Uranium has returned to the center of investors’ attention, as the rally in the commodity has pushed uranium-related stocks to fresh all-time highs. Uranium prices have climbed to $85.25 per pound, marking the highest level in nearly 18 months.

The market is increasingly pricing in a combination of rising structural demand and an additional buying impulse from investment funds. Shares of companies such as Uranium Energy Corp (UEC.US) in the United States, Canada’s Cameco (CCJ.US), and Kazatomprom (KAP.UK)—the world’s largest uranium producer based in Kazakhstan—have posted gains on a historic scale, driven by the powerful comeback of nuclear energy.

In recent commentary, Bank of America indicated it expects uranium prices to rise steadily in 2026, with investor focus likely to remain tilted toward large-scale producers such as Cameco, rather than smaller mining names.

The uranium bull market is back — after nearly 20 years

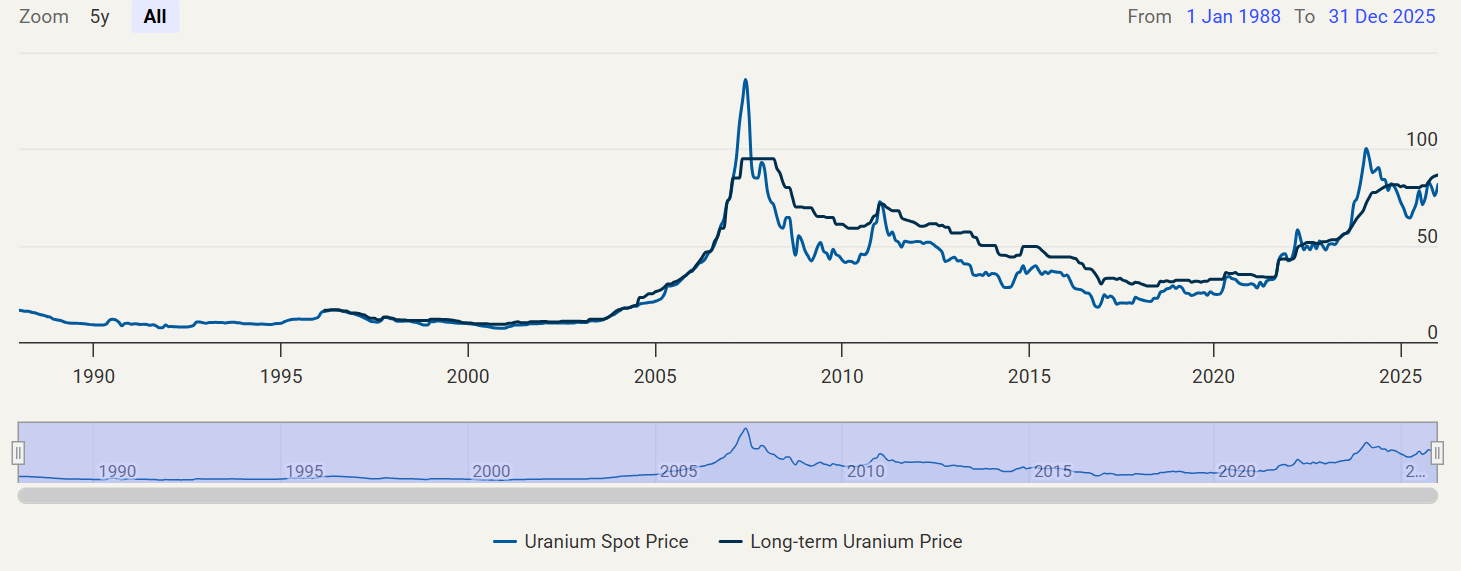

Uranium prices have already notched a substantial rebound, yet they remain far below the peak levels seen during the previous bull market in 2007. The sector endured the shock of the Fukushima disaster, but today the narrative is shifting again—toward uranium as one of the most efficient and reliable energy sources in a world seeking stable, scalable power. Source: Cameco

Uranium prices have already notched a substantial rebound, yet they remain far below the peak levels seen during the previous bull market in 2007. The sector endured the shock of the Fukushima disaster, but today the narrative is shifting again—toward uranium as one of the most efficient and reliable energy sources in a world seeking stable, scalable power. Source: Cameco

Key drivers behind the rise in uranium prices

-

A broader commodities upcycle and a long-term demand recovery

The uranium rally fits into the wider context of a commodities bull market and a rebuilding of long-term demand. Nuclear power is increasingly viewed as a cornerstone of stable, low-emission electricity generation—also essential for expanding compute capacity and powering artificial intelligence. -

A shift in the U.S. approach to nuclear policy

Political momentum is growing to rebuild America’s domestic nuclear fuel supply chain. Signals from the market suggest that some regulatory requirements for permits related to uranium enrichment facilities have been eased, while the topic of expanding U.S. nuclear infrastructure has returned to the policy agenda. -

Adapting to sanctions and reduced availability of Russian nuclear fuel

A key structural theme is the market’s adjustment to constraints created by sanctions and diminished access to Russian nuclear fuel. The gradual move away from Russian uranium is increasing interest in cooperation with Western partners—such as Cameco and Centrus—to stabilize supply and fill potential gaps. -

More aggressive buying by funds and the physical market

Investment demand is gaining importance again, particularly in vehicles backed by physical uranium. In recent weeks, attention has turned to the reported purchase of 100,000 pounds of uranium by Canada-based Sprott, reinforcing the view that institutional capital is re-entering the sector with renewed conviction. -

Nuclear gaining support from the data center boom

The rapid expansion of digital infrastructure and AI is driving demand for highly reliable power. This strengthens the argument that nuclear energy could become a key pillar in supplying energy-intensive data centers, indirectly supporting uranium demand expectations. -

Shrinking availability of secondary supply

Over the medium to long term, the market may increasingly feel the decline in “liquid” supply from inventories, reprocessed material, and other secondary sources. Historically, this has been a catalyst for rising price premiums whenever the global market tightens. -

New reactors in Asia as the foundation of long-term demand

Longer-term upward pressure could intensify as new nuclear units are commissioned—primarily in China and India, but also across other developing economies where nuclear power is becoming more important for energy security. -

Demand outlook: the market sees a persistent structural gap

Industry estimates suggest global uranium demand could rise by around 28% by 2030, implying sustained pressure for utilities to increase procurement hedges, fiercer competition for available material, and upward pressure on the spot market. -

Volatility remains part of the game, but fundamentals are strengthening

Uranium markets are naturally prone to sharp moves and episodes of fast corrections. Even so, there are growing signs that short-term “nervousness” can coexist with a longer-term uptrend—driven by rising contracting activity, utility buying, and nuclear energy’s expanding role in the global power mix.

Uranium Energy Corp is the largest U.S.-based company involved in uranium production within the United States. The stock hit record highs yesterday, climbing above $18 per share, and is up more than 36% year-to-date.

Source: xStation5

Shares of Centrus Energy—the largest and effectively the only major U.S. company specialized in uranium processing—have delivered exceptional gains. Recently, the stock rebounded from its 200-day moving average on the daily chart, resuming its upward trend.

Source: xStation5

Shares of the second largest US uranium miner, Cameco set all-time high at $117 per share.

Source: xStation5

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.