-

Global stock markets fall on Monday

-

Poor data from China weighs on sentiment

-

Gold prices testing $1,790 an ounce

Global equity markets fell on Monday and snapped a winning streak. European stocks ended a 10-day run of gains - the longest since 2006! The sentiment could have been affected by poor economic data from China. Figures on industrial production, retail sales and fixed asset investment for July fell short of expectations, which makes investors worried about the economic slowdown in the second-largest economy. The geopolitical uncertainty could also, to a certain extent, have raised concerns. US equities opened lower, but they have already rebounded from daily lows.

The Nasdaq100 (US100) is lagging behind, but the Dow Jones (US30) is trading flat at press time. The NY Empire State Manufacturing Index for August came in below forecasts too, pointing to a slowdown in factory growth in the NY state - the print of 18.30 missed the consensus estimate of 29.00. All in all, today’s calendar was fairly empty, with no major market-moving events. Nevertheless, US bond yields experienced a steep decline amid worrying signals from China - a move that may be particularly important in terms of the Fed’s policy.

Gold has benefited from the economic, geopolitical uncertainty and also lower US bond yields. The price of the precious metal was testing previous local lows near $1,790 an ounce. On the other hand, silver prices are trading flat in the evening. Oil and copper prices tanked again amid economic slowdown concerns and Covid-19 restrictions in China.

The US dollar is gaining against most major currencies. EURUSD is trading near 1.1775 (-0,12%) while GBPUSD is sitting at 1.3843 (-0,15%). However, the greenback is weakening against the JPY. Tomorrow markets will surely focus on labour market data from the United Kingdom. US retail sales and industrial production for July will also be in the spotlight.

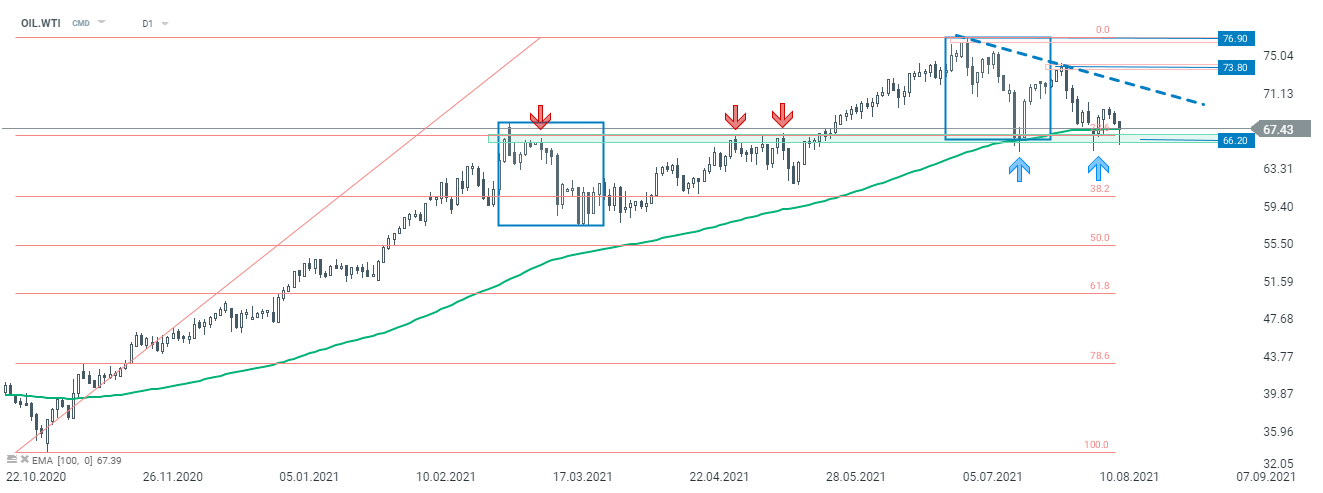

OIL.WTI started the week lower. The price tested a key support (area near the $66.20 mark seen on the chart above). The price rebounded from daily lows and is currently sitting at 100-day EMA (WTI is still down by roughly 1.50% on the day). Source: xStation5

OIL.WTI started the week lower. The price tested a key support (area near the $66.20 mark seen on the chart above). The price rebounded from daily lows and is currently sitting at 100-day EMA (WTI is still down by roughly 1.50% on the day). Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.