The ECB decision (12:45pm BST) and conference (1:30pm) is the most anticipated calendar event this week. Below we present 3 possible scenarios.

NEUTRAL

The Bank changes projections slightly, pointing out to risks of too low inflation and suggesting that further monetary easing could be necessary if the inflation outlook remains unfavorable. After yesterday’s rumors this seems to be the market consensus and thus such outcome should ne fairly neutral for EURUSD and DE3O.

DOVISH

The ECB lowers inflation projections significantly and extends the PEPP asset purchase program beyond June 2021. While more monetary easing will do little to boost economic outlook (beyond inflating asset prices) the ECB could be forced to respond to the dovish Fed. Dovish decisions are typically negative for EURUSD and positive for DE30.

HAWKISH

The ECB changes projections marginally, is upbeat on the outlook, no clear suggestions of further easing for now. This outcome seemed unlikely but the rumors say some of the members are against further easing. Hawkish decisions are typically positive for EURUSD and negative for DE30.

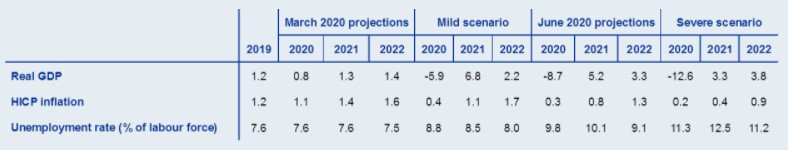

Here are projections from June – the key reference point for today’s decision and conference:

Source: ECB

Source: ECB

Make sure to visit the “News” section for out comment on the ECB meeting!

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report