Arista Networks is a major player in the artificial intelligence space, albeit in a different segment than chipmakers. Arista is a provider of data center network switches. The company will report its results today after the market close on Wall Street.

After the last quarter, the company slightly disappointed with its guidance, which led to a significant drop in its share price. Will it be different this time, given the high expectations for earnings and revenue growth?

Analyst Expectations:

- EPS: $1.74 (up 21.7% YoY)

- Revenue: $1.55 billion (up 14.8% YoY)

It is worth noting that Arista has beaten market expectations for earnings in the past two years 100% of the time and for revenue nearly 90% of the time. In addition, analysts have mostly revised their expectations upwards for the company's results. The company is one of the key suppliers in the growing data center market, but on the other hand, it is worth mentioning that the company operates in a fairly competitive market where Cisco and Juniper are major players.

In February, the company released its Q4 results for the previous year, where revenue grew 20.8% YoY and EPS was $2.08 against expectations of $1.70 per share.

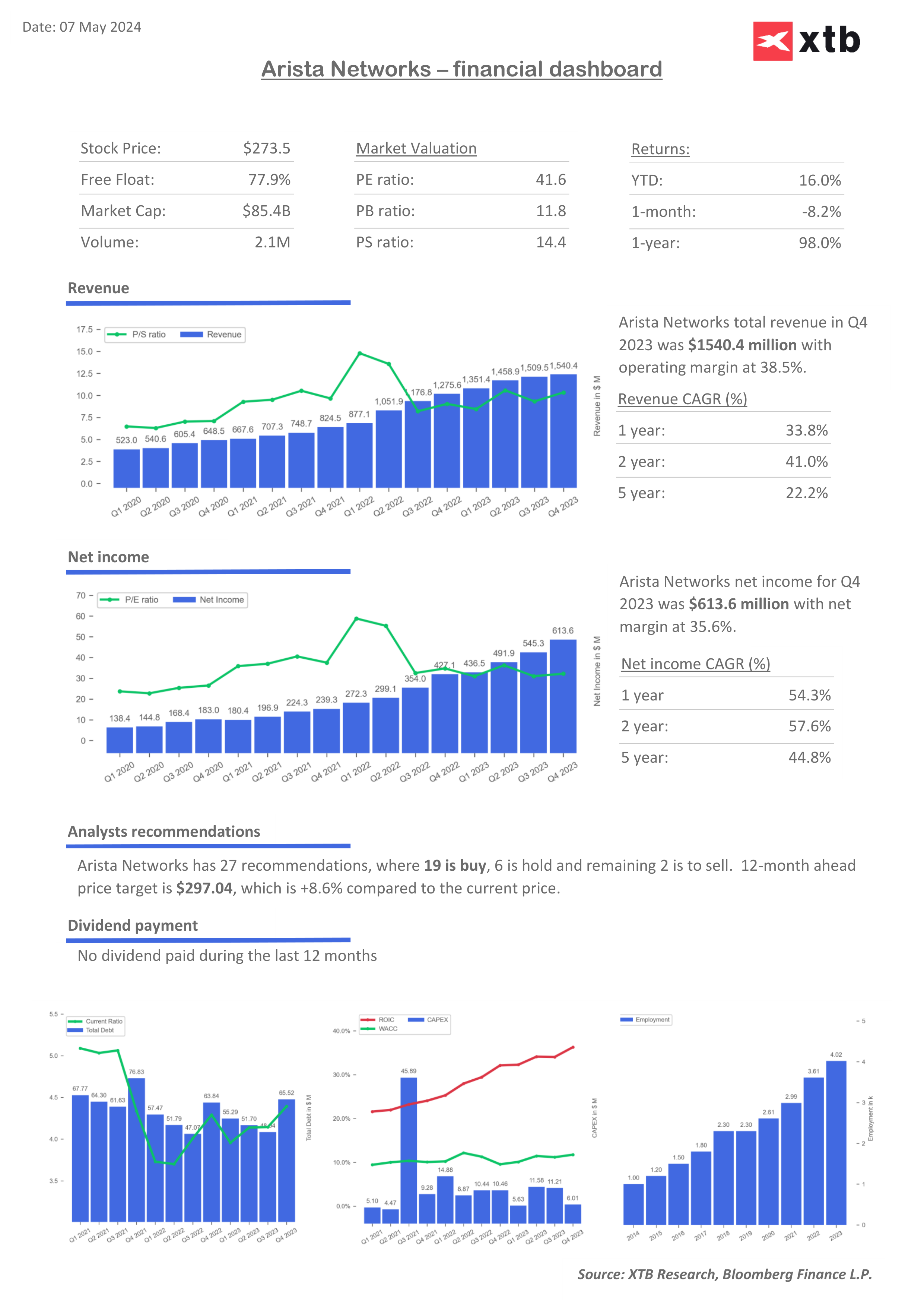

Analysts are divided ahead of the release, pointing to the company's fairly high valuations with a P/E above 40. On the other hand, many research institutions have raised their price targets for the company:

- Goldman Sachs raised its target to $356 per share at the end of March, from $313 per share

- JP Morgan raised its target to $315 per share from $297 per share (April 11)

- The most recent upward revision is from Jefferies, which revised its target on May 3 from $240 to $320 per share.

Source: Bloomberg Finance LP, XTB

Arista vs. Cisco and Juniper: Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.