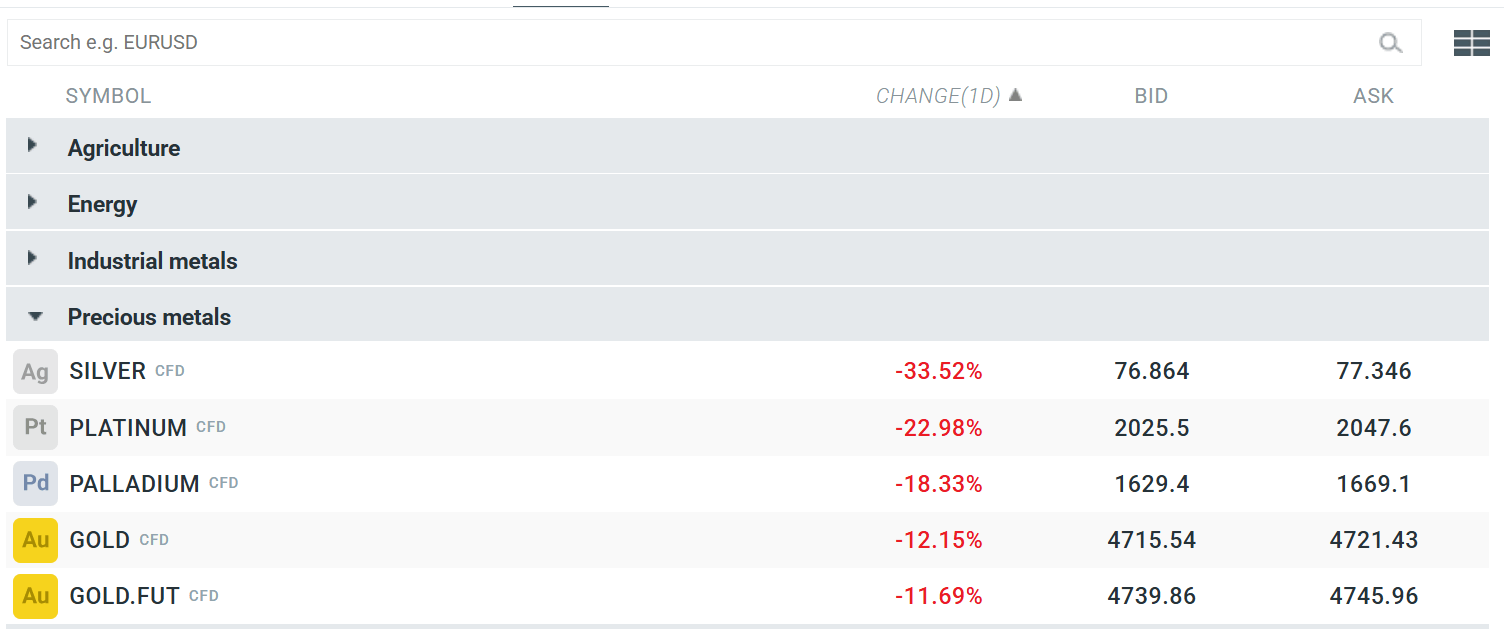

Gold and silver are experiencing unprecedented declines, closing the most difficult day in their modern trading history. Gold has already lost more than 12% of its value, falling to $4,716/oz. Silver is doing even worse, falling by as much as 34% to $76.5/oz, which is the worst daily percentage result in the history of trading this commodity, surpassing even the famous Hunt brothers' crash of the 1980s. The market lost nearly $10 trillion in capitalisation in just 24 hours, clearly indicating the bursting of the speculative bubble that had been forming over the last few months of a frenzied bull market fuelled by fears of inflation, political uncertainty and massive purchases by central banks.

Despite the dramatic correction, current levels remain historically high – gold at £4,716 is still an unimaginably high price compared to previous years. Analysts point to technical support below the £4,000 level, where long-term investors and "strong hands" ready to buy the dip may step in. The market is waiting for several critical catalysts: Trump's decisions on Iran, the Supreme Court's ruling on tariffs, and Kevin Warsh's first public comments as the newly elected head of the Fed, which may signal a new direction for monetary policy.

Source: xStation

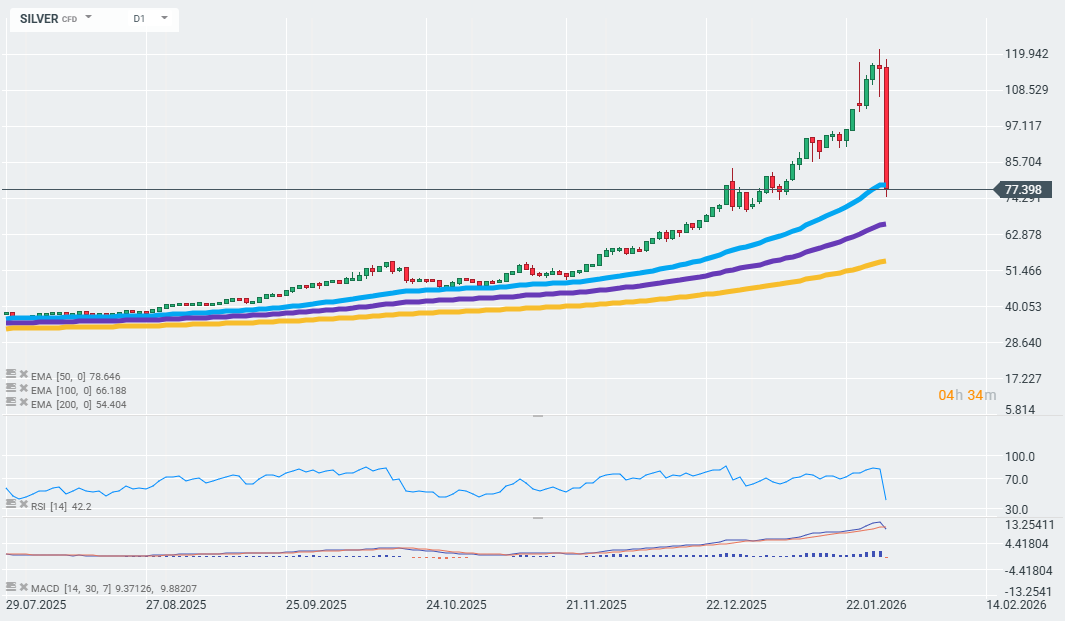

SILVER is currently testing the long-term support marked by the 50-day EMA.

Source: xStation

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74