Adidas (ADS.DE) stock tumbled more than 10.0% as the apparel maker lowered its full-year financial guidance, citing weaker demand.

-

The German sporting goods maker warned that unsold inventories are building up as consumer demand weakens across China and western markets. Adidas also expects one-off costs largely relating to its exit from operations in Russia will have a negative impact on its financials. Also publicity crisis over an alliance with rapper and designer Ye formerly known as Kanye West also weighs on the company's performance.

-

Net income from continuing operations fell sharply to €179 million ($175 million) in the quarter from €479 million in the same period last year. Operating margin also plunged to 8.8% in the quarter from 11.7% previously.

-

Net income from continuing operations should come in at some €500 million ($489.4 million) for the year, against a previous target of around €1.3 billion.

-

The company’s prognosis for 2022 has fallen from an optimistic growth of 11 to 13% at the beginning of this year, to a mid-single-digit rate now. Adidas lowered its expectations for this year’s operating margin to 4% from 7%.

-

Company plans to implement an efficiency program that should compensate for higher costs next year and generate around €200 million in profit.

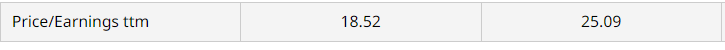

Adidas main rival Nike Inc. also reported a similar surge in inventory in September, warning of a squeeze on profit margins from resulting discounts and other clearing activity necessary to sell off excess stock. Nevertheless Adidas has a lower P / E ttm ratio. Source: Barchart

Adidas main rival Nike Inc. also reported a similar surge in inventory in September, warning of a squeeze on profit margins from resulting discounts and other clearing activity necessary to sell off excess stock. Nevertheless Adidas has a lower P / E ttm ratio. Source: Barchart

Adidas (ADS.DE) stock fell nearly 70.0% from its 2021 highs. This month price broke below major support at €113.60 which coincides with 78.6% Fibonacci retracement of the upward wave started in October 2014 and 200 SMA (red line). If current sentiment prevails, downward move may accelerate towards local support at €77.40. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.