The British pound is in the spotlight this morning. Times reported that the Truss government will delay a 1 percentage point cut to income tax rate until 2024. This is another sign that the UK government is taking a U-turn on its fiscal plans after they have triggered a meltdown on the UK debt market and forced the Bank of England to act in the bond market. New UK Chancellor of Exchequer Jeremy Hunt (appointed on October 14, 2022) is set to make a statement on the government's fiscal plans today at 11:00 am BST. This could be the announcement of what parts of the fiscal plan may be scrapped or delayed and will surely draw the attention of GBP traders.

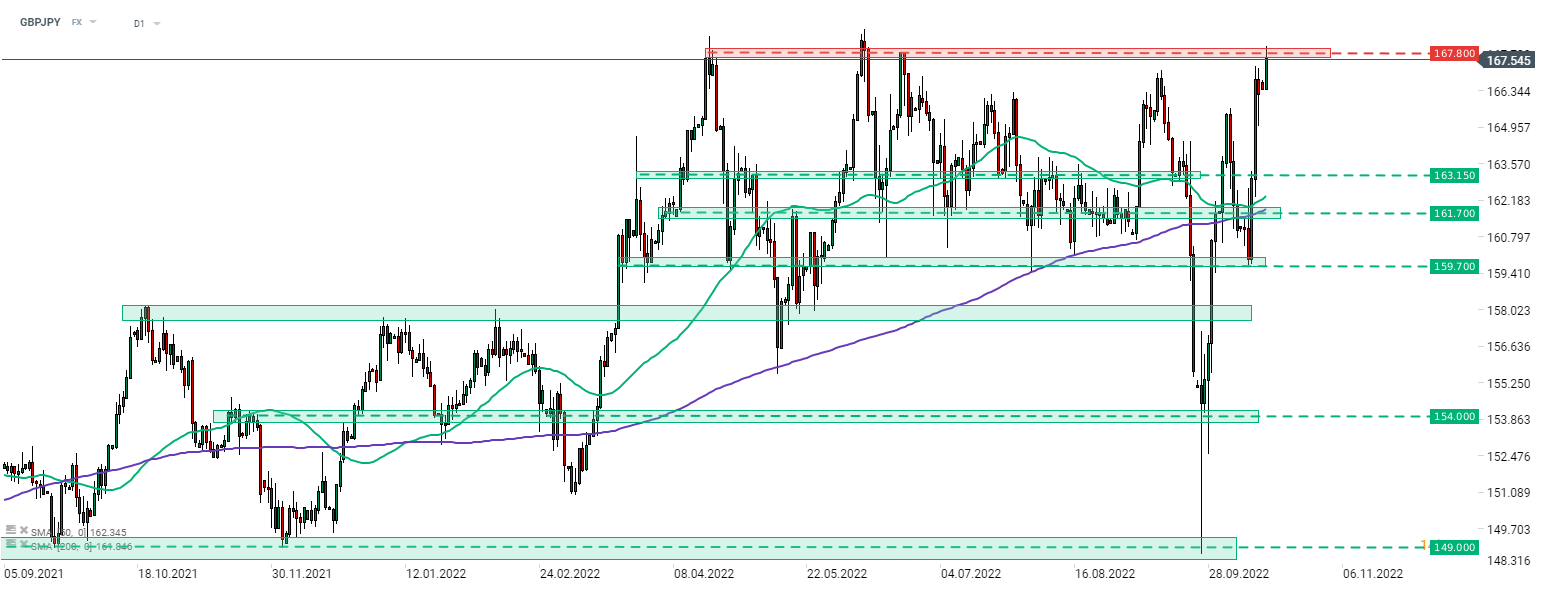

Taking a look at GBPJPY chart at D1 interval, we can see that the pair has fully recovered from its recent slump and is testing the 167.80 resistance zone, marked with local highs from the first half of 2022. A break above would result in the pair reaching the highest level since the 2016 Brexit referendum.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.