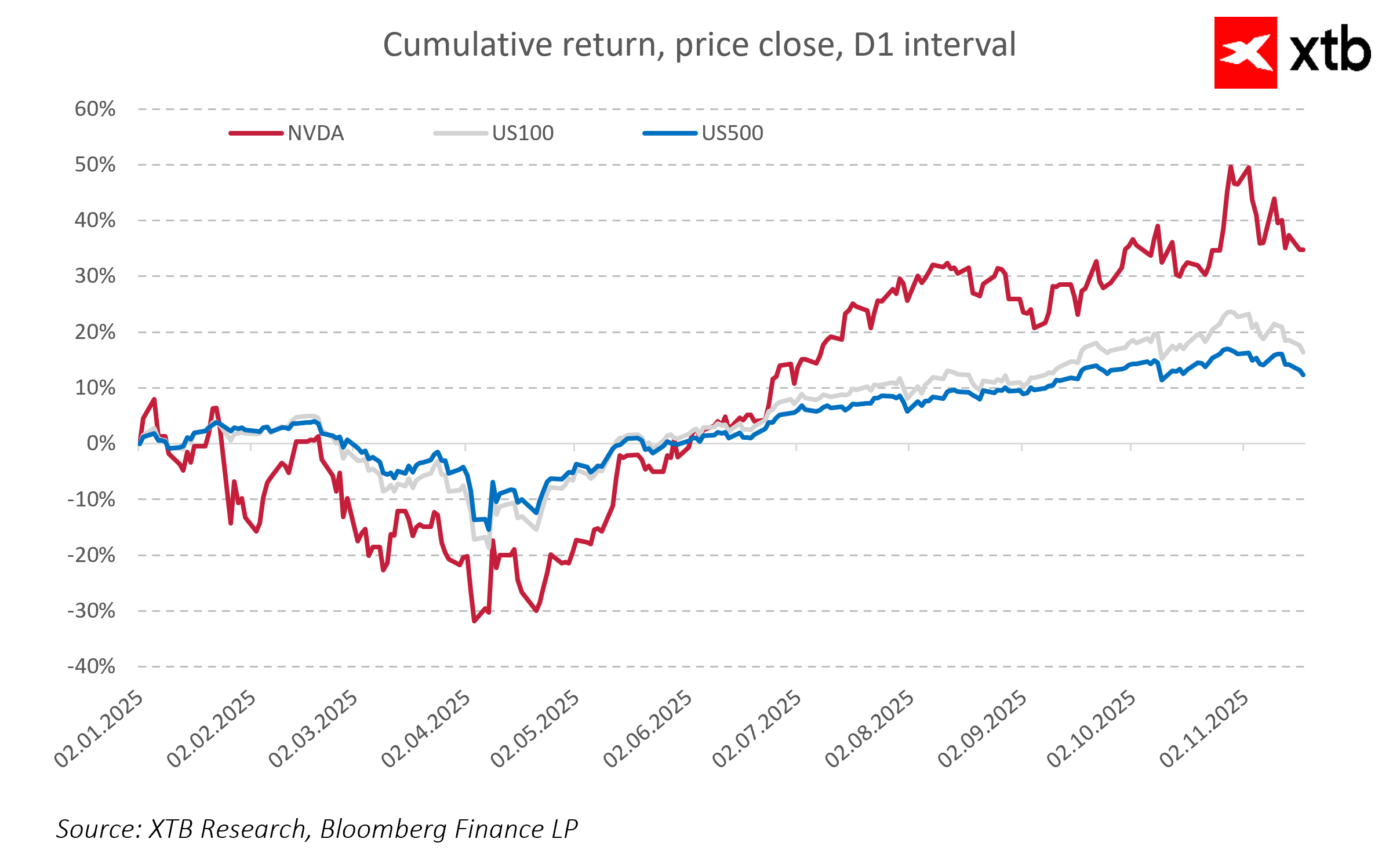

Huawei has announced groundbreaking AI software that could double the efficiency of its Ascend chips. This is a significant step in the context of export restrictions to China and geopolitical tensions, as it allows the Chinese manufacturer to maximize the use of its available hardware resources. The "software-first" strategy enables Huawei to scale existing chips through clustering and software optimization, enhancing the company's competitiveness in AI, including cloud and inference applications.

Until now, Nvidia has been the virtually undisputed leader in the Chinese AI chip market, offering the highest computational power and a well-established developer ecosystem. However, the increasing efficiency and scalability of Ascend chips, combined with state support for the Chinese producer, are beginning to shift the dynamics of competition. Huawei is gaining adoption among major cloud companies in China and steadily increasing production of its chips, which in the longer term could limit Nvidia’s previously dominant position in the region.

It is worth noting that although Nvidia still dominates globally, the Chinese market is becoming increasingly difficult to maintain without local partners or appropriate strategic adaptations. The efficiency and scalability of Ascend chips, combined with growing demand from local customers, could in practice take away part of Nvidia’s market share in China, particularly in inference and cloud AI segments. For Nvidia, this means closely monitoring local developments, adjusting pricing and technology strategies, and facing the potential risk of losing its competitive edge in a key Asian region.

Currently, the AI technology boom appears to be at a crossroads. Markets are cautious about technology company valuations, while the rapid pace of innovation and rising competition in China are adding further volatility. In this context, Huawei may set new standards and accelerate local AI adoption, which on one hand intensifies competition, and on the other highlights that Nvidia can no longer treat the Chinese market as a fully secure space for its growth.

In practice, the question of whether Nvidia is losing the Chinese market is no longer theoretical. The growing influence of Huawei and other local players demonstrates that even global leaders must account for regional shifts in power, as the AI market in China becomes an arena of increasingly fierce competition.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%