Why Microsoft’s Earnings Matter

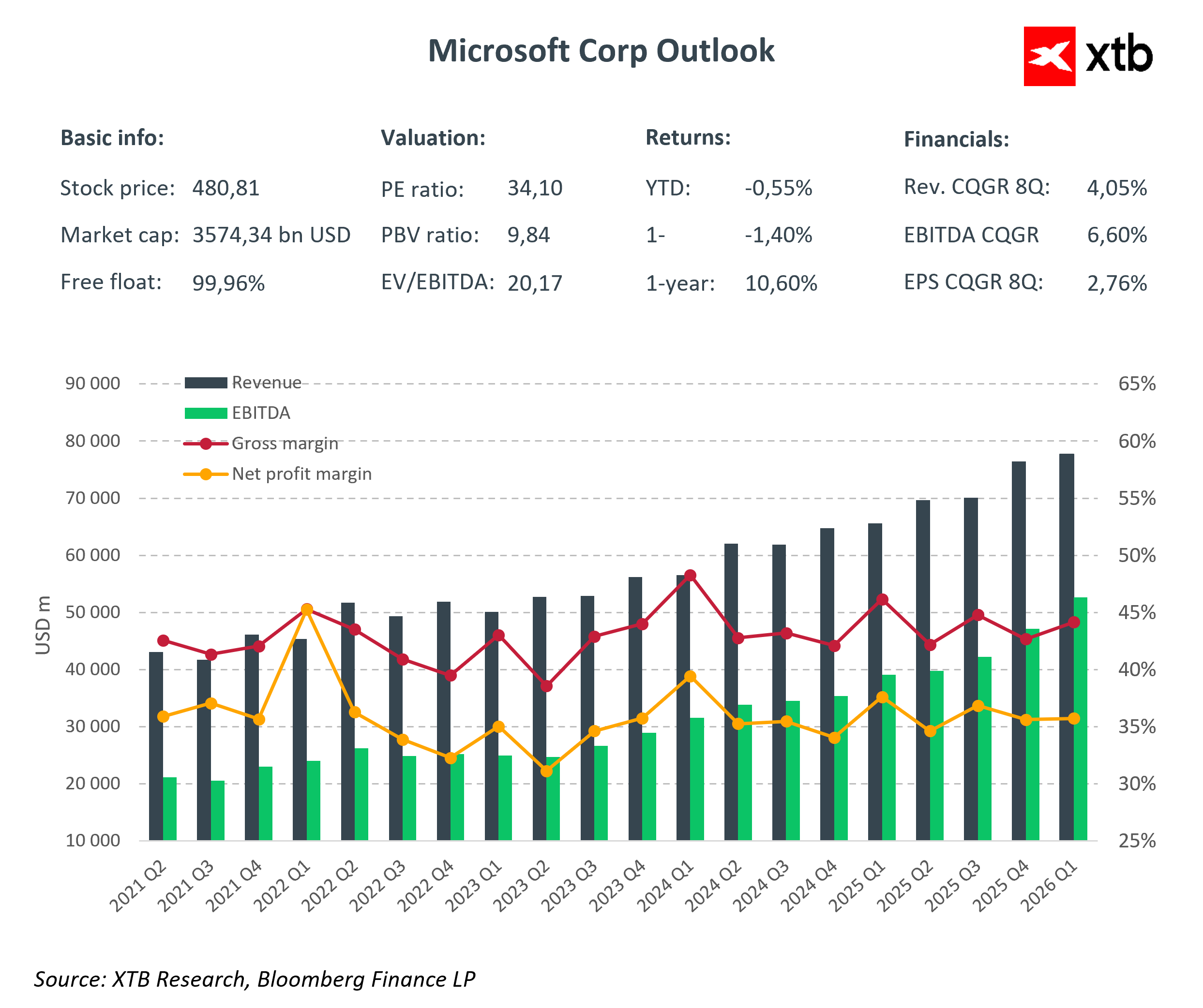

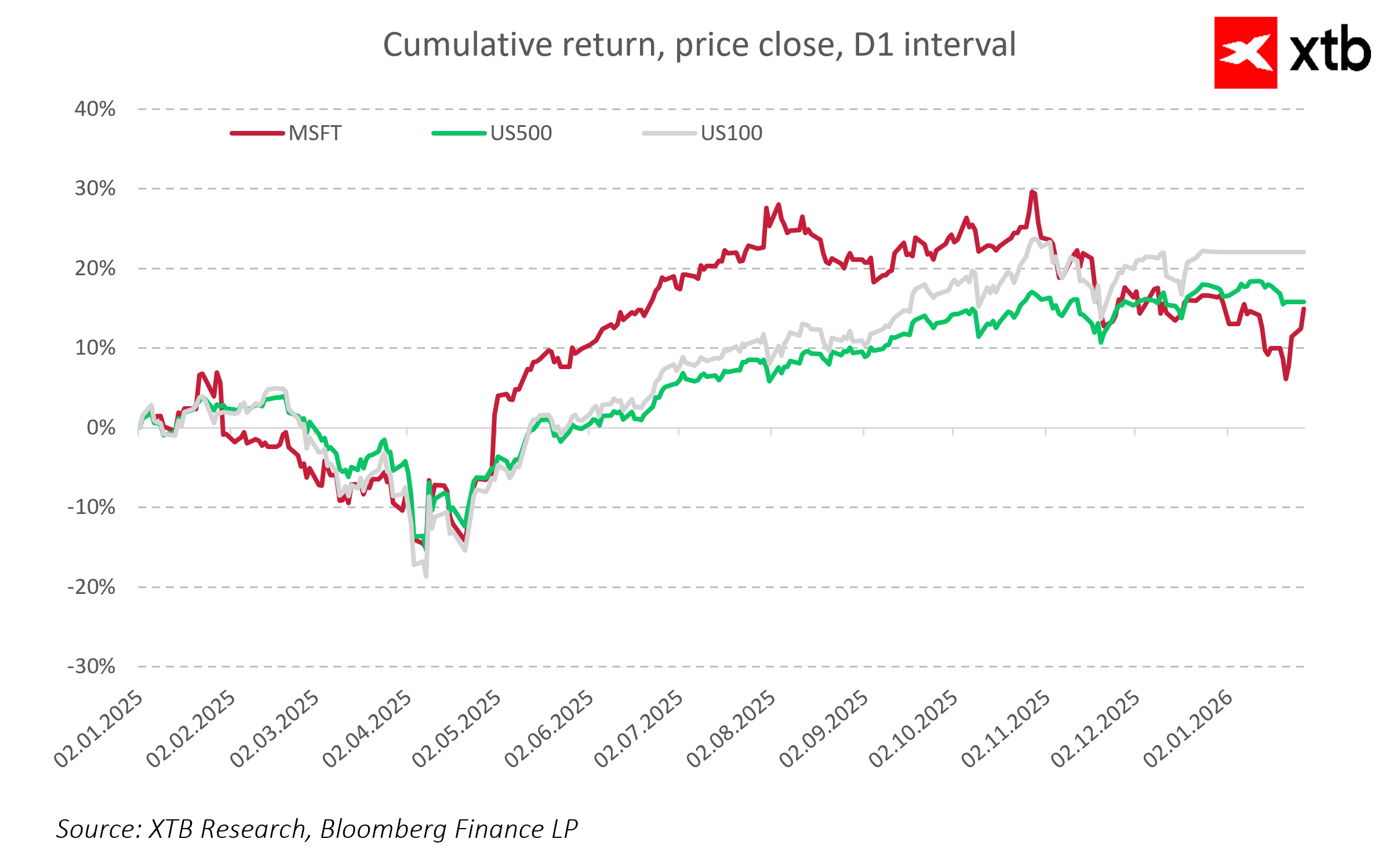

Microsoft enters the earnings season as one of the most important and, at the same time, most demanding technology companies to evaluate globally. After years of consistent strategic execution, rapid cloud expansion, and an aggressive push into artificial intelligence, the market is no longer looking for vision statements or ambitious promises. Today’s results represent a test of the company’s business model maturity in an environment of very high valuation, rising infrastructure costs, and intensifying competition. Investors will focus not only on headline numbers, but primarily on whether growth in Azure and AI-related services remains strong enough to justify the scale of investments and ongoing margin pressure.

The Intelligent Cloud segment remains the primary growth engine, with Azure continuing to expand at a pace well above the broader IT market. The dynamics of this segment, rather than absolute revenue or EPS levels, will be the key reference point for the market. Microsoft is at a stage where even small changes in growth momentum can be interpreted either as a sign of structural slowdown or as confirmation of a durable competitive advantage. The market is not expecting spectacular acceleration, but rather consistent execution of a strategy that combines sustainable revenue growth with cost discipline and long-term investments in critical future technologies.

Forecasts and Consensus

-

Total revenue: USD 80.31bn

-

Net income: USD 29.08bn

-

EPS: USD 3.92

-

Intelligent Cloud: ~USD 32.39bn (+27% YoY)

-

Azure growth: 26–27% YoY

-

Gross margin: 67.2%

-

Net margin: 36.2%

-

EBITDA: USD 47.92bn

-

CapEx: USD 23.77bn

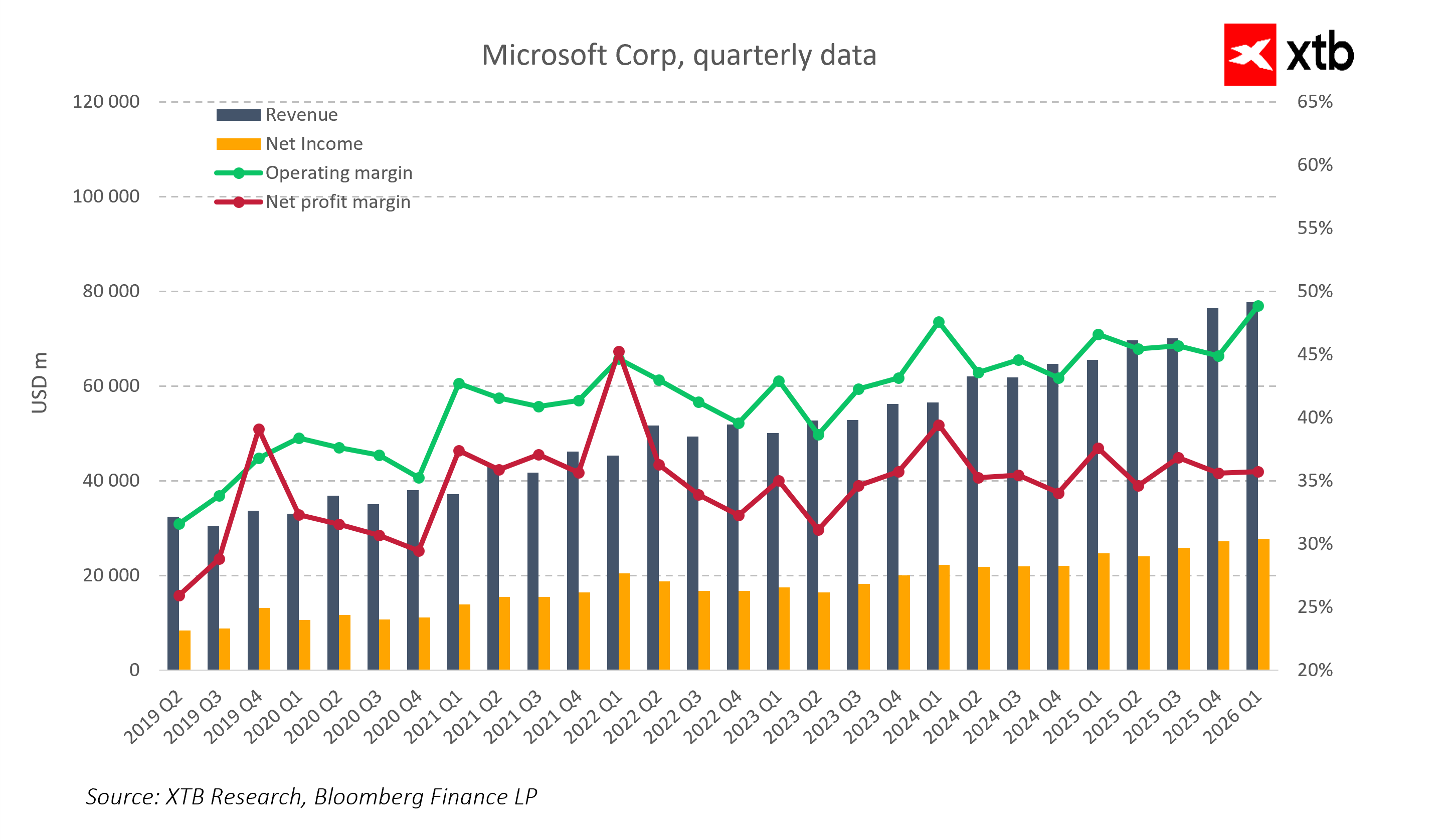

For the market, the absolute revenue figure matters less than its structure and sources of growth. Is Azure still the dominant driver of performance? What share of growth is generated by AI-related products? Are investments in data centers and GPUs rising faster than AI revenues? These are the questions that will ultimately shape market perception of today’s report. Microsoft approaches this earnings release at a point where expectations are already partially priced into the valuation, leaving little room for disappointment.

Azure and AI – The Core of the Strategy

The Intelligent Cloud segment, and Azure in particular, remains the central pillar of Microsoft’s growth strategy. Rising demand for cloud services and AI compute has positioned the company as one of the main beneficiaries of the global race for computing power and generative AI adoption. Products such as Copilot, deep AI integration within Microsoft 365, and the growing number of AI workloads hosted on Azure continue to strengthen the company’s appeal to enterprise customers.

This rapid expansion comes with enormous demand for data centers, energy, and GPUs, directly translating into record capital expenditures. Microsoft must simultaneously meet rising customer demand, maintain its competitive edge against AWS and Google Cloud, and manage cost pressure that scales with investment intensity. The performance of this segment will largely determine how effectively the market perceives Microsoft’s strategy and long-term value creation.

CapEx and Margins – A Test of Growth Quality

The most significant challenge facing Microsoft is cost pressure. Heavy investments in data centers, AI infrastructure, and cloud capacity are weighing on operating margins, even amid strong revenue growth. Investors will look beyond EPS and focus closely on management commentary regarding CapEx, cost control, and returns on AI investments. Today’s results are a test of growth quality. The key question is not only how fast Microsoft is growing, but whether it can scale efficiently in the AI era without permanently impairing profitability.

Stable Foundations – Office, Windows, and Gaming

Beyond cloud services, Microsoft benefits from stable, mature business segments that help absorb the risks associated with aggressive AI investments. Office and Microsoft 365 generate recurring cash flows that offset the cyclicality of cloud-related spending. Windows and the More Personal Computing segment benefit from a recovery in the PC market, while gaming, supported by the Activision Blizzard assets, remains a long-term option for further revenue diversification. This financial stability enables Microsoft to pursue aggressive investments in Azure and AI while limiting short-term pressure on cash flows.

Risks for Investors

Despite its strong market position, Microsoft faces tangible risks. Competition in cloud computing and AI from AWS and Google Cloud remains intense and continues to escalate. The company’s high valuation leaves the market with little tolerance for any disappointment in Azure growth or margin performance. In addition, regulatory pressure, antitrust risks, and geopolitical uncertainty add to long-term unpredictability. Investors must assess not only quarterly results, but also Microsoft’s ability to sustain its competitive advantages over multiple years.

A Test of Strategic Execution

Q2 2026 results will provide the first meaningful signal of whether Microsoft can translate its massive investments in AI and Azure into tangible financial outcomes. Sustained revenue growth, stable margins, and positive cloud and AI indicators would reinforce confidence in the company’s strategy. For this plan to succeed, Microsoft must defend its Azure leadership, scale AI profitably, manage capital intensity, and preserve strong fundamentals across its mature business segments.

Microsoft stands at a point where its strategy is clear, demand is real, and competitive advantages are substantial. The remaining question is whether execution quality and growth momentum in the coming quarters will meet market expectations that already assume near-perfect outcomes. If so, Microsoft will remain a cornerstone of the global technology market. If not, the path to further value creation may prove more challenging than current consensus suggests.

Key Takeaways

Microsoft is in a strong position, supported by a clear strategy, tangible demand for its products, and meaningful competitive advantages. Execution speed and quality in the coming quarters may allow the company to maintain cloud leadership, expand AI-driven revenues, and push Free Cash Flow to record levels. Sustained growth in Intelligent Cloud and AI would reinforce Microsoft’s role as a pillar of the global technology ecosystem, with Q2 2026 potentially marking the beginning of another significant phase of value expansion.

Source: xStation5

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.