-

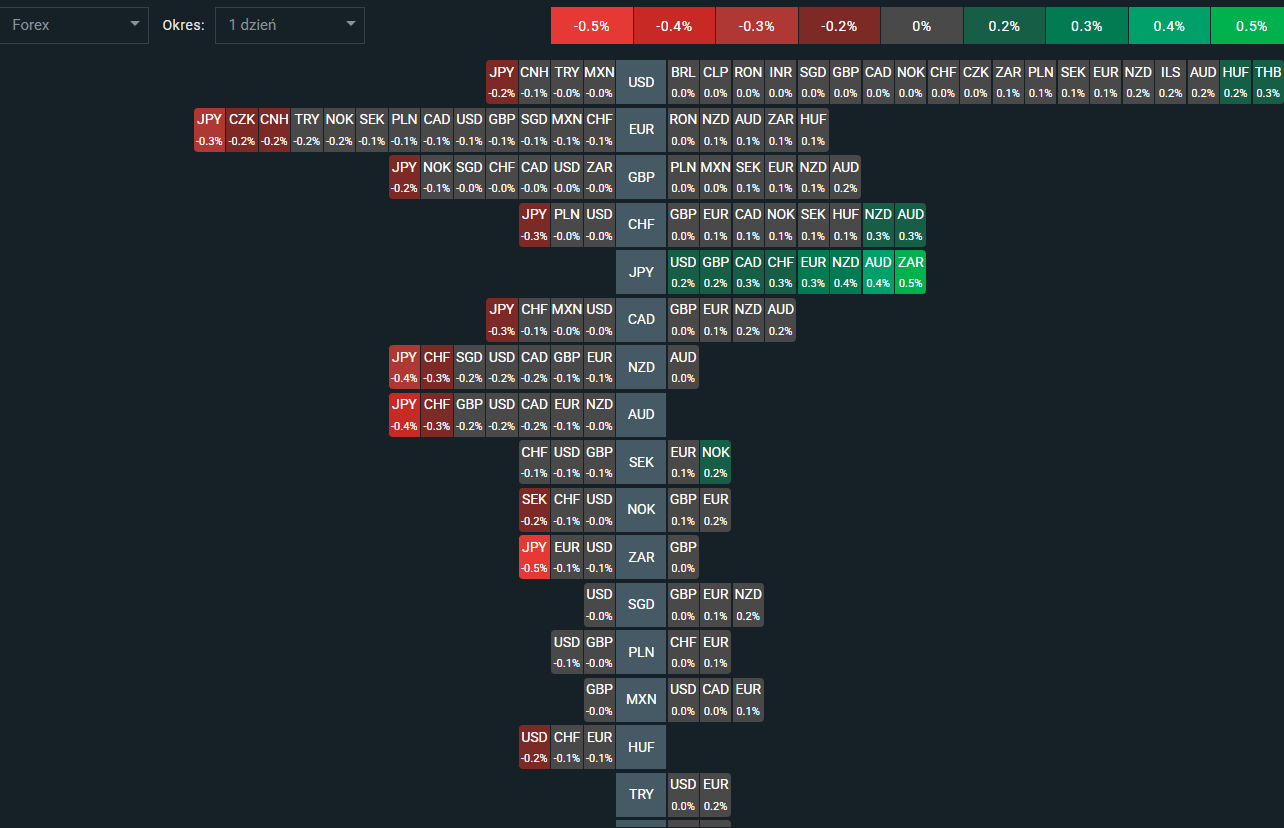

The session in the Asia-Pacific region is unfolding in calm sentiment. Changes across most indices are limited to +/- 0.50%. Japan’s JP225 is up 0.02%, Singapore’s SG20cash is rising 0.88%, and Australia’s AU200.cash is gaining 0.55%.

-

The Australian dollar is one of the stronger G10 currencies today and strengthened following solid labor market data, which increased expectations of a potential RBA rate hike in March. The AUDUSD pair rose 0.25% to 0.7070 before partially retracing the move.

-

Employment increased by 17.8k in January, which is not a particularly strong result. However, the unemployment rate held at 4.1%, below expectations, and hours worked rose by 0.6%.

-

Unemployment has now declined for four consecutive months — a similar pattern was last seen before the 2022 tightening cycle.

-

Japan’s core machinery orders surged 19.1% m/m and 16.8% y/y, significantly exceeding forecasts. The rebound followed sharp declines in November, suggesting that the earlier weakness was temporary. Investment momentum supports expectations of continued economic expansion.

-

Stronger investment data reinforce the growth narrative and support Japanese equities. Foreign capital inflows into Japanese stocks have recently accelerated.

-

Two-thirds of Japanese companies have expressed concerns about fiscal discipline under Prime Minister Takaichi. The proposed tax suspensions and spending plans have unsettled the bond market and pushed yields higher. Businesses fear yen depreciation and rising financing costs.

-

The January FOMC minutes removed the explicit reference to reaching the 2% inflation target by 2028. The Fed’s analytical team now assesses inflation as slightly higher than in the December projections. The omission signals greater uncertainty about the “last mile” in the fight against inflation. Markets may interpret this as reinforcing a “higher for longer” rate scenario.

-

The FOMC minutes confirm that Jerome Powell will remain Chair until his successor is formally approved. The confirmation process for Kevin Warsh may be delayed for political reasons in the Senate.

-

Reports indicate that the US military is prepared for potential strikes on Iran, although no final decision has been made. The situation remains dynamic and politically sensitive.

Economic calendar: US trade balance and jobless claims 🔎

Fed minutes released 🗽Key takeaways

Daily summary: Wall Street and oil gain 📈 EURUSD slides 0.5%

Gold surges 2.5% nearing $5000 per ounce 📈

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.