- European stocks finished mostly higher

- Wall Street rebounds on earnings

- Precious metals surge

Most of the major indices from the Old Continent finished today’s session higher as solid earnings results from Burberry, Richemont and ASML overshadowed concerns regarding rising bond yields. Germany’s 10-year Bund yield turned positive for the first time since 2019, as the country's inflation rate remained at a 29-year high. Meanwhile, CPI data from the UK showed the consumer price inflation jumped 5.4% last month, a level not seen since March 1992. Markets have priced in a 10 basis-point rate hike from the ECB in September and some analysts expect a second rate hike by December.

Major Wall Street indices rose sharply in early trade, however bullish momentum faded away later in the session. Investors digest fresh earnings reports from Bank of America, Morgan Stanley, Procter & Gamble and a small decline in Treasury yields. Yesterday, US 10-year bonds yields reached almost 1.9%, the highest since July 2019, while today pulled back to 1.85%. Rising yields may reflect in some way expectations regarding the long-term interest rate hikes. From this perspective, given the current inflation frenzy, yields seem to be still low anyway. Even with the announced strong interest rate hikes this year in the US, real interest rates are likely to remain “strongly” negative. The market is in some way afraid of hikes and the fact that the Fed may no longer look favorably on Wall Street, as it was after 2018, when the monetary tightening ended very quickly which negatively affected stock market. During today's session Nasdaq 100 at some point fell 10% retraction from its all-time high, which point out the index entered in to "technical" correction. Of course, the bear market is still a long way off, but it seems that the bulls do not know how to stabilize the market. This is due to the fact that the quarterly results of Wall Street companies are not impressive. Of course, they are not bad, we do not see negative results, but they are largely below market expectations. If the current earnings season turns out to be weak, given rising inflation, higher interest rates and further supply problems, US companies will not be able to sustain the strong earnings and revenue growth seen in recent years.

Upbeat moods prevail today in most commodity markets. Precious metals prices rose amid a weaker dollar. Gold price broke above major resistance at $1830.00 and is testing $1,840.00, which is the highest level observed this year, while silver jumped over 3% above $ 24.00. WTI oil rose above $86.60 which is the highest level since October 2014, while Brent tested $89.00 level, however bulls failed to hold onto those gains later in the session.

Major cryptocurrencies moved lower today after that vice-president of the European Securities and Markets Authority, called for a change in the current methods of bitcoin mining as it consumes huge amounts of energy. In an interview with the Financial Times, ESMA's current vice chairman, Mr. Erik Thedéen, said that the current form of cryptocurrency mining creates a risk of not meeting the goals of the Paris Agreement, which aims to achieve climate neutrality for the European Union by 2050. Bitcoin price fell to $41 000 level while Ethereum tested $3040 level. However, the bulls manage to recover some of the losses following the news that Google is considering allowing its clients to keep cryptocurrencies on virtual cards. Google informs that PayPal will be specially hired for this job and will be responsible for the payment sections.

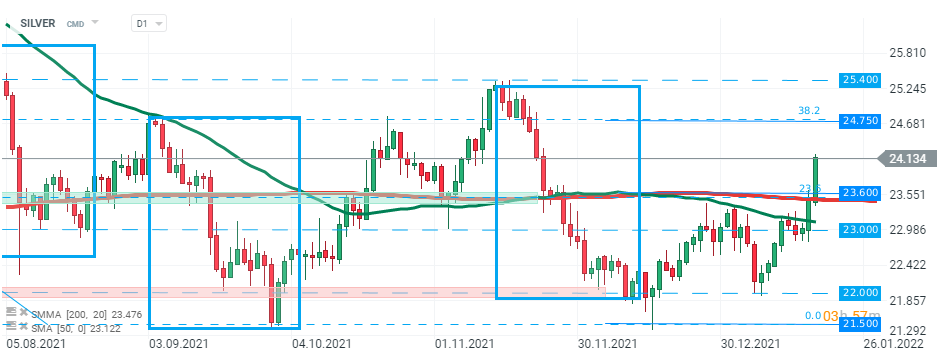

Silver price followed in gold footsteps and rose more than 3% on Wednesday. Buyers managed to break above another major resistance zone around $23.60, which is marked by previous price reactions, 200 SMA (red line) and 23.6% Fibonacci retracement of the last downward correction. If current sentiment prevails, upward move may accelerate towards next resistance at $24.75. Source: xStation5

Silver price followed in gold footsteps and rose more than 3% on Wednesday. Buyers managed to break above another major resistance zone around $23.60, which is marked by previous price reactions, 200 SMA (red line) and 23.6% Fibonacci retracement of the last downward correction. If current sentiment prevails, upward move may accelerate towards next resistance at $24.75. Source: xStation5

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.