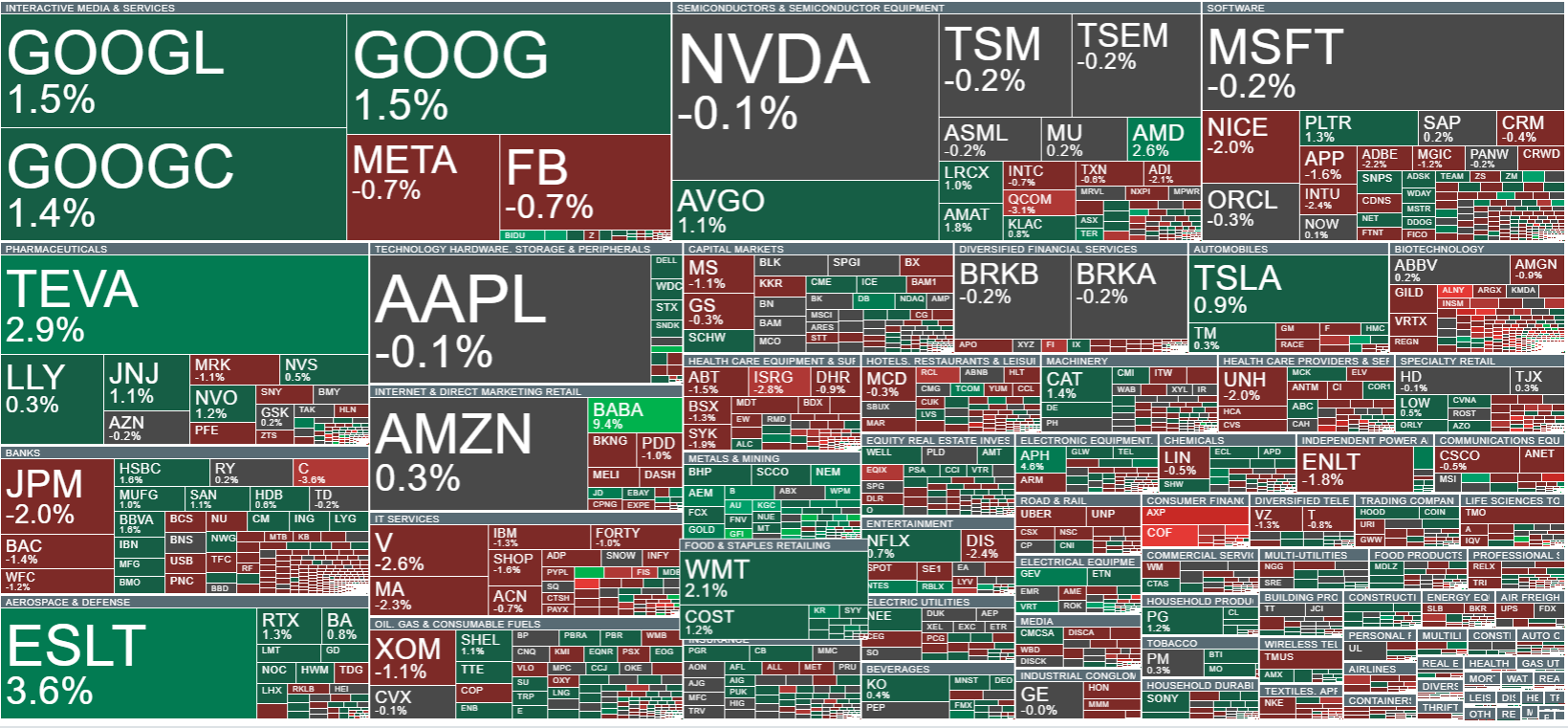

At the opening of the Wall Street session, the Dow Jones Industrial Average is down 0.5%, the S&P 500 has lost 0.2%, and the Nasdaq Composite is down 0.1%, reflecting growing investor uncertainty amid escalating political tensions surrounding the Federal Reserve. Over the past weekend, U.S. federal prosecutors launched a criminal investigation into Fed Chair Jerome Powell concerning the bank’s headquarters renovation project and his Senate testimony. The Department of Justice has issued grand jury subpoenas and suggested the possibility of charges, an unprecedented event in the modern history of the Fed. Powell has denied the allegations, calling them a politically motivated attack aimed at pressuring the central bank to lower interest rates faster, as requested by President Donald Trump’s administration.

The declines in equities are driven by investors’ concerns over the Fed’s independence and the potential increase in risk and volatility in monetary policy. Political pressure on the central bank could influence interest rate decisions, borrowing costs, and the overall stability of the U.S. economy, heightening uncertainty in both the short and long term.

Source: xStation5

US500 (S&P 500) futures are falling today amid rising tensions between President Trump and the Federal Reserve. Markets fear an escalation of the conflict and uncertainty regarding the Fed’s future decisions, which could impact interest rates, credit costs, and the stability of the U.S. economy.

Source: xStation5

Company News:

- Beam Therapeutics (BEAM.US) shares are up around 20% after announcing progress in developing precision genetic medicines and presenting the company’s strategic plans for 2026. The company highlighted recent achievements in liver-targeted genetic diseases and hematology, outlined strategic priorities for the year, and extended its projected funding runway through 2029. Expansion of the liver-targeted genetic disease portfolio is also underway, with a new program to be announced in the first half of 2026.

- Birkenstock (BIRK.US) shares are up more than 2% following preliminary fiscal Q1 2026 revenue of €402 million, reflecting a 11.1% year-over-year increase on a reported basis and 17.8% growth in constant currency. The company will release full results on February 12.

- UnitedHealth Group (UNH.US) shares are down nearly 2% after a Senate committee found the company had employed “aggressive tactics” to boost federal payments in the Medicare Advantage program. The company denies some of the allegations

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood

Spring Statement fails to calm UK bond market,

DE40 dips 3% and falls to 2026 lows 🚨📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.