- European equities fell to multi-week lows

- Wall Street under pressure following Powell testimony

- FED will discuss speeding up taper process in December

- Moderna CEO expects existing vaccines to be less effective against Omicron

- Gold erases early gains, oil plunges

European indices finished today's session sharply lower, with DAX 30 falling over 1.0% to a seven-week low while rest major bourses recorded declines between 0.4% and 2%, as concerns over the new omicron coronavirus variant and its impact on global growth and policy mounted after Moderna's CEO said that current vaccines may be ineffective against new strain. Meanwhile, the Eurozone inflation rate jumped to its highest level since 1991.

US stocks also tumbled on Tuesday after Federal Reserve Chair Powell admitted that it is appropriate to consider normalizing ultra-accommodative monetary policy at the upcoming December meeting, given that the economy is very strong and inflationary pressures are higher even despite ongoing Omicron concerns. Powell also said that it’s time to stop using the word “transitory” to describe inflation and that the recent emergence of the omicron variant poses “downside risks to employment and economic activity and increased uncertainty for inflation".

WTI crude price plunged more than 8% and is trading below $65.00 per barrel, while Brent crude futures fell 8.50% the lowest in over 3 months. Bearish moods also prevail on the precious metals market. Gold price erased early gains and dropped nearly 0.50% testing support at $1,770 an ounce, while silver fell nearly 1.0% as both the dollar index and yields reversed early losses during Powell testimony. Higher interest rates raise the non-interest-bearing metal’s opportunity cost, reducing its appeal, while a stronger dollar makes the yellow metal more expensive for buyers with other currencies. Mixed moods prevail on the cryptocurrency market. Bitcoin fell 0.80% and is trading around $57,600, while Ethereum surged 5% and if current sentiment prevails all-time high at $ 4,870 may be at risk.

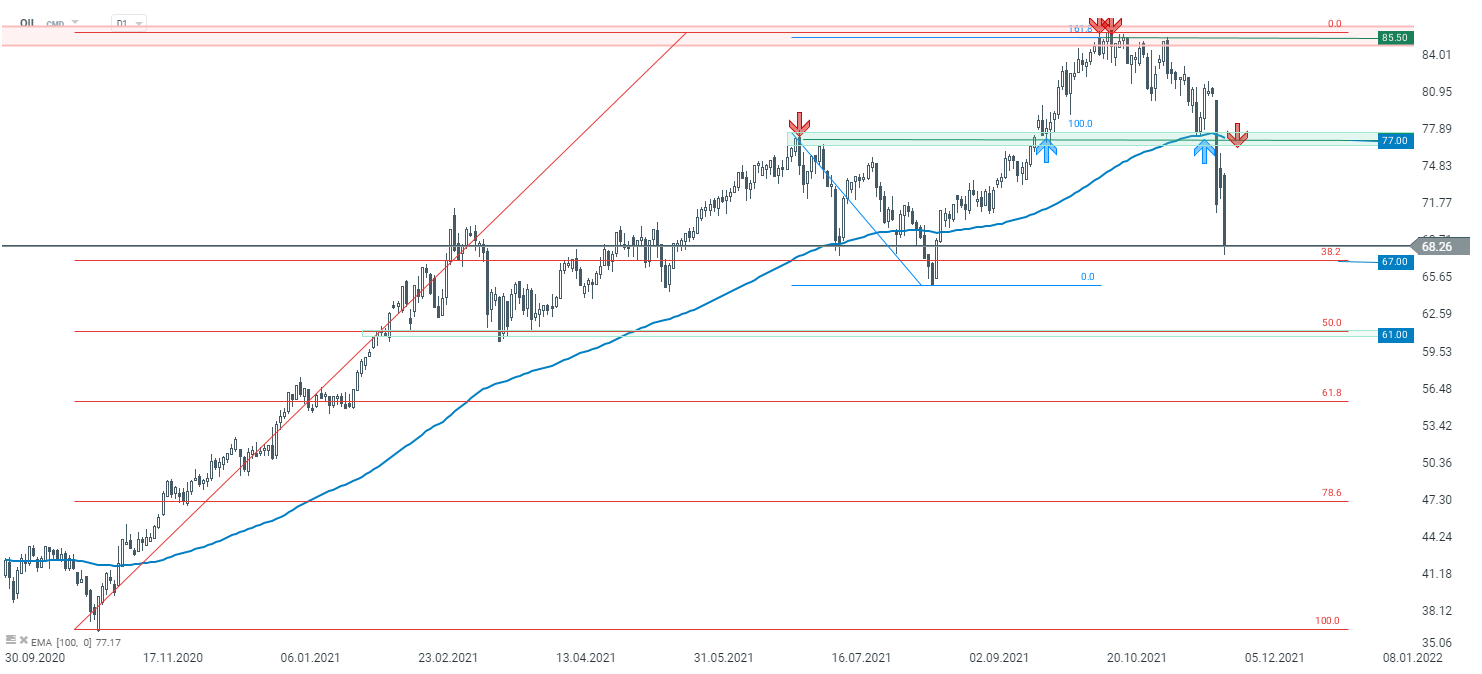

OIL price extended downward movement during today's session and is currently approaching major support at $67.00 per barrel which coincides with 38.2% Fibonacci retracement of the upward wave launched in November 2020. Should break lower occur, downward move may accelerate towards $61.00 level which coincides with 50.0% retracement. On the other hand, if buyers manage to halt declines here, then another bullish impulse towards local resistance at $77.00 may be launched. Source: xStation5

OIL price extended downward movement during today's session and is currently approaching major support at $67.00 per barrel which coincides with 38.2% Fibonacci retracement of the upward wave launched in November 2020. Should break lower occur, downward move may accelerate towards $61.00 level which coincides with 50.0% retracement. On the other hand, if buyers manage to halt declines here, then another bullish impulse towards local resistance at $77.00 may be launched. Source: xStation5

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.