Albemarle (ALB.US) is the largest global lithium producer. The company's efforts are now focused on the acquisition of Liontown, an Australian mining company focused on developing battery minerals for electric cars. Analysts took the latest news from the company as a positive sign for the industry.

Euphoric gains didn't help Albemarle valuation

- The company's AUD5.2 billion ($3.7 billion) takeover proposal was rejected for a third time by the Australians, causing Australian lithium companies to surge. Last week, Albemarle announced the planned construction of a $1.3 billion plant in South Carolina (US). Despite the company's business development news, downward pressure is keeping share valuations at relatively low levels;

- In 2022, lithium consumption per vehicle according to Adamas Intelligence increased by 17%. Despite this, Albemarle's share price is trading below January 2022 levels;

- With nickel prices normalizing and cobalt in trouble, investors fear further weakening due to a potential recession and tighter credit conditions that could hit EV demand. It is unclear on what scale fiscal programs like the US IRA or China's opening will be able to stimulate demand;

- Long-term, lithium may still be a highly desirable commodity. As of 2035, it will not be possible to sell cars with internal combustion engines in the EU except for synthetic fuels. These, however, are still in the research phase, and demand for EVs is growing.

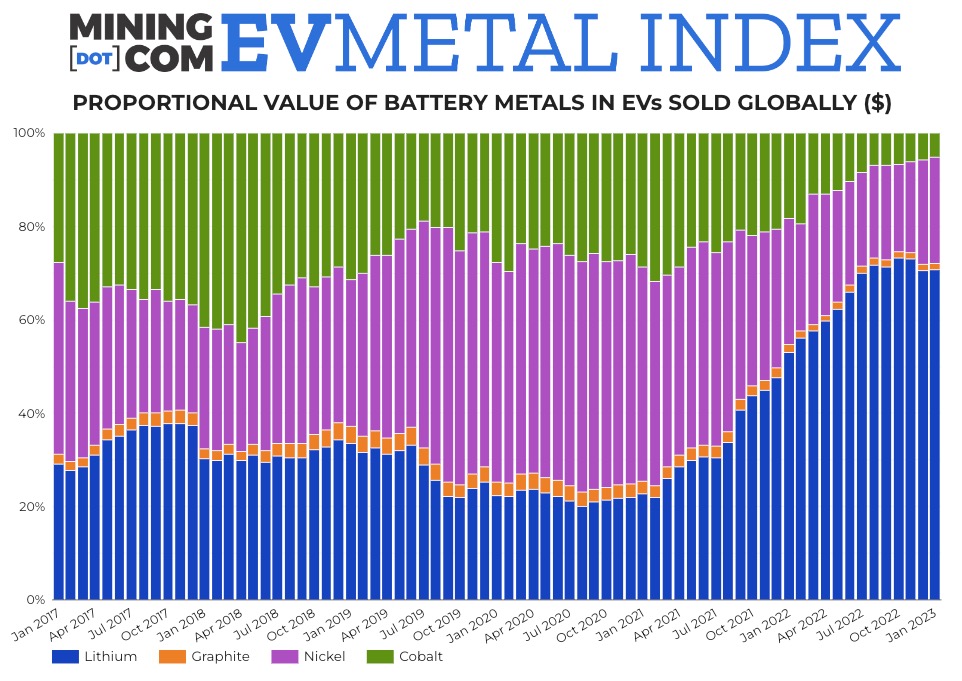

Proportionate to the value of lithium in used batteries, EV began a dynamic upward trend in April 2021. The beginning of 2023 brought a slight cooling. Source: Mining.com

Short look at the 2022 lithium market

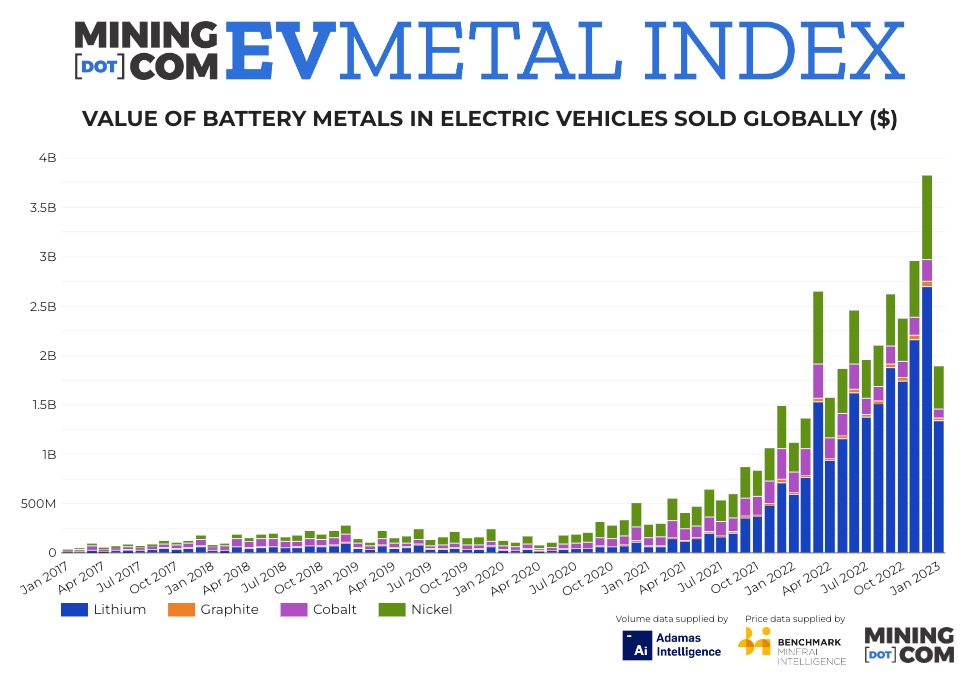

- The 2022 Electric Vehicle Metal Index, which tracks the value of metals in EV batteries, reached $26.9 billion (232% y/y growth). The value of metals used in batteries in December 2022 alone surpassed the cumulative results of 2019 and 2020.EV battery capacity in December 2022 reached a new record by 63.6 GWh according to Adamas Intelligence (29% y/y)

- Analysts expect higher demand for lithium from China, with recent data coming out of the country suggesting a progressive economic rebound. Higher demand could translate into higher prices which would potentially favor Albemarle's share price.

- The metals sales business for automotive batteries and accumulators in 2022 recorded a higher sales total than the previous 5 years' total. The value of battery metals in 2022 newly sold electric cars tripled as a result of soaring lithium and nickel prices;

- As of December 2022, a total of 38,061 tons of lithium (46% year-on-year increase) was found in batteries sold in passenger EVs on roads around the world. At that time, the price of the raw material rose to $70,000 per ton, increasing by 280% y/y. The share of nickel also increased, with the declining role and prices of cobalt having an increasingly traceable share in the EV market. We are now seeing a correction of these euphoric increases.

Sales of metals used in EVs have grown by leaps and bounds in recent years. It has been dominated by lithium (blue bars), although its total value has fallen from a record $2.7 billion to about $1.3 billion today. The drop in sales was reflected in the discounting of Albemarle shares. Source: AdamasIntelligence, Mining.com

Albemarle (ALB.US) shares, D1 interval. Although the SMA200 and SMA100 averages are approaching a bearish 'death cross' formation, it is still not confirmed. If the decline deepens the $170 level may be worth watching. The RSI indicator has broken out a double bottom near 30 points, which historically has been an important support for the bulls and the level from which the price rebound occurred. Source: xStation5

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals