Adidas (ADS.DE) stock tumbled more than 10.0% as the apparel maker lowered its full-year financial guidance, citing weaker demand.

-

The German sporting goods maker warned that unsold inventories are building up as consumer demand weakens across China and western markets. Adidas also expects one-off costs largely relating to its exit from operations in Russia will have a negative impact on its financials. Also publicity crisis over an alliance with rapper and designer Ye formerly known as Kanye West also weighs on the company's performance.

-

Net income from continuing operations fell sharply to €179 million ($175 million) in the quarter from €479 million in the same period last year. Operating margin also plunged to 8.8% in the quarter from 11.7% previously.

-

Net income from continuing operations should come in at some €500 million ($489.4 million) for the year, against a previous target of around €1.3 billion.

-

The company’s prognosis for 2022 has fallen from an optimistic growth of 11 to 13% at the beginning of this year, to a mid-single-digit rate now. Adidas lowered its expectations for this year’s operating margin to 4% from 7%.

-

Company plans to implement an efficiency program that should compensate for higher costs next year and generate around €200 million in profit.

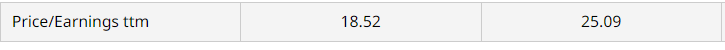

Adidas main rival Nike Inc. also reported a similar surge in inventory in September, warning of a squeeze on profit margins from resulting discounts and other clearing activity necessary to sell off excess stock. Nevertheless Adidas has a lower P / E ttm ratio. Source: Barchart

Adidas main rival Nike Inc. also reported a similar surge in inventory in September, warning of a squeeze on profit margins from resulting discounts and other clearing activity necessary to sell off excess stock. Nevertheless Adidas has a lower P / E ttm ratio. Source: Barchart

Adidas (ADS.DE) stock fell nearly 70.0% from its 2021 highs. This month price broke below major support at €113.60 which coincides with 78.6% Fibonacci retracement of the upward wave started in October 2014 and 200 SMA (red line). If current sentiment prevails, downward move may accelerate towards local support at €77.40. Source: xStation5

Daily summary: Banks and tech drag indices up 🏭US industry stays strong

Largest in its class: What do BlackRock’s earnings say about the market?

US OPEN: Bank and fund earnings support valuations.

MIDDAY WRAP: Capital flows into European technology stocks 💸🔎