-

US economy added 850k jobs in June (est. 700k)

-

Wall Street climbs to new record highs

-

European stock indices mixed

-

OPEC+ talks drag on, oil prices swinging

Friday was all about key jobs data from the United States and OPEC+ talks. The NFP report showed that the US economy added 850k jobs in June (vs exp. 700k). Average hourly earnings increased 0.3%, below forecasts of 0.4% so the report eased inflation fears a bit. As the headline number topped expectations, US equity markets hit fresh all-time highs.

The initial reaction on the FX market following the NFP release was rather mixed. However, several hours after the publication the US dollar is weakening against most of its peers as the risk of rapid monetary tightening eased (due to wage growth miss). The CAD is the strongest among major currencies. Gold and silver prices are also moving higher amid weaker USD.

European stock markets finished the day mixed. The German DAX added 0.30% while blue chip indices from the UK, France and Italy closed more-or-less flat. Oil traders are still staying on the sideline as OPEC+ delayed its decision. The meeting started late and, according to commodity markets correspondents, has not finished yet. Brent and WTI prices are swinging near the flatline at press time.

Commodity traders will stay on watch today due to OPEC+ meeting. Apart from that, one should expect thinner volume on Monday as Americans will celebrate Independence Day and US stock markets will be closed. Regular trading in US stocks and bonds will resume on Tuesday.

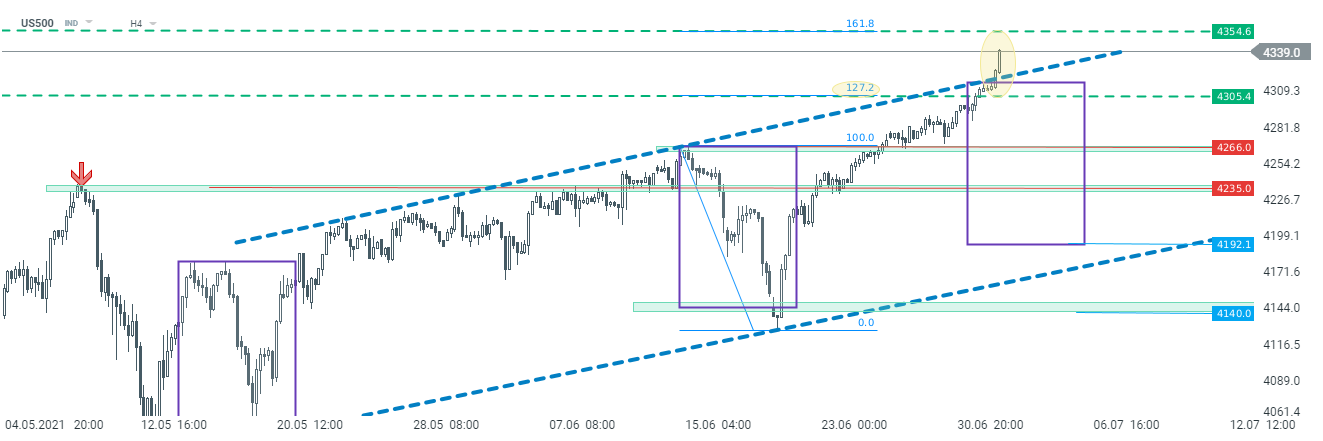

US500 advanced and hit new all-time highs after long-awaited NFP data, which topped expectations. The index climbed above the upper limit of an upward channel. Currently there are 2 near-term levels to watch: 4,354 pts (the 161.8% Fibonacci retracement) and 4,305 pts (the 127.2% Fibonacci retracement) of the recent drop. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.