- UK and the EU are close to reach a Brexit trade deal, officials say

- Trump could veto the coronavirus aid bill.

- New South African Covid-19 strain identified in the UK

- US Crude stocks all less than expected

- France reopens border with U.K.

European indices finished today’s session higher following the news that the Brexit trade deal can be reached today and as France reopened its borders with Britain with people required to show proof of a negative Covid-19 test taken within the previous 72 hours. Also other countries have also severed transport links with the U.K., but the French border is of particular importance as it covers the Channel Tunnel, a vital artery for trade within the continent. Meantime Britain and the European Union are close to clinching a Brexit trade deal, diplomats said on Wednesday, however, this has not been officially confirmed. Bloomberg reported that the outline of a post-Brexit trade agreement has been reached, citing officials familiar with the matter although EU-UK trade talks are still in their “final stages” according to a source from Reuters. However, EU ambassadors meeting has been convened for tomorrow to be briefed on Brexit negotiations. This may be a sign that the Brexit deal is virtually done. Meanwhile a second new variant of the COVID-19 has been detected in the UK having first been discovered in South Africa. The government is now set to implement travel restrictions on those entering the nation from South Africa. DAX 30 rose more than 1%, CAC advanced 1.1% and FTSE100 gained 0.7%.

US stocks also moved higher even after President Donald Trump expressed concerns about the new Covid-19 relief package calling it an unsuitable “disgrace” and urged lawmakers to make a number of changes to the measure, including raising checks to $2,000 from $600. Moods in the markets improved after jobless claims unexpectedly fell last week, however they still remained at elevated levels due to restrictions to curb the spread of new COVID-19 infections. Meantime Pfizer Inc (PFE.US) reached a deal with the US government to buy an additional 100 million doses of the company’s Covid-19 vaccine.

US crude futures are trading 2.40% higher at $ 48.15 a barrel, while Brent contract rose 2.3% to $ 51.26. US crude oil inventories fell by 0.562 million barrels in the week ended December 18th, following a 3.135 million decline in the previous week and compared with analysts’ estimates of a 3.186 million decline, according to the EIA Petroleum Status Report. Gasoline inventories fell 1.12 million barrels last week the EIA said, compared with expectations for a 1.2 million-barrel build. Yesterday API data had shown a surprise crude oil inventory build in the US. Elsewhere, gold futures jumped 0.69% to $ 1,872.00 /oz, while silver is trading 1.9% higher at $25.60/oz.

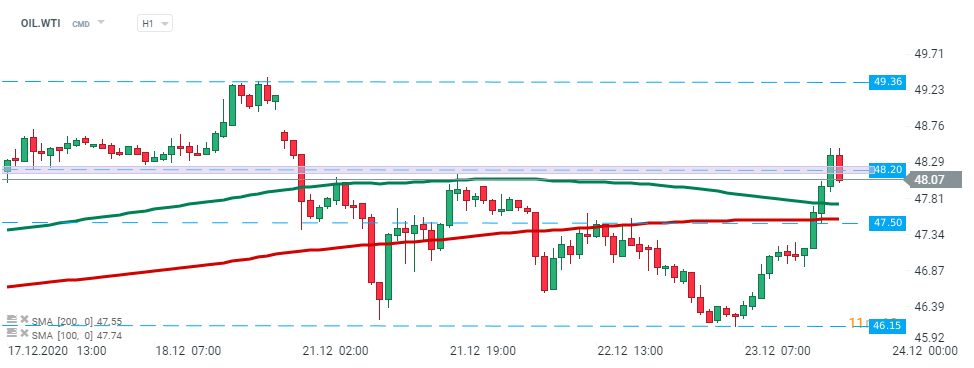

WTI crude futures (OIL.WTI) rose sharply after publication of today's EIA report. Price broke above both 50 SMA (green line) and 200 SMA (red line) and reached resistance at $48.00 level. If buyers will manage to uphold momentum, the upward move could be extended to the resistance at $49.36. On the other hand, breaking below the aforementioned $48.00 level may trigger a bigger downward correction. Source: xStation5.

WTI crude futures (OIL.WTI) rose sharply after publication of today's EIA report. Price broke above both 50 SMA (green line) and 200 SMA (red line) and reached resistance at $48.00 level. If buyers will manage to uphold momentum, the upward move could be extended to the resistance at $49.36. On the other hand, breaking below the aforementioned $48.00 level may trigger a bigger downward correction. Source: xStation5.

Three markets to watch next week (27.02.2026)

Daily summary: The beginning of the end of disinflation?

Wheat at its highest level in 8 months 📈

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.