-

US indices finished yesterday's trading mostly lower. S&P 500 dropped 0.03%, Nasdaq declined 0.58% and Russell closed 0.74% lower. Dow Jones gained 0.29%

-

Stocks in Asia declined. Nikkei closed 0.19% lower while S&P/ASX 200 finished flat. Kospi trades 1.2% lower and indices from China decline during the first trading session after Lunar New Year

-

DAX futures point to a flat opening of the European session

-

FOMC minutes showed that central bankers think it will take some time to meet conditions to taper QE

-

Pfizer said that new data showed 1 dose of its coronavirus vaccine to be 93% effective after 2 weeks and urged countries to switch to single dosing. Moderna said that its vaccine works against all variants of the virus but results for South African strain are not clear

-

White House said it is engaged in addressing chip shortages on the automotive market

-

Draghi's government won confidence vote at the Italian Senate

-

Brent jumped above $65 as the energy crisis in the United States worsens. Texas authorities banned natural gas companies from exporting fuel outside of the state. US oil has dropped by almost 40% amid temporary shutdowns

-

Australian dollar gained following release of employment report for January. Employment increased 29.1k (exp. 40k) while unemployment rate dropped to 6.4% (exp. 6.5%)

-

API data showed 5.8 million barrel decline in the US oil inventories (exp. -2.2 mb)

-

Bitcoin trades slightly below $52,000 mark

-

Precious metals gain with silver being the exception

-

AUD and EUR are top performing major currencies while NZD and CHF lag the most

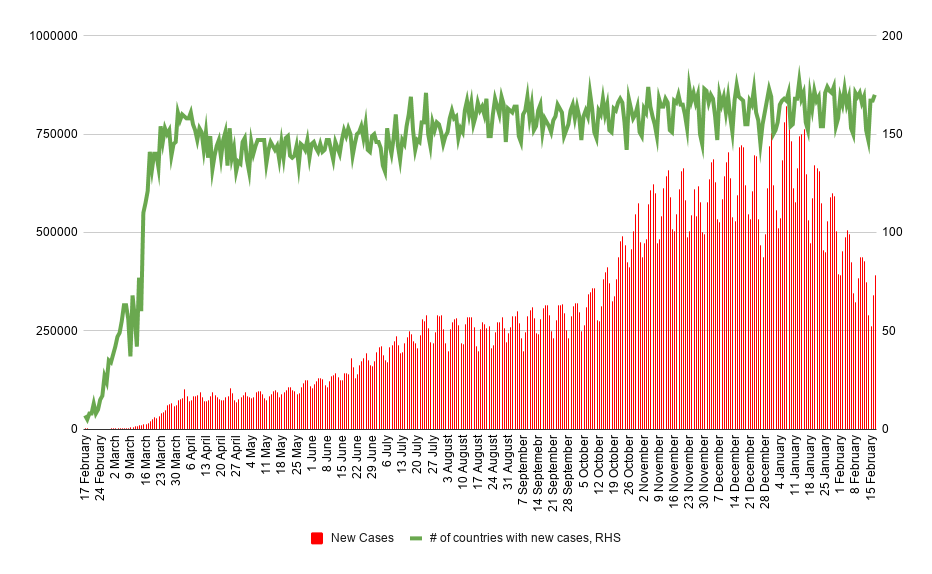

Over 390 thousand new coronavirus cases were reported yesterday. Source: worldometers, XTB

Over 390 thousand new coronavirus cases were reported yesterday. Source: worldometers, XTB

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.