Walmart (WMT.US) rallies over 6% today, following release of fiscal-Q1 2025 earnings report (calendar February - April 2024). US retailer reported results that were much better than expected, as well as decided to boost a full-year outlook.

Walmart reported a 6.1% YoY jump in total revenue, with net sales increasing 5.9% YoY and almost reaching $160 billion. Growth in cost of revenue was slower than revenue growth, allowing for an improvement in gross margin. Company also managed to improve operating margin compared to a year ago, while EBITDA margin remained unchanged. An over-200% spike in net income can be attributed to a $794 million in 'other interest gains'. Walmart reported almost $3 billion in 'other interest losses' a year ago.

However, while fiscal-Q1 results were better than expected, the move higher today is driven primarily by forecasts, especially full-year forecast. Walmart boosted its full-year 2025 net sales growth forecast and now expects it to be near the upper-end or slightly above previous guidance of 3-4% guidance. It is rather unusual for the company to adjusted its full-year outlook as soon as in fiscal-Q1 and analysts hint that such a move reflect company's confidence.

Walmart (WMT.US) rallies over 6% today and exceed $500 billion in market capitalization for the first time in history.

Fiscal-Q1 2025 earnings

- Revenue: $161.51 billion vs $159.58 billion expected (+6.1% YoY)

- Net sales: $159.94 billion vs $158.13 billion expected (+5.9% YoY)

- Membership & Other Income: $1.57 billion vs $1.37 billion expected (+21% YoY)

- Cost of revenue: $121.43 billion vs $120.56 billion expected (+5.3% YoY)

- Gross profit: $40.08 billion vs $38.74 billion expected (+8.3% YoY)

- Gross margin: 24.8% vs 23.8% expected (23.7% a year ago)

- Operating income: $6.84 billion vs $6.56 billion expected (+9.6% YoY)

- Operating margin: 4.2% vs 4.1% expected (4.1% a year ago)

- EBITDA: $9.97 billion vs $9.56 billion expected (+9.7% YoY)

- EBITDA margin: 6.2% vs 5.7% expected (6.2% a year ago)

- Net income: $5.10 billion vs $4.21 billion expected (+205.8% YoY)

- Net margin: 3.2% vs 2.7% expected (1.1% a year ago)

- Diluted EPS: $0.63 vs $0.52 expected ($0.21 a year ago)

- US same store sales excluding fuel: 3.9% vs 3.4% expected

- Walmart US Stores: 3.8% vs 3.5% expected

- Traffic: 3.8% vs 3.2% expected

- Ticket: 0.0% vs 1.3% expected

- E-Commerce Contribution: 2.8% vs 1.5% expected

- Sam's Club: 4.4% vs 3.3% expected

- Traffic: 5.4% vs 0.8% expected

- Ticket: -1.0% vs 2.3% expected

- E-Commerce Contribution: 1.8% vs 1.6% expected

- Walmart US Stores: 3.8% vs 3.5% expected

Fiscal-Q2 2025 forecast

- Net sales growth: 3.5-4.5% YoY

- Operating income growth: 3.0-4.5% YoY

- Adjusted EPS: $0.62-0.65

Full-year fiscal-2025 forecast

- Net sales growth: at high-end or slightly above previous 3-4% guidance

- Adjusted EPS: at high-end or slightly above previous $2.23-2.37 guidance

- Capital expenditures: still expected at 3.0-3.5% of net sales

Walmart (WMT.US) gains around 6% today and trades at fresh all-time highs. Company's market capitalization exceeded $500 billion for the first time in history. Source: xStation5

Walmart (WMT.US) gains around 6% today and trades at fresh all-time highs. Company's market capitalization exceeded $500 billion for the first time in history. Source: xStation5

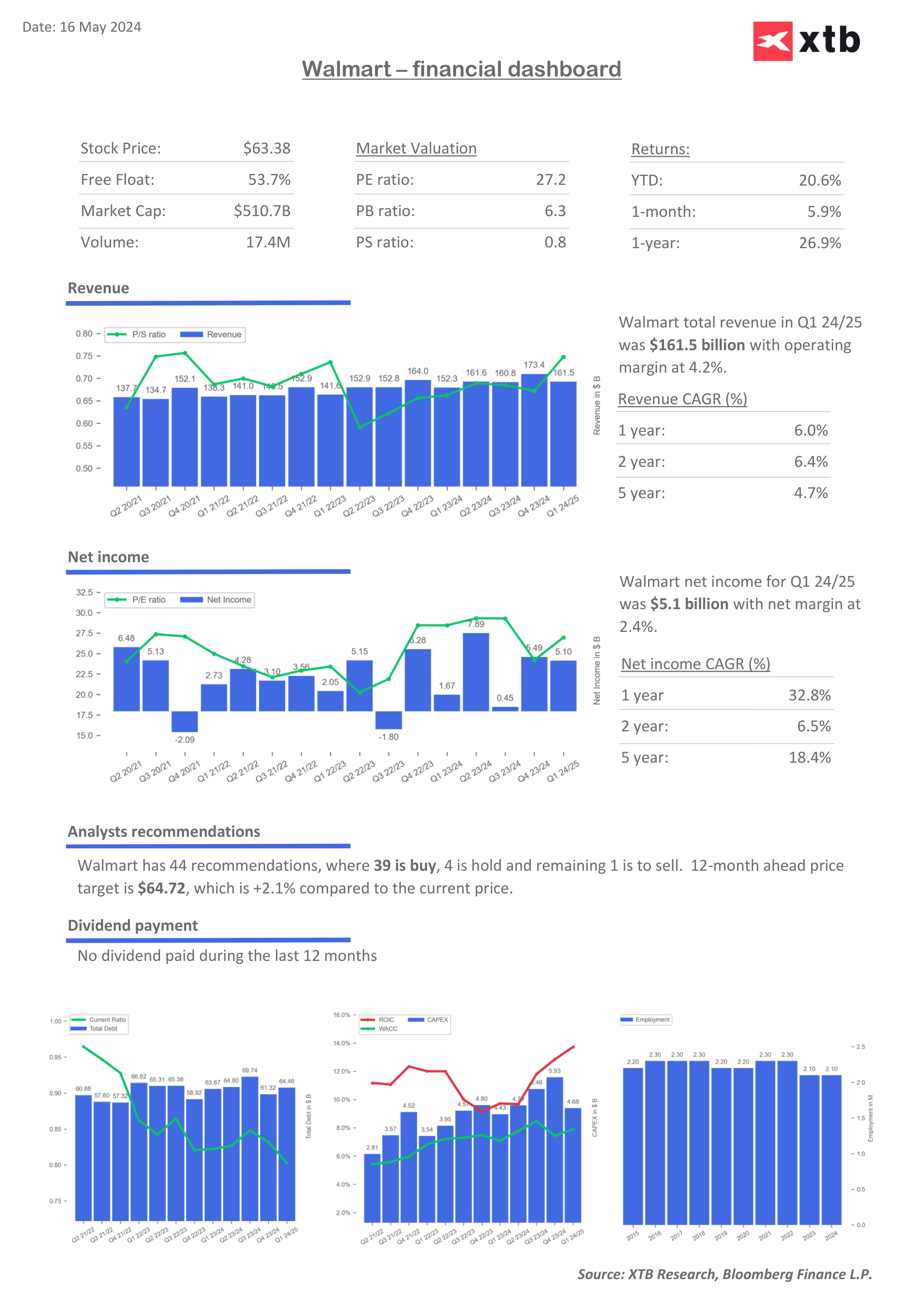

Financial dashboard for Walmart. Source: Bloomberg Finance LP, XTB

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.