Amazon (AMZN.US) stock plunged 10.0% before the opening bell after the tech giant posted disappointing quarterly results and revealed a revenue forecast that missed analyst estimates. Company's sales growth slowed down to 7.0% compared to 44% last year, meanwhile costs increased and its investment in electric vehicle company Rivian (RIVN.US) erased its profits.

- Revenue at $116.4 billion came in-line with Wall Street expectations. However, Amazon reported a surprising loss per share of $7.56, while market expected profit of $8.40 per share. Company recorded net loss of $3.8 billion, it was the first quarterly loss since 2015;

- E-commerce giant recorded a $7.6 billion loss on its investment in EV manufacturer Rivian after its stock fell over 50.0%. Amazon owns nearly 20% EV maker shares;

- Advertising amounted to $7.88 billion well below market estimates of $8.17 billion;

- Operating expenses increased by more than 13.0% to $112.78 million;

- On the upside, Amazon Web Services rose to $ 18.44 billion beating analysts’ estimates of $18.27 billion;

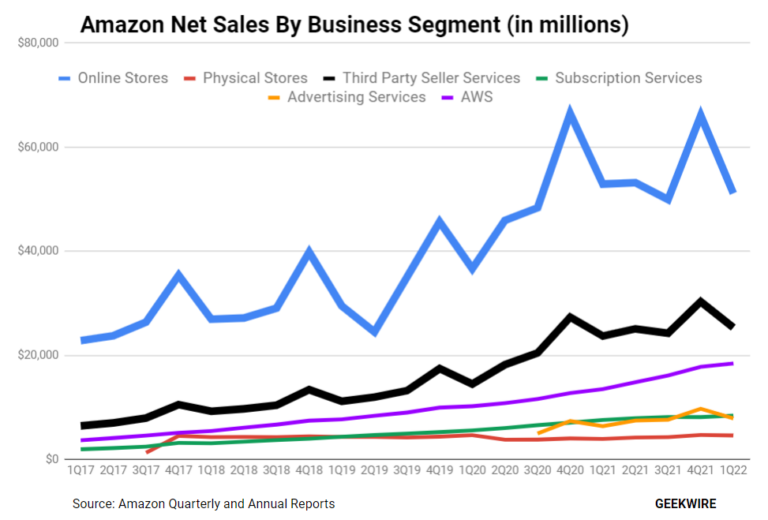

Solid performance of cloud business to some extent counteracted lower e-commerce sales and Rivian related losses, and continues to be the biggest driver of profit for Amazon. Source: Geekwire

Solid performance of cloud business to some extent counteracted lower e-commerce sales and Rivian related losses, and continues to be the biggest driver of profit for Amazon. Source: Geekwire

- Amazon’s CFO Brian Olsavsky said incremental costs from inflation, warehouse capacity exceeding demands and other issues had cost the company about $6bn over the quarter.

- “The pandemic and subsequent war in Ukraine have brought unusual growth and challenges,” said CEO Andy Jassy.

- Amazon's unveiled plans for its first stock split in more than 20 years. On May 25 shareholders will receive 19 shares of the group for each one held. Trading is expected to begin on a split-adjusted basis on June 6

- For the current quarter, the company forecasts operating income between a loss of $1bn and a gain of $3bn, which looks bleak compared to $7.7bn in Q2 of 2021. Revenues in the range of $116 billion to $121 billion, also widely missed analysts forecast of around $125 billion.

Amazon was one of the biggest winners of the pandemic, however since the covid seems to be in retreat, customers returned to bricks and mortar shopping. In-store shopping jumped over 11.0% last month while online dropped 3.3%, according to the Mastercard SpendingPulse report. If this trend continues in the upcoming months, company may face further downward pressure.

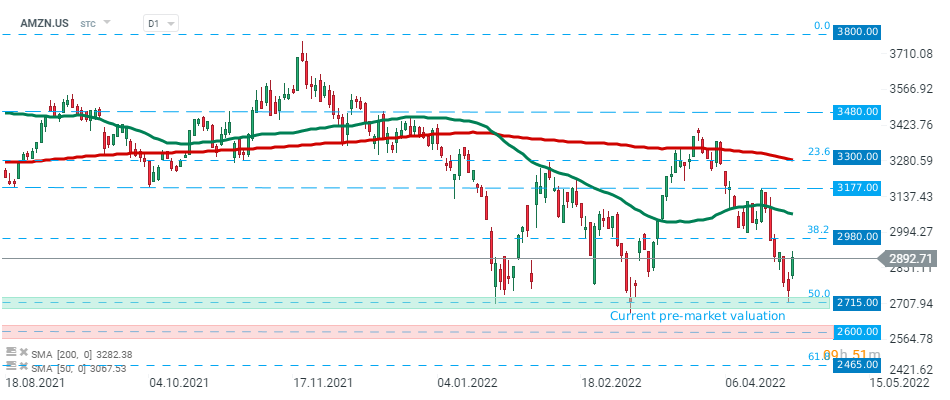

Amazon (AMZN.US) stock fell sharply and is currently trading around $2600 level. If current sentiment prevails, downward move may accelerate towards major support at $2465 which coincides with 61.8% Fibonacci retracement of the upward wave launched in March 2020. The nearest resistance is located around $2715 and is marked with previous price reactions and 50.0% retracement. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.