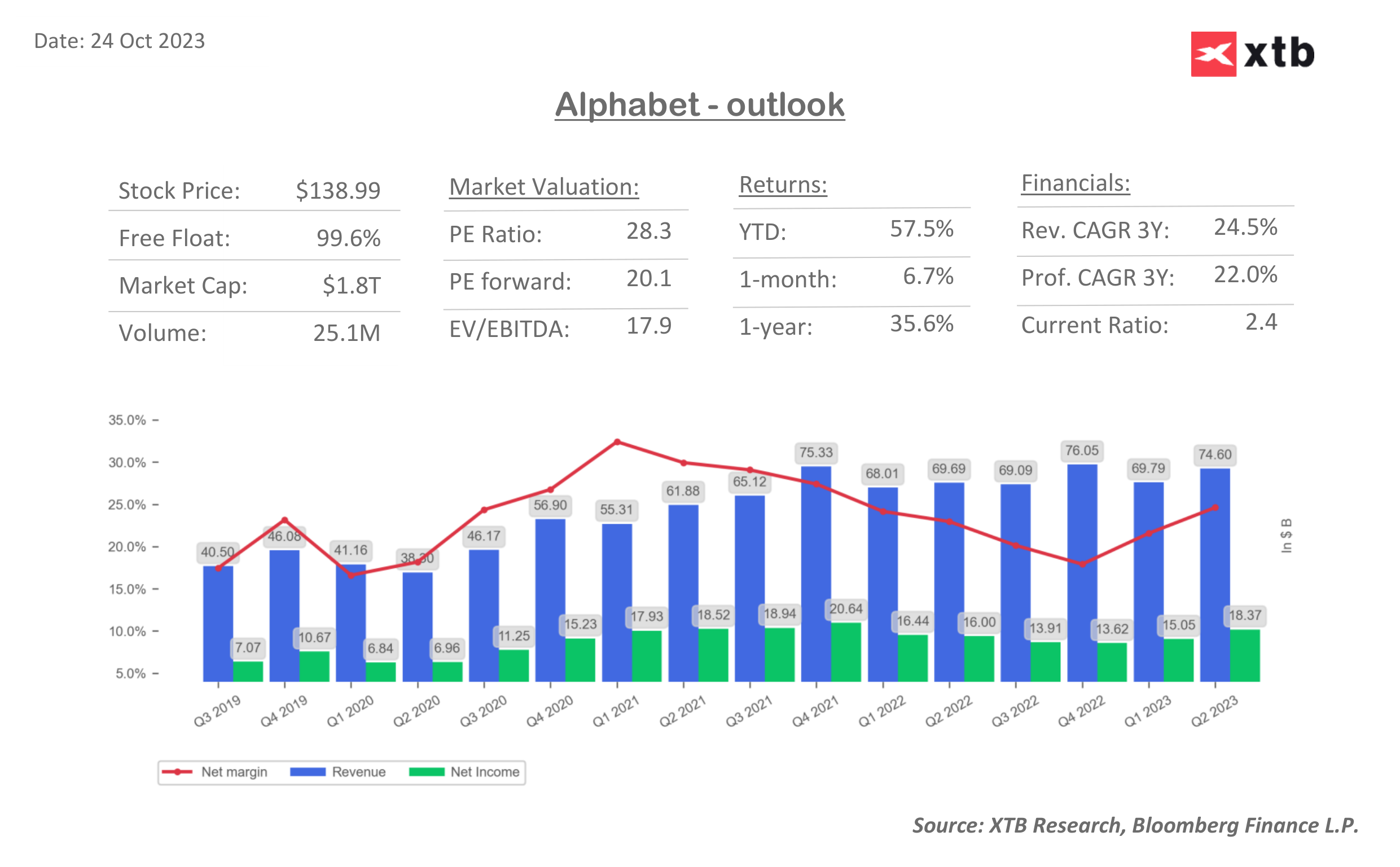

Alphabet Inc. (GOOGL.US), the parent company of Google and YouTube, is set to release its earnings report after the close of trading today. The report is anticipated to shed light on the current state of the digital advertising landscape and provide crucial insights into the performance of the cloud computing sector. Analysts remain positive about both areas. For the Q3 report, expectations are set for sales to reach $76 billion, marking a 10% increase from the previous year, and profits are projected at $1.46 per share, up from $1.06.

Cloud computing

The earnings report is expected to show a revenue of $8.6 billion for Google Cloud, marking a 26% year-on-year increase. This growth is further bolstered by the company's strong position in generative AI software, which analysts view as a competitive edge for their cloud business. The rising demand for artificial intelligence tools, especially in AI-training workloads, is expected to provide a tailwind for Cloud sales, emphasizing the symbiotic relationship between cloud computing and AI in driving Alphabet's revenue.

Google Strategy

The recent transition of Ruth Porat from her position as Chief Financial Officer to a new role as president and chief investment officer for both Alphabet and Google has garnered attention. This move, effective from September 1, has left a vacancy in the CFO position, with Alphabet yet to announce a successor. Investors and analysts are keenly observing this shift, speculating on its implications for the company's strategic direction. Furthermore, there's heightened interest in how Porat's new role might influence Alphabet's non-core holdings. Questions have arisen regarding the potential spinout or sale of certain assets, notably Waymo, Alphabet's autonomous vehicle business, and Verily, its healthcare unit. Both of these ventures represent significant investments for Alphabet

Key Expected Results by Sector:

- Sales: $76 billion (+10% Y/Y)

- Profits: $1.46 (up from $1.06)

Digital Advertising:

- Advertising Revenue: $59.2 billion

- Google Search and Other Ads: $43.3 billion

- YouTube Ads: $7.8 billion

Cloud Computing:

-

Google Cloud Revenue: $8.6 billion (+26% Y/Y)

Other Key Metrics:

- Google Services Revenue: $66.89 billion

- EPS: $1.45

- Operating Income: $21.44 billion

- Google Services Operating Income: $22.89 billion

- Google Cloud Operating Income: $433.6 million

Analysts predict a sequential growth in Cloud sales for the third quarter, driven by AI-training workloads. Google's advertising revenue, which had previously returned to positive growth, is expected to continue its upward trajectory. The stock has seen a 57% increase year-to-date, with a 14% rise since the last earnings report.

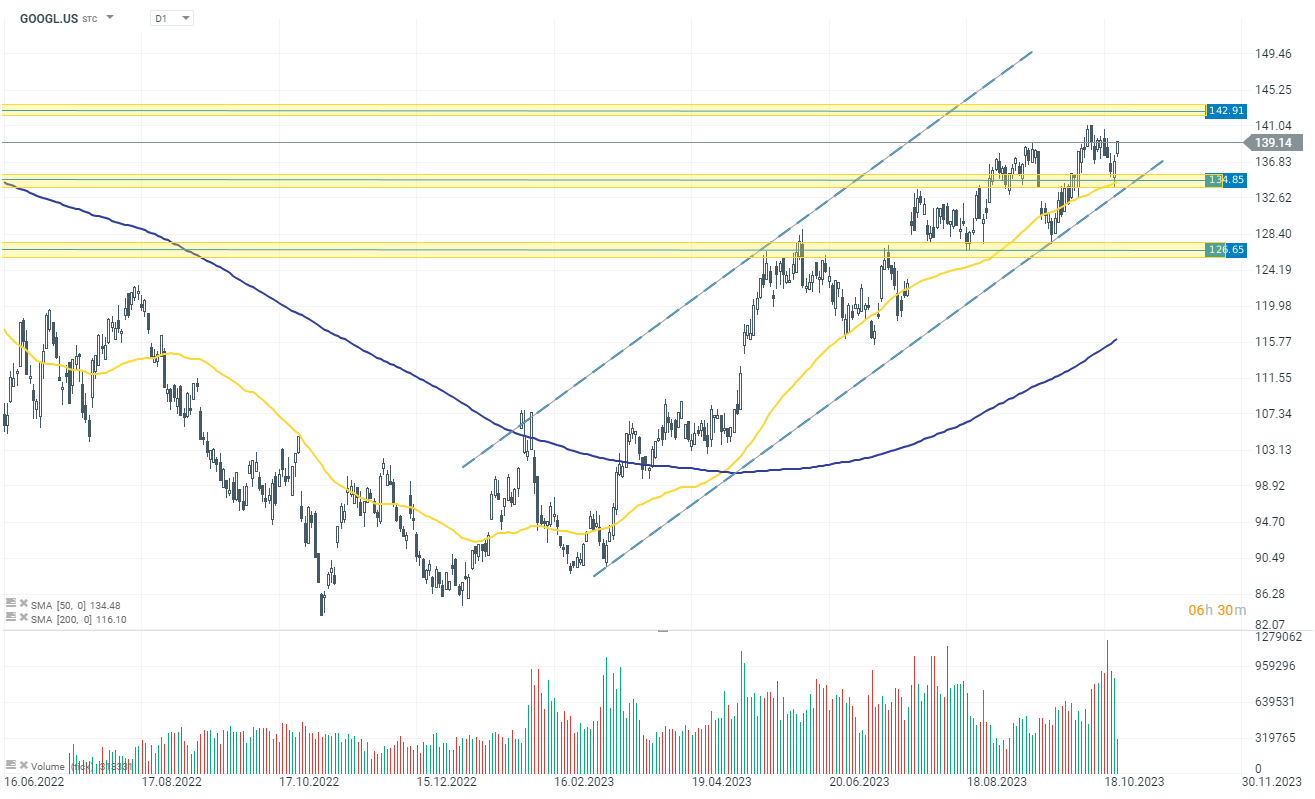

Google (GOOGL.US) shares are up 1.71% today ahead of the earnings release after the market closes. Alphabet has been in a rising growth channel since the beginning of 2023 after forming a local triple bottom at around $90. For the past two days, the stock has been gaining, bouncing off the support level at $134. If the report turns out to be as good as the market expects, we might see a retest of the next resistance levels at $142-143. Otherwise, we should anticipate increased sell pressure and a potential retest of the $134-135 levels.

Kongsberg Gruppen after earnings: The company catches up with the sector

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

Morning wrap: Tech sector sell-off (06.02.2026)

Amazon shares tumble 10% as investors recoil at the price of AI dominance