The US economy advanced by an annualized 2.9% in the fourth quarter of 2022, following a 3.2 % jump in the previous three-month period, above analysts’ estimate of 2.6% increase flash GDP report showed. The advance estimate showed the GDP growth mainly reflected increases in private inventory investment, consumer spending, federal government spending, state and local government spending, and nonresidential fixed investment that were partly offset by decreases in residential fixed investment and exports. Imports decreased. Considering full 2022, the economy expanded 2.1%, following a 5.9% increase in 2021. The outlook for 2023 is very different however, as the effects of the Fed's biggest interest rate hike campaign since the 1980s weigh on consumer demand, business investment, inventories and the housing market, with market consensus pointing to an imminent recession.

US GDP expanded for the second quarter in a row despite high interest rates. Source: U.S. Bureau of Economic Analysis

US GDP expanded for the second quarter in a row despite high interest rates. Source: U.S. Bureau of Economic Analysis

Simultaneously data from the labour market and PCE inflation figures were released.

• Core PCE inflation: 3.9% QoQ. Expected 4.0% QoQ

• Jobless claims: 186vs 205k expected (190k previously), the lowest since April and is another sign of a tight labor market despite the Fed aggressive tightening path last year, challenging market bets that the US central bank will halt its tightening path before reaching the forecasted terminal rate of 5.25%.

• Continuing Jobless Claims: 1675k vs 1659k expected (1647k previously)

Initial jobless claims fell to 9-month lows. Source: Blooberg via ZeroHedge

• Durable goods: 5.6% MoM vs 2.5% expected (-2.1% MoM previously). It is the sharpest gain since July 2020. Transportation equipment, up four of the last five months, drove the increase, $15.5 billion or 16.7% to $108.1 billion. Excluding transportation, new orders decreased 0.1%. Excluding defense, new orders increased 6.3%.

When it comes to market reaction, index futures gained slighlty while US dollar strenghtened.

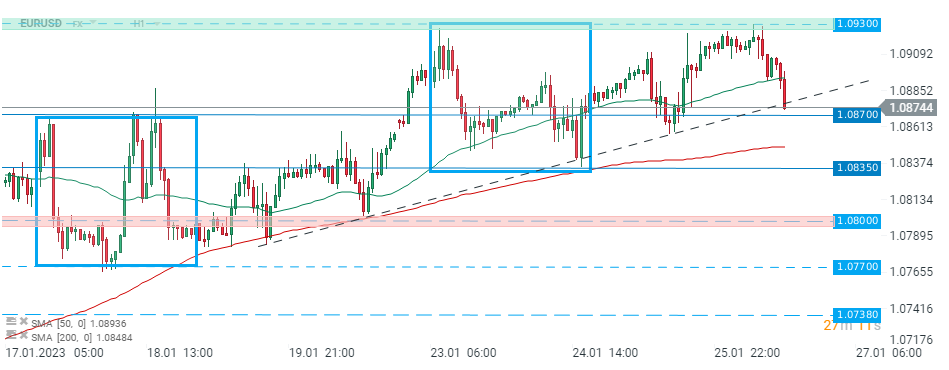

EURUSD pair pulled back to support at 1.0870 after today's US data pack. Source: xStation5

EURUSD pair pulled back to support at 1.0870 after today's US data pack. Source: xStation5

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.