-

Today's session on global financial markets was quiet, without much volatility

-

The range of movement on the main stock indices from the Old Continent did not exceed 0.5%

-

On Wall Street, we are observing a moderately positive mood, volatility is also limited, at the time of preparing this commentary, the Dow Jones is the best performer, with gains of 0.55%, while the S&P500 is up 0.13% and the Nasdaq 100 has managed to make up for earlier losses and is oscillating around the benchmark level

-

Citi downgraded US and UK equities to Neutral from its previous recommendation of Overweight, while upgrading European equities (to Overweight).

-

This week marks the start of the second quarter earnings release season from companies

-

Investor attention today focused on speeches by the Fed's central bankers. Comments from policymakers confirm that the Federal Reserve intends to continue the interest rate hike cycle all the time. However, most of today's speakers are members without decision-making power at the FOMC.

-

The only banker who sounded slightly more dovish was Raphael Bostic, who said that we can reach the inflation target without further hikes, and that recent macro data has been encouraging. However, it is worth mentioning that Bostic is not the deciding member on the FOMC board.

-

Michael Barr (who is part of the FOMC) commented that inflation is still too high and the Fed still has work to do

-

The quotations of the main currency pair started the week with gains, with the EURUSD rate approaching the USD 1.10 barrier, which if broken could result in an attack on this year's maximums.

-

The yen is the best performing G10 currency today, with the JPY appreciating 0.5% against the USD, while the Australian dollar is the weakest performer AUD

-

The correction on the USDJPY is gaining momentum, with the currency pair retracing last week's retracement from resistance at 145.20, with the nearest important support located at 140.80.

-

In the commodities market, crude oil slipped around 1 per cent, with the WTI variety paying just under $73, while Brent costs $77.5.

-

Gold and silver quotations are oscillating in the region of the opening level, nevertheless, in case the upward trend on EURUSD continues, precious metals will have a chance to strengthen, after the recent not so good streak.

-

The crypto market also did not see much volatility on Monday, with bitcoin holding slightly above the $30,000 level. Standard Chartered updated its forecast for the price of Bitcoin to US$120,000 (for 2024).

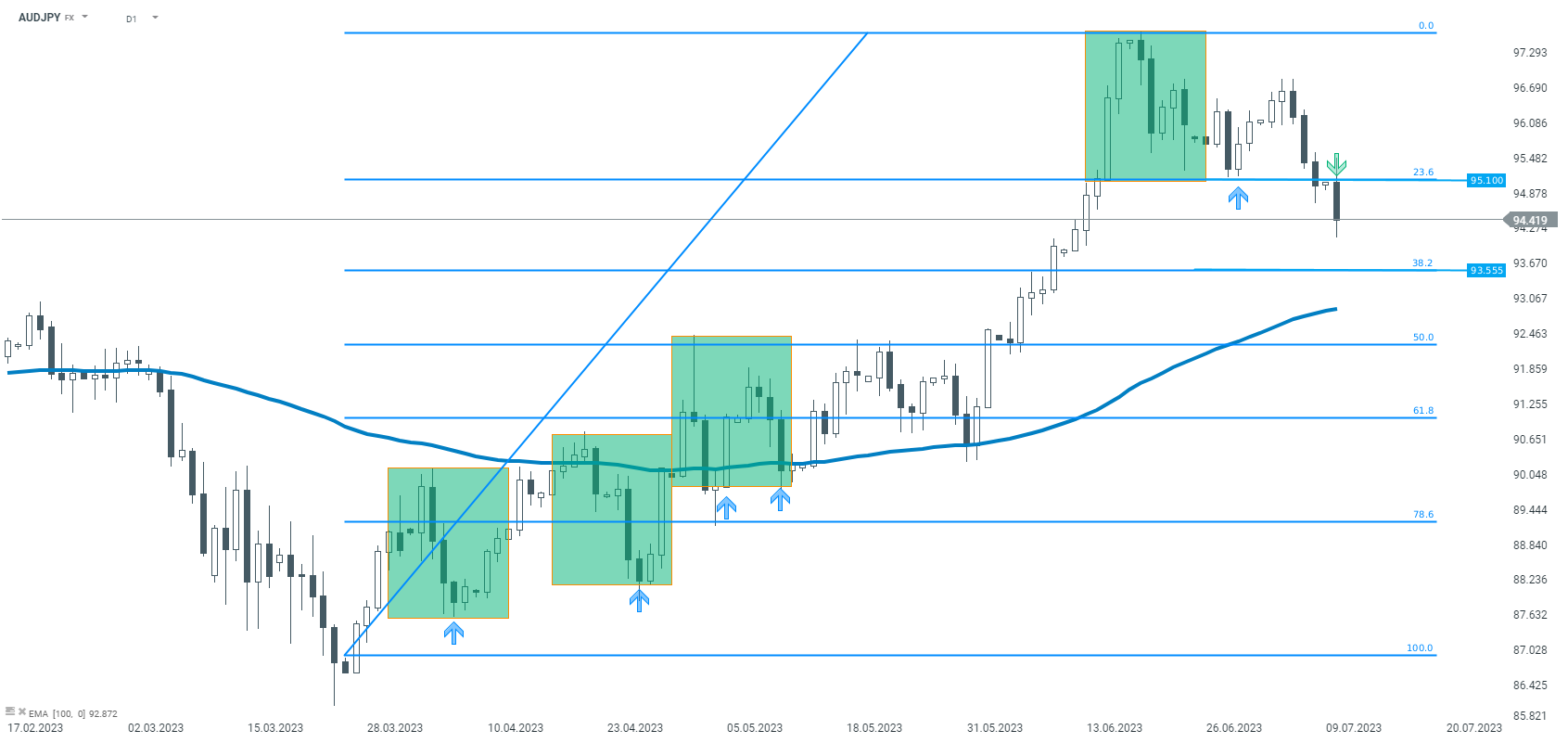

AUDJPY quotes broke support at 95.10 today, which, according to the Overbalance methodology, could herald a larger correction or even a downward trend change. Source: xStation5

Market wrap: European stocks attempt to stabilize despite the surge in oil prices 🔍

Chart of the Day: EURUSD – Why is the Euro Losing to the Dollar?

An elevated oil price is here to stay as supply concerns grow, equities fall

Economic Calendar: U.S. Unemployment Claims in spotlight (12.03.2025)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.