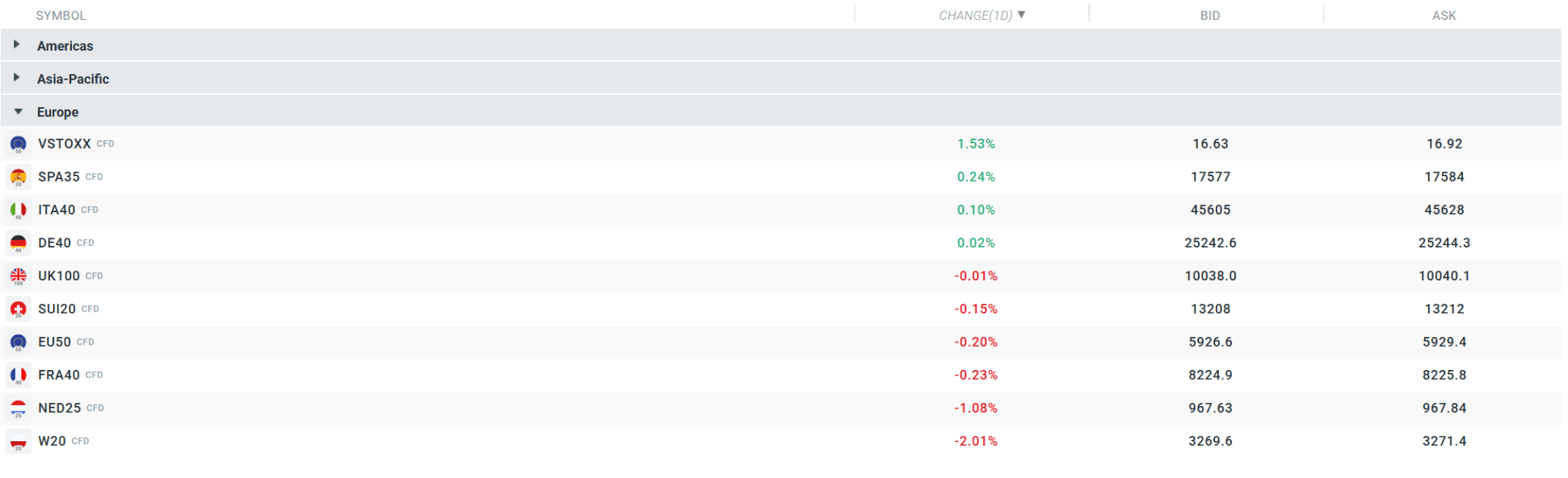

European indices are performing relatively poorly at the start of the second phase of Thursday's trading session. The German DAX is up just 0.02%, while the French CAC40 is down 0.23% and the British FTSE100 is down 0.15%. The Polish W20 is performing very poorly, falling by nearly 2%. Markets are awaiting data from the US on jobless claims, as well as Friday's US labour market report. In terms of sectors, the defence industry stands out today, on the wave of Trump's comments about greater investment in armaments.

Current quotations for major contracts. Source: xStation

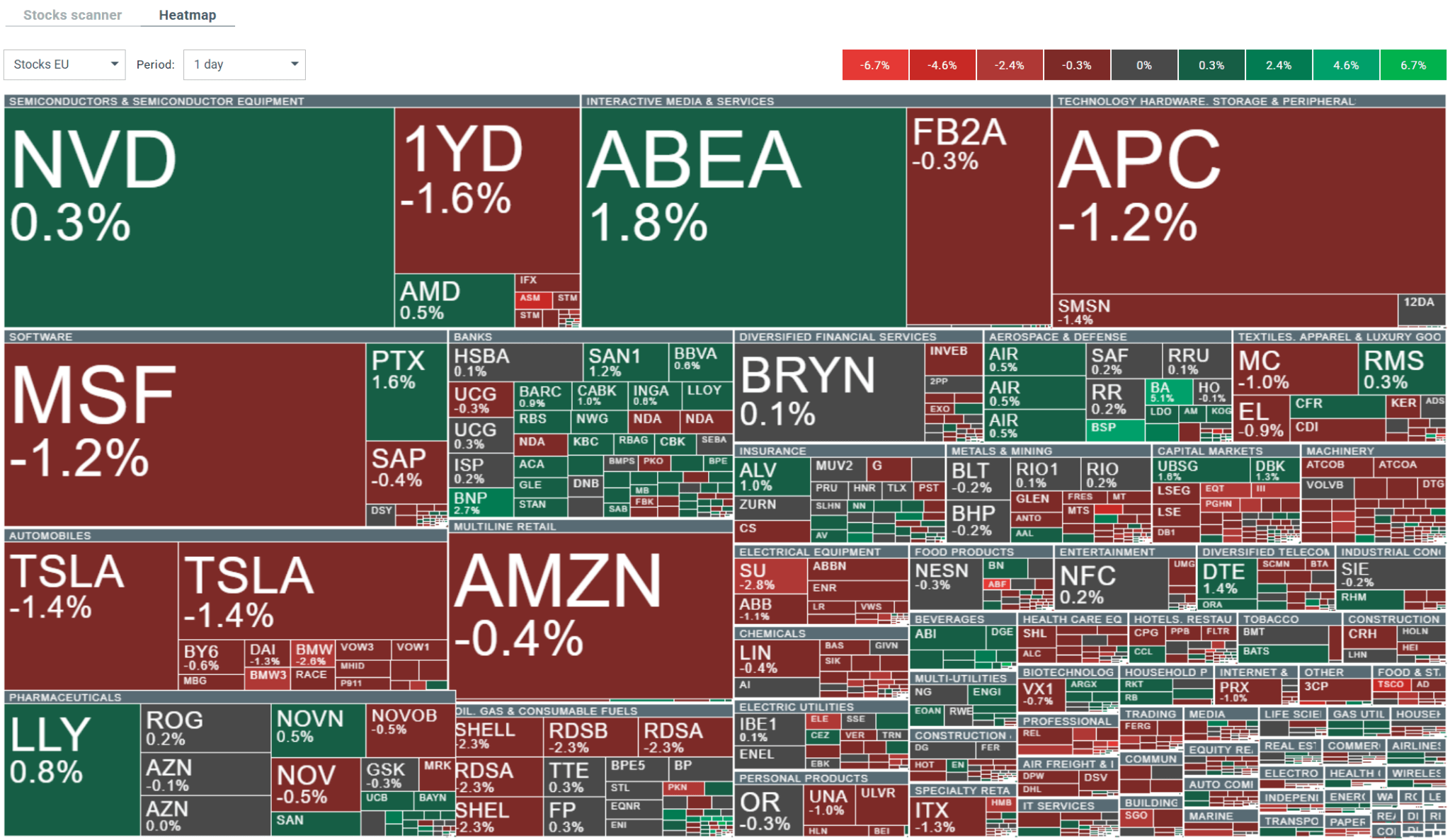

Current volatility observed on the broader European market. Source: xStation

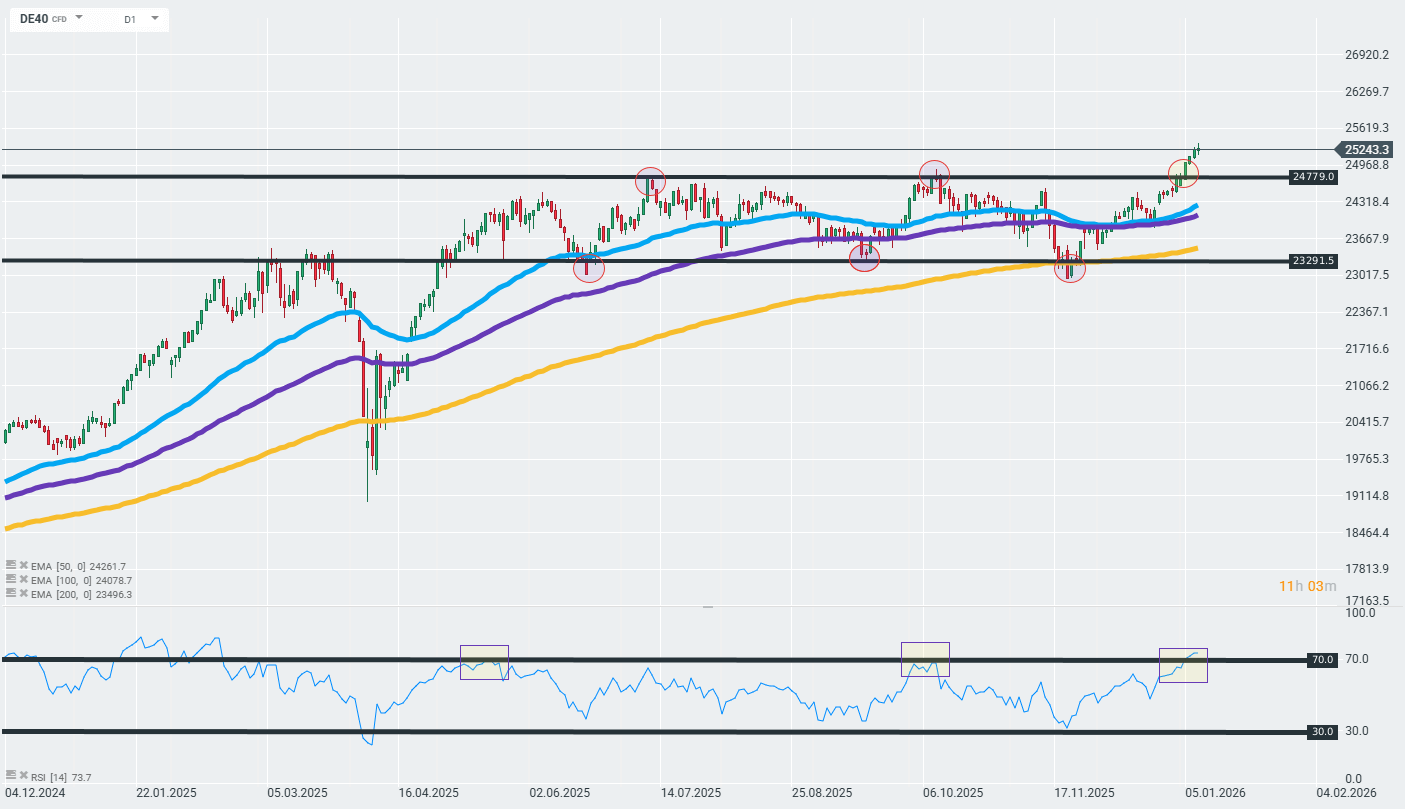

During Thursday's trading session, the DAX continued its upward trend and broke through the previously mentioned barrier of 24,780 points, which was the main resistance level in 2025. What is more, the current bullish momentum, which managed to break the contract above the 50-day exponential moving average (blue curve on the chart) and the 100-day exponential moving average (purple curve), is, from a technical perspective, an indication of a short-term upward trend in the instrument. As long as DE40 remains above these support barriers, the current trend is likely to continue. Source: xStation

Key corporate news:

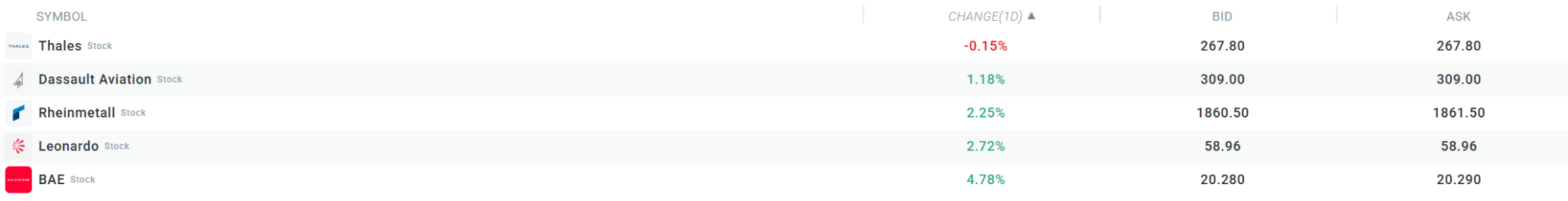

During today's session, defence sector stocks once again stood out after US President Donald Trump called for an increase in American defence spending. Leonardo (LDO.IT) jumped to the top of Italy's Ftse Mib index, gaining almost 3%.

Source: xStation

Vallourec (VK.FR) has launched a €200 million share buyback programme, which will run until 30 June 2026, to cover part of its subscription warrants (BSAs) and limit dilution upon their exercise, and to a lesser extent to service employee incentive plans. The company also plans to pay an extraordinary interim dividend in Q3 2026, comprising approximately EUR 300 million from the sale of BSA and the surplus of 80-100% of the cash generated in 2025 not allocated to the share buyback. The total return to shareholders is expected to reach at least EUR 500 million in 2026, with no annual dividend proposed for 2025 due to this payment. The strategy is in line with the company's capital policy, which assumes financial leverage of +/- 0.5x net debt/EBITDA and liquidity above EUR 1 billion. Philippe Guillemot, Chairman and CEO, emphasised that this is a step towards becoming one of the most shareholder-friendly companies in the industry.

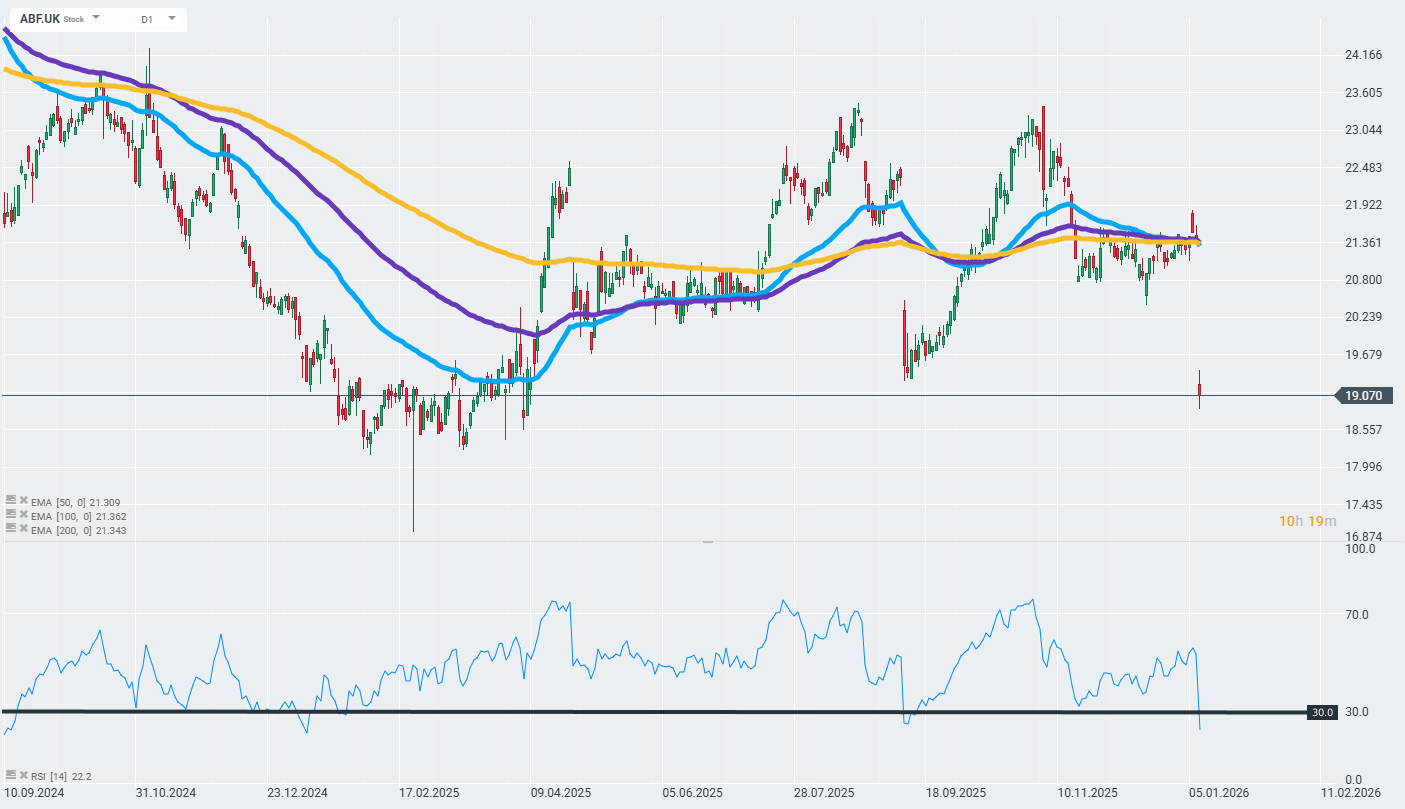

Associated British Foods (AB Foods; ABF.UK) warned of lower-than-expected operating profit and EPS for the fiscal year due to weaker Primark sales and mixed results in the food division. The company's shares fell as much as 12% to 9-month lows.

Source: xStation

BREAKING: Oil falls after NYT report on talks between Iran and the CIA regarding a suspension of military action💡

Gold and silver rebound after the sell-off 📈

VIX struggle to rise higher despite uncertainty on Wall Street 🔎

Bitcoin jumps above $70k USD despite stronger dollar📈