The largest contract semiconductor manufacturer, Taiwan Semiconductor Manufacturing (TSM.US) will report its financial results tomorrow, probably around 6:30 AM GMT, as the earnings conference call has been scheduled for 7 AM GMT. The report is likely to prove to be the main stock market event of the week and answer more questions for the market about the growth trajectory of technology companies and the AI trend. The market expects the company to report earnings growth, driven mainly by the AI trend and orders from Nvidia. It appears that TSMC's report could prove pivotal to the broader technology stock sector, with quite a few BigTech companies reporting earnings in April. The question is, will the overall weakness in the smartphone market (Apple shipments fell 9.6% in Q1 2024) be offset by strong demand for AI chips? The company's shares, during today's session in Taiwan, rose nearly 2.5% and sales it's Q1 sales was very strong on YoY measures (but lower than 20% company's FY 2024 forecasts).

Q1 2024 results expectations:

- Revenue: NT$592.64 billion (US$18.26 billion, 16.5% year-on-year increase)

- Earnings per share (EPS): NT$8.3 vs NT$9.21 in Q4 2023 and NT$7.96 in Q1 2023

- Net earnings: NT$214.91 billion (US$6.71 billion, 5% y/y increase)

- CAPEX: NT$29 billion vs. NT$28-$32 billion of company forecasts

What to expect?

- The company has provided monthly revenue figures for many years. TSMC's revenue in March alone rose 34% YoY (the fastest pace since November 2022) and 7.5% MoM. Revenues were up 16.5% for the entire Q1; they totaled $18.26 billion.

- Wall Street expects gross margin to remain unchanged QoQ 53%, and to decline to 52.8% in Q2 2024. The company had indicated in the previous quarter that it expected 20% revenue growth in 2024. Revising these forecasts in either direction could increase volatility

- According to IDC's updated forecasts, AI spending is expected to reach $400 billion by 2027, 250% above International Data Corporation's (IDC) previous forecasts, which definitely has the potential to support Taiwan Semiconductor's growth in the long term.

- TSMC's valuation remains close to the median of the past five years, at less than 20 times future earnings. At the same time, the broad Philadelphia Semiconductor Index is trading at an average of 28 times future earnings (a 15-year high).

- Slowing iPhone sales poses some 'tail risk' for the company as a whole, but despite on that, Apple has had a great four quarters. It's worth considering that weaker smartphone sales may be offset by Apple itself's implementation of AI across its product range with, among other things, M4 chips in MAC computers, in 2024-2025.

The company will focus on high-end, more profitable products with larger 'moat' for data centers, AI accelerators. Source: TSMC

What will the market pay particular attention to?

- Turning to TSMC's chip production, with 3nm technology by companies such as MediaTek and Qualcomm, is also noteworthy, although revenues may be limited by stagnant iPhone sales growth

- Investors will also pay attention to the company's investment in Arizona, which is expected to bring it unprecedented support of $11.6 billion (loans, grants) in funding from the US Chips and Science ACT - perhaps the company will share more precise timelines for the delivery of the investment

- Capex could be very important, as the company, which expects demand to grow, should increase capital expenditures. Their further stagnation could be a big question mark for the market; on the other hand, it is uncertain to what extent their increase (and the consequent decline in free cash flow, caused also by moving production outside Taiwan) will be offset by margins and profits;

- Bloomberg Intelligence believes that TSMC's performance will be driven by high demand for advanced process and chip-casting technology; by which the company may increase capital expenditures from the planned $28-32 billion to maintain its dominant position and meet growing demand for AI chips.

- Analysts at Morningstar suggested that the company is still undervalued, given its 'wide moat' and dominance in manufacturing cutting-edge chips - a perception that may be partly driven by geopolitics and the risk of a potential Chinese invasion of Taiwan

- Saxo Bank expects demand and revenue growth to be higher for a longer period of time than the current valuation of TSMC's shares would suggest. In addition, the company plans to produce state-of-the-art 2nm chips, in the US.

AI momentum will stay?

The last quarter (especially March) for the company was very good, and if nothing has changed over the past few months, it seems that TSMC may be willing to raise its sales and capital spending forecasts, which could provide evidence that strong AI-driven growth will be sustained and perhaps offset the company's more cyclical, uncertain demand for electronics and smartphones. The company's stock could gain due to the systemic importance of the company in the long-term AI trend, similar to Nvidia - as long as companies continue to increase budgets to invest in artificial intelligence

- Fubon Securities suggested that while TSMC has indicated that artificial intelligence could account for several percent of its revenue by 2026, based on the fund's own calculations, this target known for its conservative forecasts could be reached earlier, in 2025. Recently, analysts at Nomura and Goldman Sachs have raised their forecasts for TSMC's shares, also citing weakness in competition from Intel (INTC.US).

- Nomura expects AI revenue to grow between 12 and 16% between 2024 and 2025. According to analysts, orders from Intel and the deeper need to understand 2-nanometer products for TSMC's key customers, including AMD, could serve as key catalysts for future growth. Intel Nova Lake processors will use TSMC's 2nm technology, and Intel itself has already confirmed that Arrow Lake chips will also be based on N3 technology from TSMC.

TSM chart (D1 interval)

As we can see TSMC's shares have more than doubled since the October 2022 bottom, its market capitalization increased by $340 billion. We saw similar growth in the rebound from the Covid-19 crash to the peak of the euphoria in 2021, although it was much steeper then. In the scenario of a somewhat disappointing report, $135 per share (SMA50, 23.6 Fibonacci retracement of the 2022 surge) may prove to be a significant support level, but the main support level runs at $120 and is marked by the consolidation of 2021-2022 and the 38.2 Fibo levels. Also in the 2020-2022 cycle was an important support point, the breakthrough of which resulted in a drastic discount. The main resistance runs at $160 per share (record levels in March). The ratio of sell, to buy trades has fallen from its March peak, which may suggest that there has been more activity on upside forecasting options than bearish bets, according to Bloomberg data. The average expectation in the options market implies roughly 6% volatility in stock prices after the report.

Source: xStation5

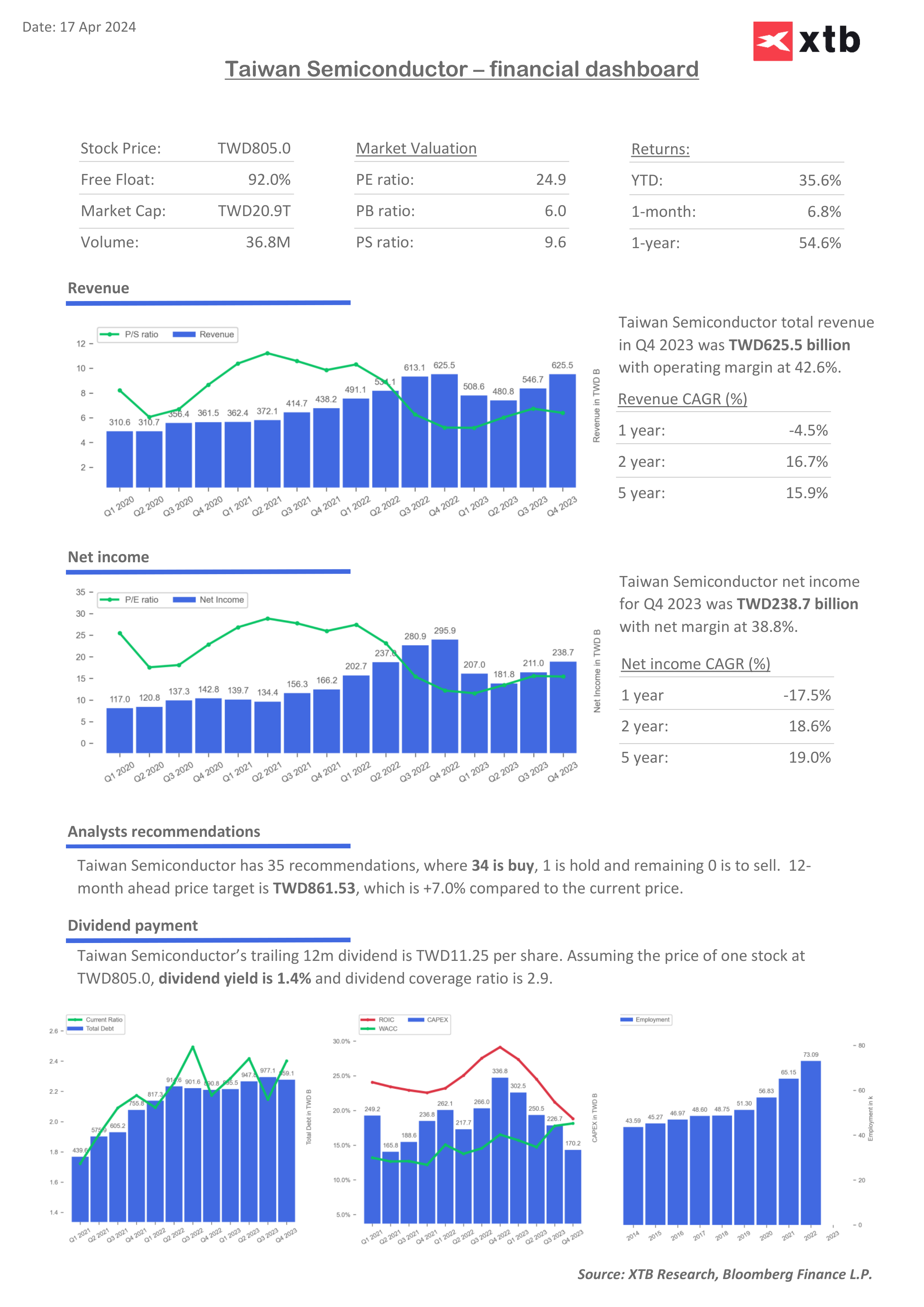

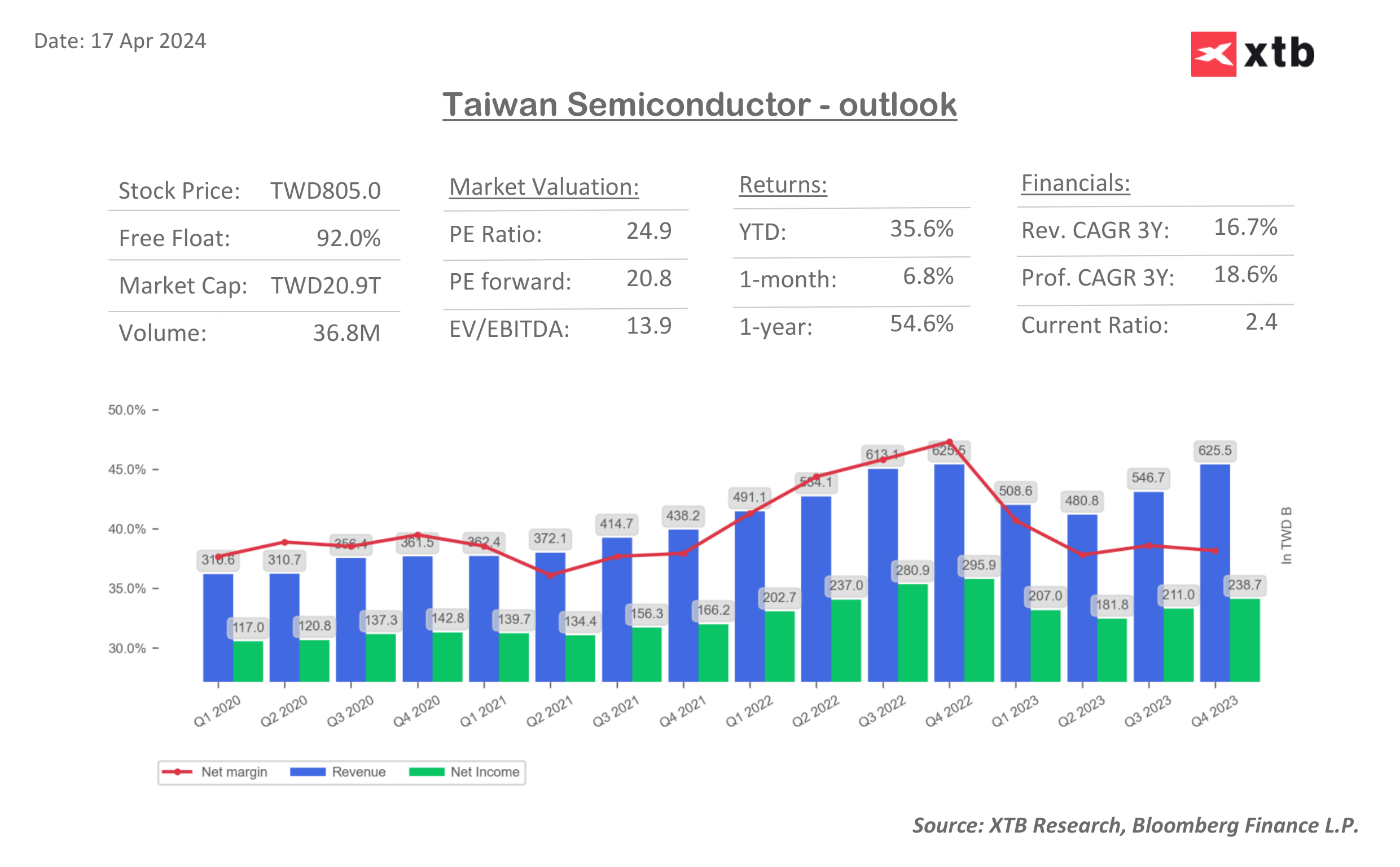

TSMC valuation multiples and ratios

The Current Ratio is more than satisfactory, and the market is valuing the company with a forward PE, 20% lower than the current one, indicating a potential positive mid-term reaction to earnings rebound.

Source: XTB Research, Bloomberg Finance LP

Source: XTB Research, Bloomberg Finance LP

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.