- Tesla's stock plunge intensifies

- Elon Musk's Brother sold $109 million in Tesla stock last week

- Michael Burry believes Musk may want to sell his shares to cover his personal debts

Tesla Inc (TSLA.US) stock fell more than 10% during today's session pushing the company's market capitalization down by about $137 billion since the sell-off started Monday, when shares dropped nearly 5.0%., as investors dumped the high-flying stock in anticipation of a possible stake sale by company chief Elon Musk.

The rout comes after Musk asked his Twitter followers over the weekend if he should sell 10% of his stake in the company as Washington proposes to hike taxes for the super-wealthy. Nearly 58% correspondents said the world’s richest person should sell a stake worth about $21 billion. It seems that many investors who own electric carmaker shares decided to sell their holdings before Musk does the same, in order to avoid panic sell-off. Also recent news that Musks' brother Kimbel sold 88,500 Tesla shares on Friday, a day before his brother launched his now infamous Twitter poll, weighed on sentiment. Kimbel sold the stake at an average price of $1,229.91 per share which amounts to about $109 million. The shares sold represented about 15% of Kimbal’s equity stake, excluding options.

Meanwhile, the media hype around Tesla caused Micheal Burry, an investor known from the movie "The Big Short" and head of Scion Asset Management, to return to Twitter. Burry, who is known for his bearish stance towards Tesla stock, suggested Elon Musk might want to sell some stock to cover his personal debts and to sound the alarm on dangerous speculation in financial markets. Burry posted a link to a SEC filing in August, which noted that Musk has pledged about 88 million shares, or 36% of his total stake, as collateral for personal loans as of June 30. Burry believes that Musk needs some funds to service the loans he's taken out using his Tesla stock.

Investors will be closely watching SEC filings from Tesla for any details on Musk's plans. SEC rules give companies four working days to report major events.

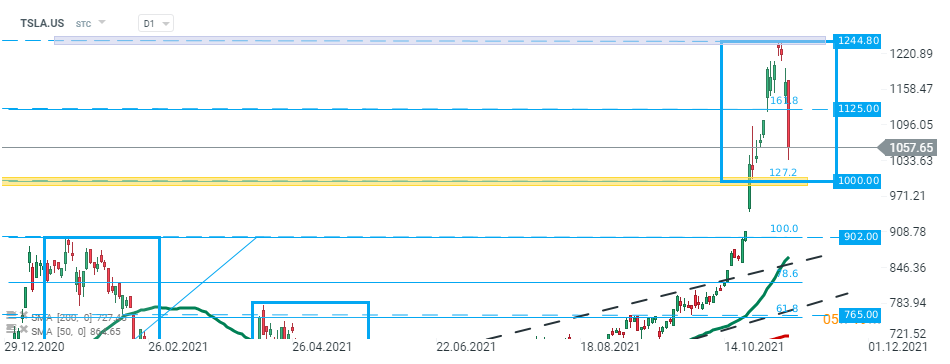

Tesla Inc (TSLA.US) stock fell over 10.0% on Tuesday and is approaching psychological support at $1000.00 which is marked with lower limit of the 1:1 structure and 127.2% external Fibonacci retracement of the downward correction launched in January 2021. Source: xStation5

Tesla Inc (TSLA.US) stock fell over 10.0% on Tuesday and is approaching psychological support at $1000.00 which is marked with lower limit of the 1:1 structure and 127.2% external Fibonacci retracement of the downward correction launched in January 2021. Source: xStation5

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.