- The main European indices managed to erase some of the recent loses and ended today's session in positive territory. The Austrian and Swiss indices performed particularly well, gaining more than 1%. The German DAX finished 0.27% higher.

- Moods on Wall Street improved despite the surging US dollar. Three major US benchmarks are currently gaining over 1%. Meta Platforms (formerly Facebook) will publish its quarterly results after the closing bell.

- Stock market rebound provided support for cryptocurrencies. Bitcoin returned above the $ 39,100 level and Ethereum is trading around $ 2,870.

- The US dollar index approached its multi-year highs amid growing uncertainty over next week's FOMC's decision and scale of rate hikes, the epidemic in China and the lingering conflict in Ukraine. The appreciation of the world reserve currency also negatively affected the valuation of gold, which fell below $ 1,900.

- Crude oil gains slightly after today's EIA report showed US oil inventories rose less than expected. The data on distillate inventories was a surprise, as they showed a greater than expected decline.

- NATGAS is gaining over 6% supported by reports of freeze-offs in pipelines in the Rocky Mountains. Meanwhile demand from LNG liquefaction terminals strengthened, as maintenance works were seen ending, while in Europe, Gazprom has halted supplies to Poland and Bulgaria, after both countries refused to pay for gas in rubles.

- Bloomberg reported that four European countries have already paid Russia for gas in rubles despite the fact that the European Union informed the member states that such actions would violate the sanctions.

During today's volatile session major stock indices managed to halt the downward movement at least for now. The European indices finished sessions higher, while the buyers on Wall Street after a poor start also managed to take control despite mixed results from two FAANG members- Alphabet and Microsoft. Today Meta (formerly Facebook) will publish its results, which may also cause some moves on the markets. Nevertheless, today's gains may turn out to be short-lived, given that the negative sentiment related to the deteriorating pandemic situation in China, expected interest rate hikes and worsening geopolitical tensions. This led to a sharp strengthening of the dollar which in turn put pressure on gold.

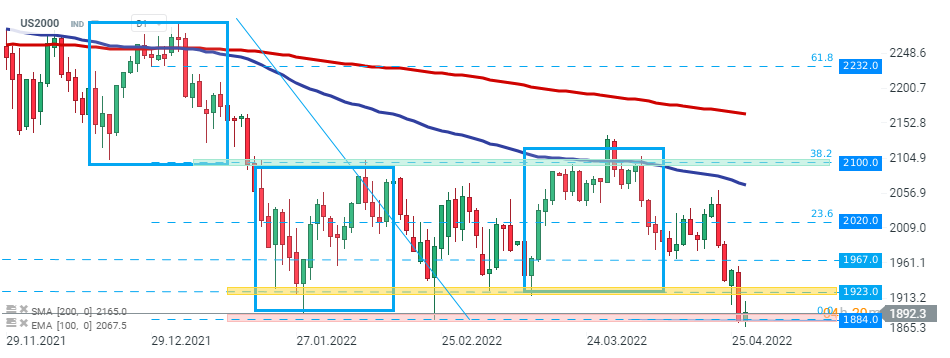

US2000 plunged 3.5% on Tuesday and today the index swings between gains and losses around key support at 1884 pts which is marked with previous price reactions and lower limit of the 1:1 structure. A decisive close below this level would be a confirmation that bears remain in control and could herald further downward pressure. However at the moment, buyers are showing more initiative, therefore another upward impulse towards local resistance at 1923 pts may be launched. Source: xStation5

NFP preview

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.