Summary:

-

UK PM May states plans for meaningful Brexit vote 3rd week of January

-

Move counters opposition plans for vote of no confidence

-

Pound remains little changed on the day; GBPUSD near 1.26

Politics in the UK remains the biggest driver of the pound as the Brexit saga wrangles on and today there’s been more developments on this front with PM Theresa May setting a date for a vote on her Brexit deal. According to her statement Parliament will vote on the deal sometime during the third week in January, which begins on the 14th. The decision to make this announcement has seemingly outmaneuvered the opposition, with the Labour party leader Jeremy Corbyn reportedly preparing to call a motion of no confidence in her if she failed to announce a date today.

Selected comments from PM May are as follows:

-

The backstop will not need to be triggered

-

If the backstop was triggered it would be temporary

-

Discussions continue on the backstop with the EU

-

Cabinet will discuss no deal plan on Tuesday

-

Do not imagine that if the deal is voted down that a new one will magically appear

The prime minister was addressing the house on the latest with the backstop following her largely unsuccessful trip to Europe last week during which she attempted to gain more clarification on the clause and received little backing. It’s now just 14 weeks until the UK leaves the EU and after a barrage of Brexit related news in the past week there may be a bit of a lull over the festive period before it is ramped up again ahead of the vote.

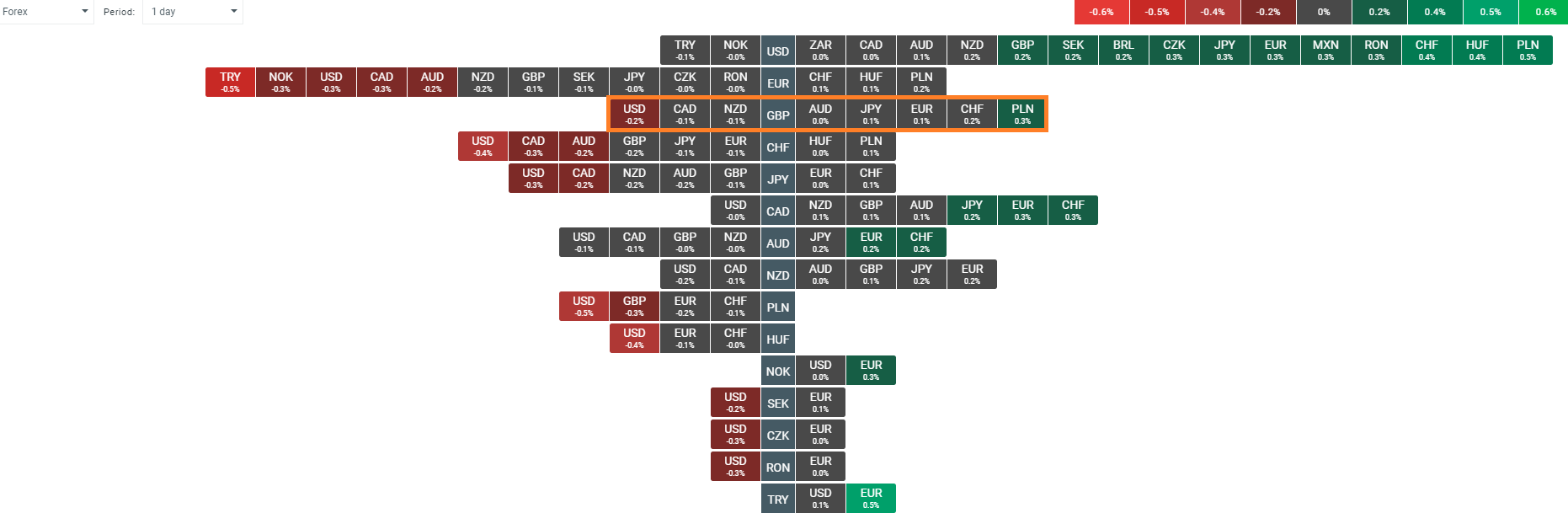

The Pound is little changed on the day with no major moves seen. The focus now will likely shift back to May’s deal and the chances of her getting it passed in January. Source: xStation

Looking at cable, the market had attempted to push higher earlier today but has since fallen back a little. Price moved back above the 8 period EMA on D1 but looks set to give a fair chunk of those gains back and remains in a downtrend according to these indicators. The market really needs to get back above the 1.27 handle for the outlook to improve markedly while recent lows at 1.2475 continue to be a potentially important reference point below. Looking ahead the USD side of the pair may actually be the bigger driver in the coming days as attention turns to the Fed meeting and their final policy decision of the year on Wednesday.

There’s been little reaction to the day’s Brexit news in the GBPUSD market, with the pair remaining in a downtrend according to the 8 and 21 EMAs. 1.2700 could be seen as important resistance while 1.2475 may offer support below. Source: xStation

There’s been little reaction to the day’s Brexit news in the GBPUSD market, with the pair remaining in a downtrend according to the 8 and 21 EMAs. 1.2700 could be seen as important resistance while 1.2475 may offer support below. Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.