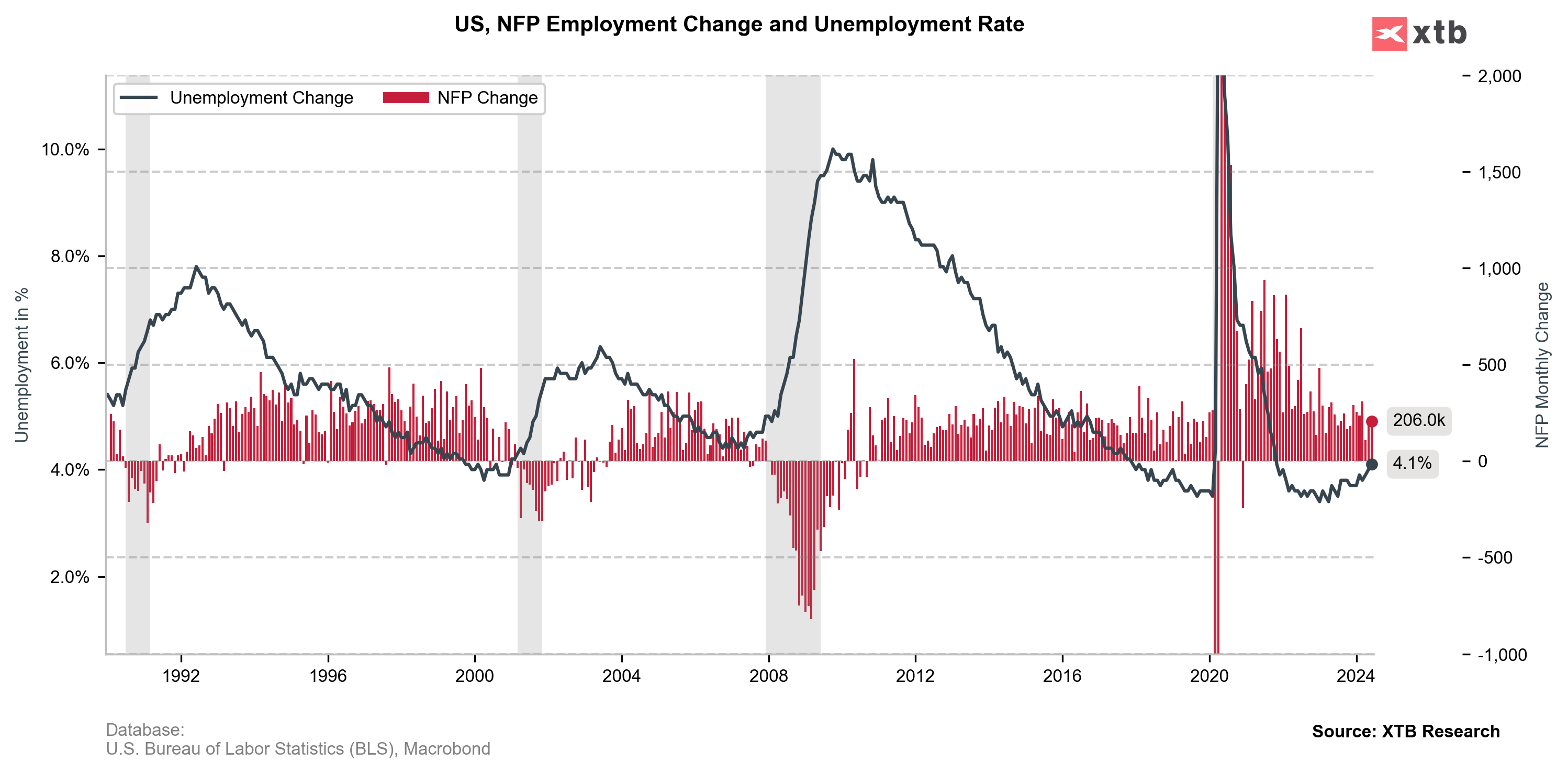

US Non-Farm Payrolls (NFP) for June: 206k Expected: 190k vs. 272k previously

- Change in private employment.136k Expected: 160k vs. 222k previously

- Change in employment in the manufacturing sector. -8k Expected: 5k vs. 8k previously

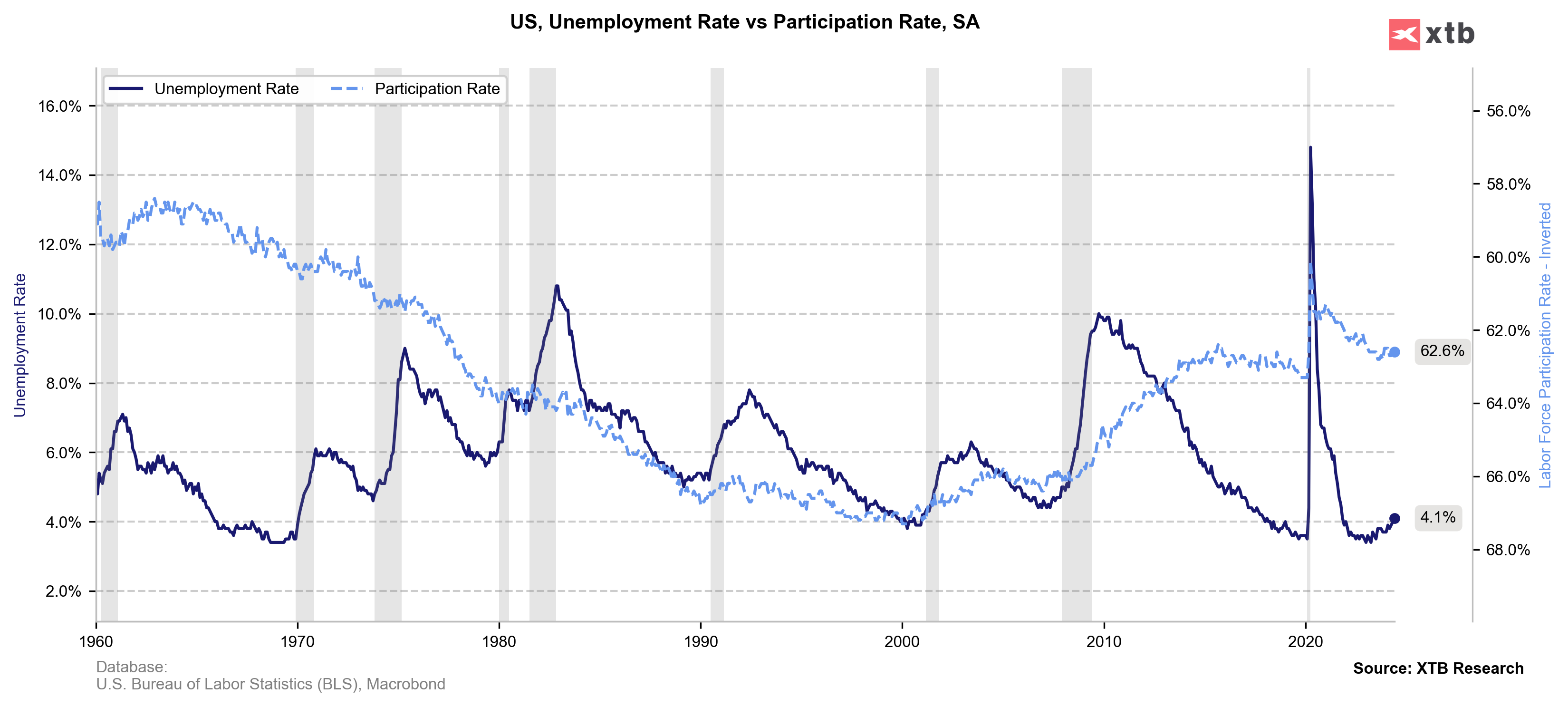

- Unemployment rate. 4.1% Expected: 4% vs. 4% previously

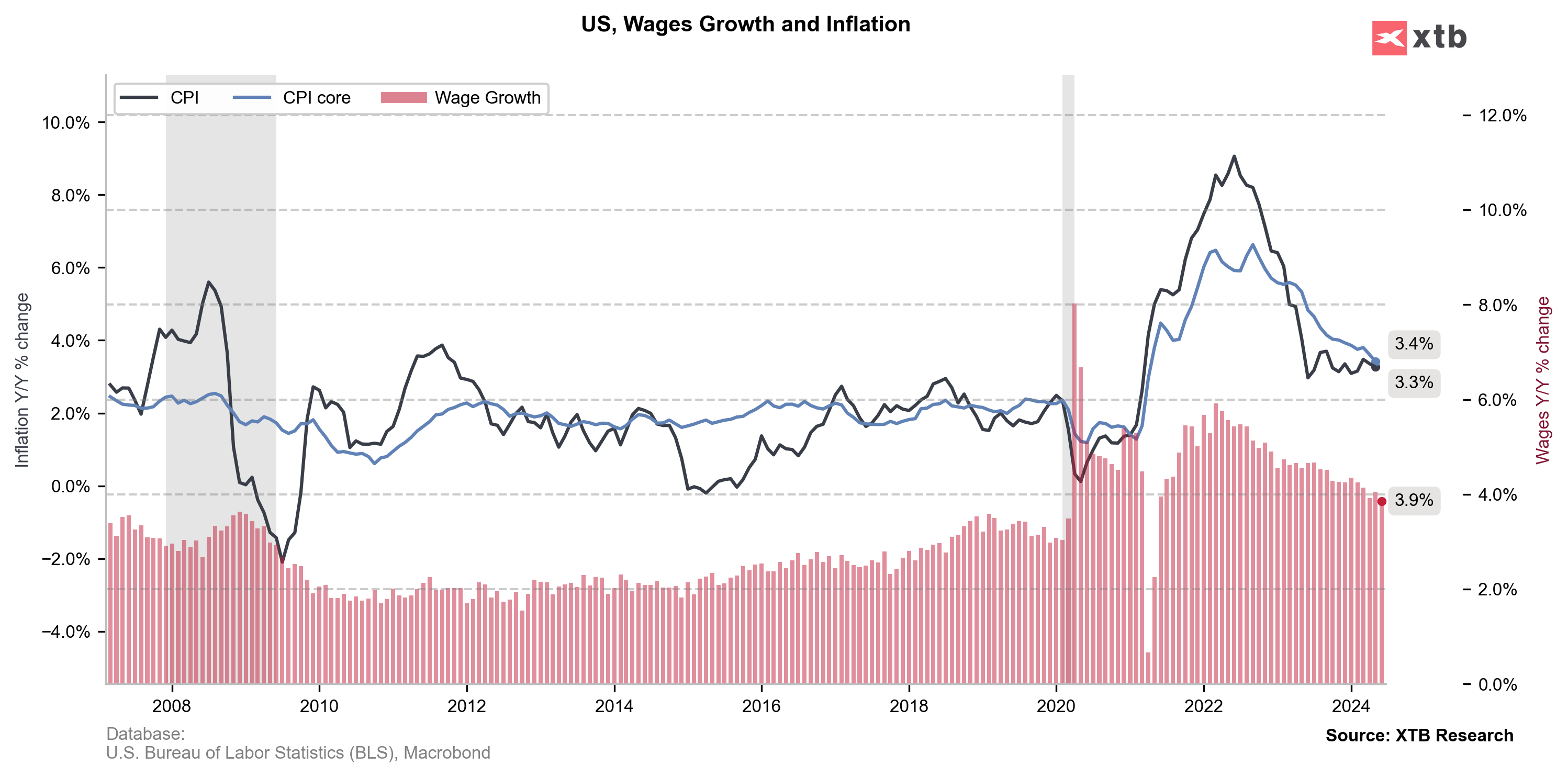

- Average earnings.3.9% Expected: 3.9% y/y growth vs. 4.1% previously (0.3% m/m growth vs. 0.4% previously)

US short-term interest-rate futures reverse earlier losses and now are mostly up vs before the NFP report. US dollar declines as data showed higher unemployment rate, lower change in private employment and unexpected drop in manufacturing employment change. The US dollar declines slightly and Wall Street sees the today report as quite dovish, despite slightly higher than expected Non-Farm Payrolls change. As for now, US rate-futures traders price in slightly higher chance for September Fed rate cut.

US500

In the first reaction after NFP data, futures on S&P 500 (US500) dropped slightly, but buyers reversed the sell-off very fast and now Wall Street futures are on slightly higher levels, than before the key US labour market data.

Source: xStation5

Source: xStation5

Source: BLS, XTB Research, Macrobond

Source: BLS, XTB Research, Macrobond

Source: XTB Research, BLS, Macrobond

Source: XTB Research, BLS, Macrobond

Source: XTB Research, BLS, Macrobond

Source: XTB Research, BLS, Macrobond

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.