- Abbott reports Q3 results in line with forecasts

- However, concerns about tariffs push share prices down ahead of Wall Street opening

- Abbott reports Q3 results in line with forecasts

- However, concerns about tariffs push share prices down ahead of Wall Street opening

Abbott (ABT.US) published a solid report for the third quarter of 2025, presenting results in line with market expectations, although the context surrounding the company was not free from tensions resulting from the threat of new trade tariffs from the Trump administration.

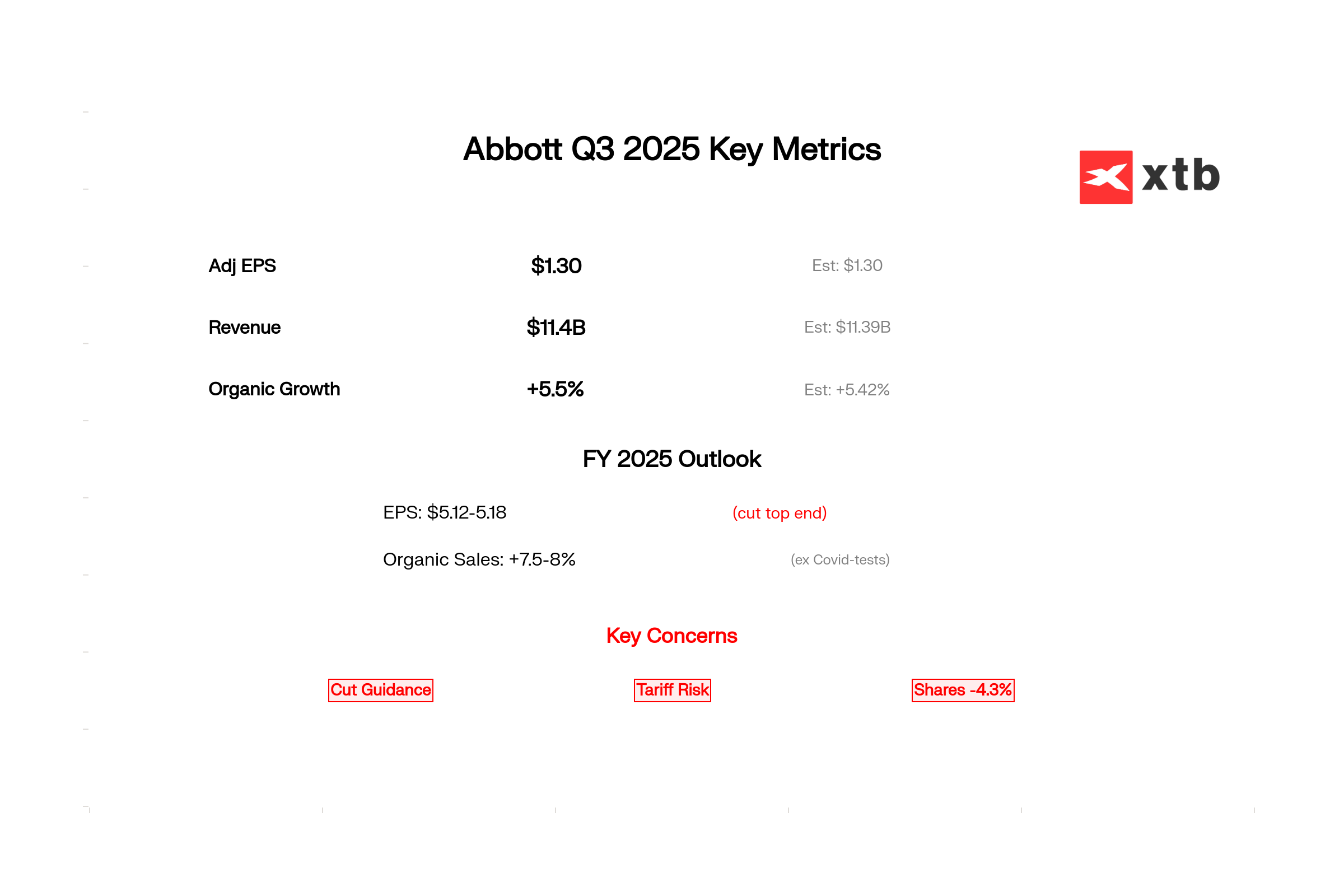

In Q3, Abbott reported adjusted earnings per share (EPS) of $1.30 and revenues of $11.4 billion, both in line with analyst consensus. Organic sales growth was 5.5% y/y, while sales in the Medical Devices segment grew by as much as 15%. The company reported a mixed annual EPS forecast of $5.12–5.18 (expected $5.15; the upper limit, which was $5.20, was lowered) and expects organic sales growth in 2025 to be 7.5-8% (excluding COVID-19 tests; 7.74% was expected).

Despite the figures being in line with forecasts, concerns about potential US tariffs on medical devices had a negative impact on the stock price, which fell by more than 4% before the opening of Wall Street sesion. At the same time, Abbott is not slowing down its investments in the US, expanding production and adapting to new regulatory challenges.

Abbott Q3 2025: earnings, sales, and forecasts. Source: XTB

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street