-

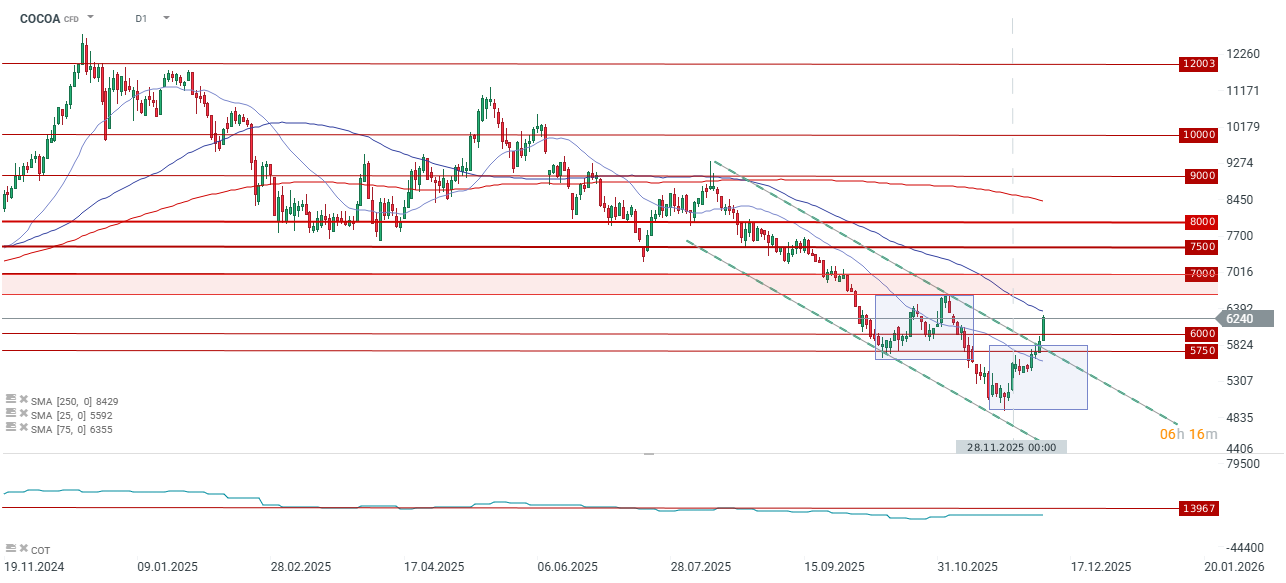

Explosive Rally: Cocoa has surged over 25% since November 25, breaking above $6,000 and testing the 75-period moving average (near $6,350) on severely reduced global surplus forecasts.

-

Fundamental Shift: Key organizations (ICCO, Rabobank) dramatically cut their 2024/25 and 2025/26 surplus estimates, signaling persistent tightness and driving the aggressive price move.

-

New Capital Inflow: The upcoming inclusion of NY cocoa futures in the Bloomberg Commodity Index (BCOM) in January could trigger up to $2 billion in passive fund buying, alongside low US inventories and weaker Côte d'Ivoire port arrivals.

-

Explosive Rally: Cocoa has surged over 25% since November 25, breaking above $6,000 and testing the 75-period moving average (near $6,350) on severely reduced global surplus forecasts.

-

Fundamental Shift: Key organizations (ICCO, Rabobank) dramatically cut their 2024/25 and 2025/26 surplus estimates, signaling persistent tightness and driving the aggressive price move.

-

New Capital Inflow: The upcoming inclusion of NY cocoa futures in the Bloomberg Commodity Index (BCOM) in January could trigger up to $2 billion in passive fund buying, alongside low US inventories and weaker Côte d'Ivoire port arrivals.

Cocoa has extended its strong two-week rally, rising over 6% today, with the total gain since November 25 already surpassing 25%. The price recently tested the $5,000 level and is now significantly above $6,000. It is currently testing the 75-period moving average near $6,350, reaching its highest level in approximately four weeks. Yesterday, the price surpassed the range of the largest correction in the downtrend that began in early August.

Revised Forecasts Revive the Market

Recent revisions by key organizations indicate a much smaller global cocoa surplus than originally anticipated: The ICCO (International Cocoa Organization) on November 28 lowered its forecast for the global cocoa surplus for the 2024/25 season to just 49,000 tonnes from a previous estimate of 142,000 tonnes. Concurrently, it lowered its estimated production to 4.69 million tonnes from 4.84 million tonnes. Rabobank also cut its forecast for the global surplus for the 2025/26 season, reducing it to 250,000 tonnes from its November projection of 328,000 tonnes. ING recently indicated that the oversupply in the 25/26 season is expected to be 175,000 tonnes, a level significantly smaller than Rabobank's revised forecast.

Technical and Fundamental Support

In addition to the forecast revisions, New York cocoa futures are gaining strength due to specific market factors:

- BCOM Index: Cocoa futures (NY cocoa) will be included in the Bloomberg Commodity Index (BCOM) starting in January. According to Citigroup estimates, this event could attract as much as $2 billion in purchases from passive commodity funds that track the index, certainly supporting current prices.

- Shrinking Inventories: ICE-monitored cocoa inventories held in US ports fell on Tuesday to the lowest level in almost nine months (1,672,131 bags).

- Reduced Côte d'Ivoire Arrivals: Decreased cocoa deliveries to ports in Côte d'Ivoire, the world's largest cocoa producer, are also acting as a supportive factor. Government data from Monday showed that arrivals through December 7 reached 804,288 MT, representing a 1.8% decline compared to the same period last year. However, it is worth noting that the recent weekly pace of deliveries has been significantly higher than in previous years.

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

Will Europe run out of fuel?

US OPEN: War in Iran hits the markets

Market update: energy markets king, as US stock market sell off moderates

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.