-

Wall Street indices traded higher today, supported by easing of the US dollar rally

-

European stock markets indices finished today's trading with noticeable gains with most blue chips indices from the Western Europe closing 1.4-1.7% higher. Polish WIG20 was a leader in Europe with a 4% jump

-

Fed's Bullard is leaning towards another 75 bp rate hike in September even if inflation data shows deceleration

-

Fed's Waller said he also support another big rate hike at September's meeting

-

WSJ reports that ECB will begin discussions on QT in early-October 2022 and balance sheet run-off may begin in Q1 2023

-

A Canadian jobs report showed a 39.7k drop in employment, driven by a 77.2k decrease in full-time employment. Unemployment rate jumped from 4.9 to 5.4%

-

Chinese CPI inflation decelerated from 2.7 to 2.5% YoY in August while PPI inflation decelerated from 4.2 to 2.3% YoY

-

Bank of England postponed monetary policy decision from September 15 to September 22, 2022 amid national mourning following Queen Elizabeth II's death

-

Cryptocurrencies rallied today with Bitcoin jumping over 10%

-

Commodities benefit from weaker US dollar and overall risk-on moods. Brent jumped back above $90 per barrel and trades almost 5% higher on the day

-

Japanese yen regained some ground after verbal intervention from Governor Kuroda. Kuroda said that recent rapid yen depreciation is undesirable and market took it as a warning that BoJ may step in to intervene in the FX markets

-

AUD, CHF and JPY are the best performing major currencies while USD and CAD lag the most

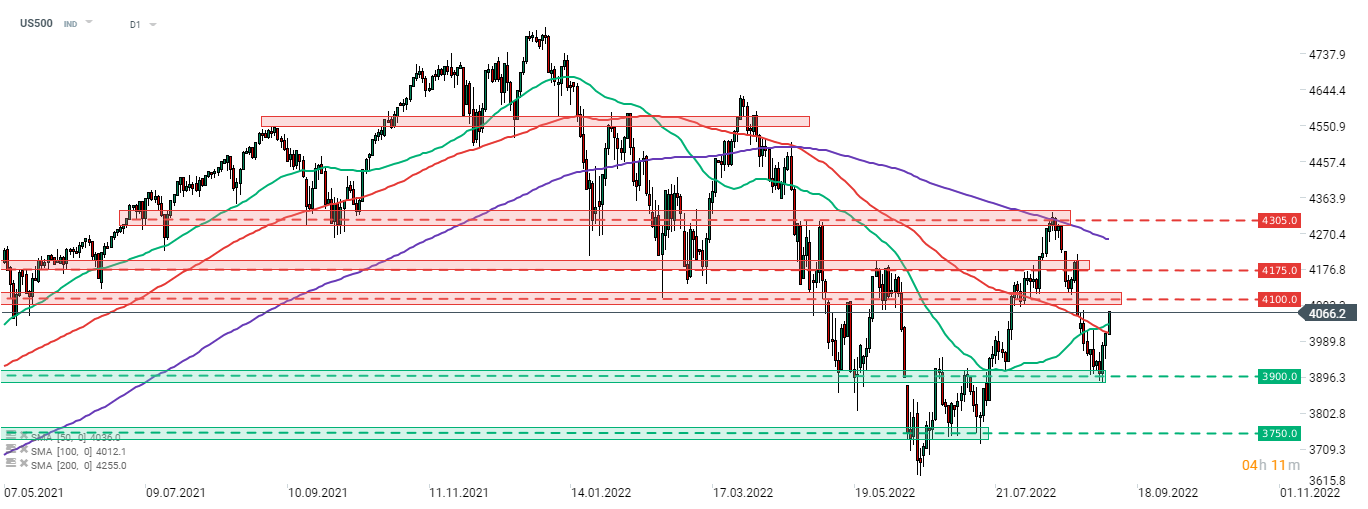

S&P 500 (US500) rallies today, trading 1.5% higher at press time. The index cleared 50- and 100-session moving averages today and is looking towards a test of the 4,100 pts resistance zone. Source: xStation5

S&P 500 (US500) rallies today, trading 1.5% higher at press time. The index cleared 50- and 100-session moving averages today and is looking towards a test of the 4,100 pts resistance zone. Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.