Apple (AAPL.US) is the final of US megatech companies to report earnings for calendar Q1 2023. iPhone maker will publish financial results for fiscal-Q2 (January-March period) today after the close of the Wall Street session. Market expects the company to report lower revenue compared to a year ago with product sales driving the decline. Let's take a look at what are expectations for the release and what to watch.

Apple fiscal-Q2 earnings expectations

- Revenue: $92.6 billion (-4.8% YoY)

- Products revenue: $71.91 billion (-7.2% YoY)

- iPhone revenue: $48.97 billion (-3.2% YoY)

- Mac revenue: $7.74 billion (-25.9% YoY)

- iPad revenue: $6.69 billion (-12.5% YoY)

- Wearables, home and accessories: $8.51 billion (-3.3% YoY) - Services revenue: $21.11 billion (+6.5% YoY)

- Diluted EPS: $1.43 (-6.5% YoY)

Drop in products sales, slowdown in services growth

While revenue drop is never welcome, it will not be a surprise. Apple itself has guided market for an around-5% revenue drop in the quarter. However, there are some worrying signs that the company, as well as analysts, may be underestimating the true extent of a drop. The biggest hit is expected to come from Mac sales with the median estimate pointing to around 25% YoY drop. However, data from IDC suggests that Mac shipments may have dropped by 40% in March quarter, signalling a potential for downside surprise in product sales. Supply chain issues as well as unfavourable FX moves are said to weigh on product sales. On the other hand, iPhone sales could surprise to the upside after Foxconn, Taiwan-based chip contract and one of Apple's main assemblers, reported a record sales for a quarter ending in March 2023. Services sales are expected to come in 6.5% YoY higher but growth is expected to slow from 17.3% YoY growth reported in a year ago period as advertisement and gaming spending slows.

Buybacks and dividends can be flat year-over-year

Fiscal-Q2 earnings release will likely include announcement on profit redistribution. Market expects this figure - a sum of buybacks and dividends - to be relatively flat year-over-year at $90 billion. However, as Apple is not as profitable as it used to and resorts to its massive cash pile to fund dividends and buybacks, investors will look for any guidance on when those funds may start to be reduced. In such a scenario, it is more likely that Apple will trim or abandon buybacks rather than divert from dividend policy. Sales guidance for fiscal-Q3 will also be on watch as market projects that Apple will manage to turn the tide and report sales increase.

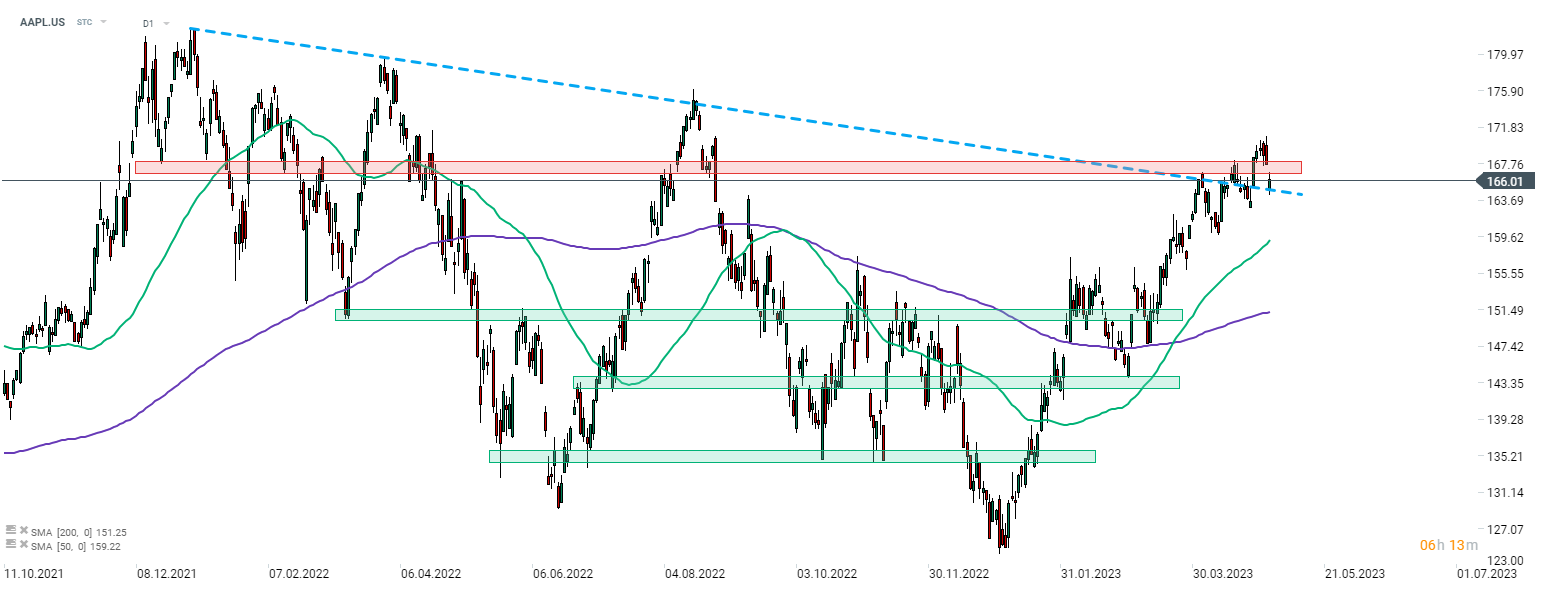

A look at the chart

Apple (AAPL.US) launched today's trading with a bearish price gap. However, looking at the stock from a broader point of view, technical outlook remains unchanged even after this drop. Stock has recently climbed above the downward trendline and reached the highest level since August 2022. If bulls managed to defend the $165 area, another upward impulse could be generated. However, today's earnings release after the session close is likely to result in elevated volatility on the stock and may lead to significant change in technical outlook.

Source: xStation5

Source: xStation5

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.