- BoE will slow the pace of its bond-buying

- US weekly jobless claims drop below 500k

- Gold price above $1800/oz

European indices finished todays’ session slightly higher as investors were not inclined to open new positions ahead of tomorrow’s highly anticipated NFP report. On the corporate front, several eurozone banks, including UniCredit and Societe Generale posted better than expected quarterly figures. On the monetary policy front, the Bank of England left interest rates and the size of its stimulus programme unchanged. The Central Bank said it would slow bond-buying to 3.4 billion pounds a week between May and August, down from its current pace of 4.4 billion pounds a week and raise 2021 GDP forecasts. Dax30 finished today’s session flat, CAC40 rose 0.3% and finished at 6,357 pts, a level not seen since the early 2000s. Meanwhile FTSE 100 rose 0.5% to 7,076 pts, its highest close since February 2020.

US stock indexes managed to erase early losses and are trading higher, with Dow Jones touching another intraday record after upbeat weekly jobless claims report which showed that the number of Americans filing new claims for unemployment benefits dropped to a new year low. Earlier major US drugmakers' shares came under pressure after President Joe Biden said he had backed a WTO waiver for COVID-19 vaccine intellectual property.

WTI crude fell more than 1.3% and is trading slightly below $64.75 a barrel, while Brent is trading nearly 1.2% lower around $68.10 a barrel. Elsewhere gold rose 1.5% to $ 1,815.00 / oz, while silver is trading 3.0 % higher, around $ 27.30 / oz amid weaker dollar and lower Treasury yields.

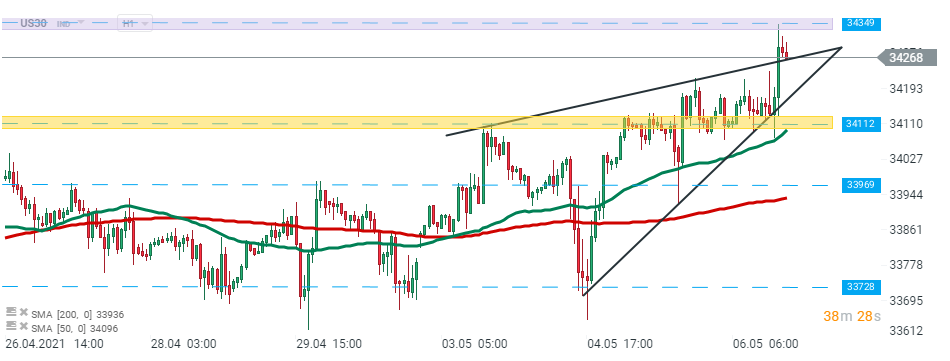

US30 rose sharply during today’s session after a strong claims report. Index broke above the upper limit of the triangle pattern and reached new all-time high at 34349 pts. However buyers failed to uphold momentum and the index pulled back slightly. However as long as price sits above major support at 34112 pts, buyers seem to be in advantage. Source: xStation5.

US30 rose sharply during today’s session after a strong claims report. Index broke above the upper limit of the triangle pattern and reached new all-time high at 34349 pts. However buyers failed to uphold momentum and the index pulled back slightly. However as long as price sits above major support at 34112 pts, buyers seem to be in advantage. Source: xStation5.

NFP preview

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.