NFP report for October was a key macro event of the day and as it is usually the case, the Canadian jobs report was released simultaneously. As expected, USDCAD experienced a big volatility spike around release time (12:30 pm GMT). Both reports topped expectations in terms of employment change but, overall, US data came in much more mixed than Canadian data.

NFP report for October

-

Non-farm payrolls: +261k vs +200k expected (+315k previously)

-

Unemployment rate: 3.7% vs 3.6% expected (3.5% previously)

-

Wage growth (MoM): 0.4% vs 0.3% expected (0.3% previously)

-

Wage growth (YoY): 4.7% vs 4.7% expected (5.0% previously)

Canadian jobs report for October

-

Employment change: +108.3k vs 5.5k expected (+21.1k previously)

- Full-time jobs: +119.3k vs +5.7k previously

- Part-time jobs: -11.0k vs +15.4k previously -

Unemployment rate: 5.2% vs 5.3% expected (5.2% previously)

As one can see, while US employment increase more than expected, this was in fact the smallest employment gain since early-2021. This is a welcome development for Fed, which wanted to see some cooling down in jobs market in order to better fight inflation. A pick-up in unemployment rate would also be welcome in this regard. However, wage growth - although slower than last month - remains high and will continue to put upward pressure on price growth.

On the other hand, the Canadian jobs report was stellar. Employment increased significantly and was driven entirely by an increase in full-time jobs - a welcome development for the economy. Unemployment rate came in less than expected. It should be noted that unlike Fed, the Bank of Canada is not waiting for a reason to end policy tightening - BoC has already said that the end of the rate hike cycle is near. Nevertheless, it is highly likely that BoC will continue to follow Fed's footsteps as it used to in the past.

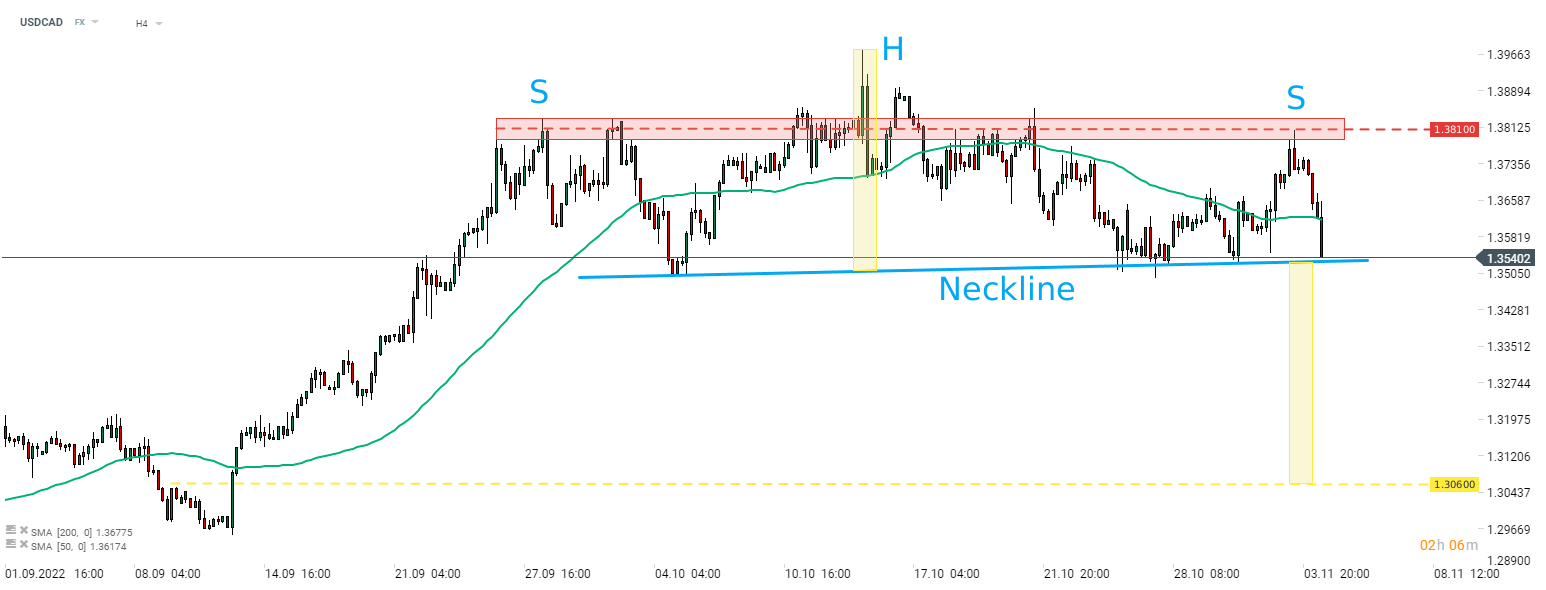

A look at USDCAD

As NFP report can be seen as mixed and the Canadian jobs report was solid, one should not be surprised by USDCAD moving lower in response to the data release. The pair broke below 1.3600 handle and is looking towards a test of the neckline of a short-term head and shoulders pattern. Should a break below occur and the pattern be executed in a textbook manner, the pair may be set for an over-3% drop from current levels as target range of the SHS pattern can be found in the 1.3060 area.

Source: xStation5

Source: xStation5

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes