Amazon.com Inc. announced that it plans to invest over USD 35 billion in India by 2030, focusing on artificial intelligence, export growth, and creating new jobs. This investment builds on previous spending of around USD 40 billion and includes the development of both physical and digital infrastructure. The company expects to create approximately 1 million jobs, including direct, indirect, and seasonal positions, which will help expand its commercial and e-commerce network.

Amazon intends to roll out AI-powered features supporting small and medium-sized businesses, aligning with the global trend of big tech companies investing heavily in artificial intelligence. The announcement follows Microsoft’s plan to invest USD 17.5 billion in AI and cloud services and Google’s commitment of USD 15 billion for data centers, highlighting India’s growing importance as a major technology hub outside the United States.

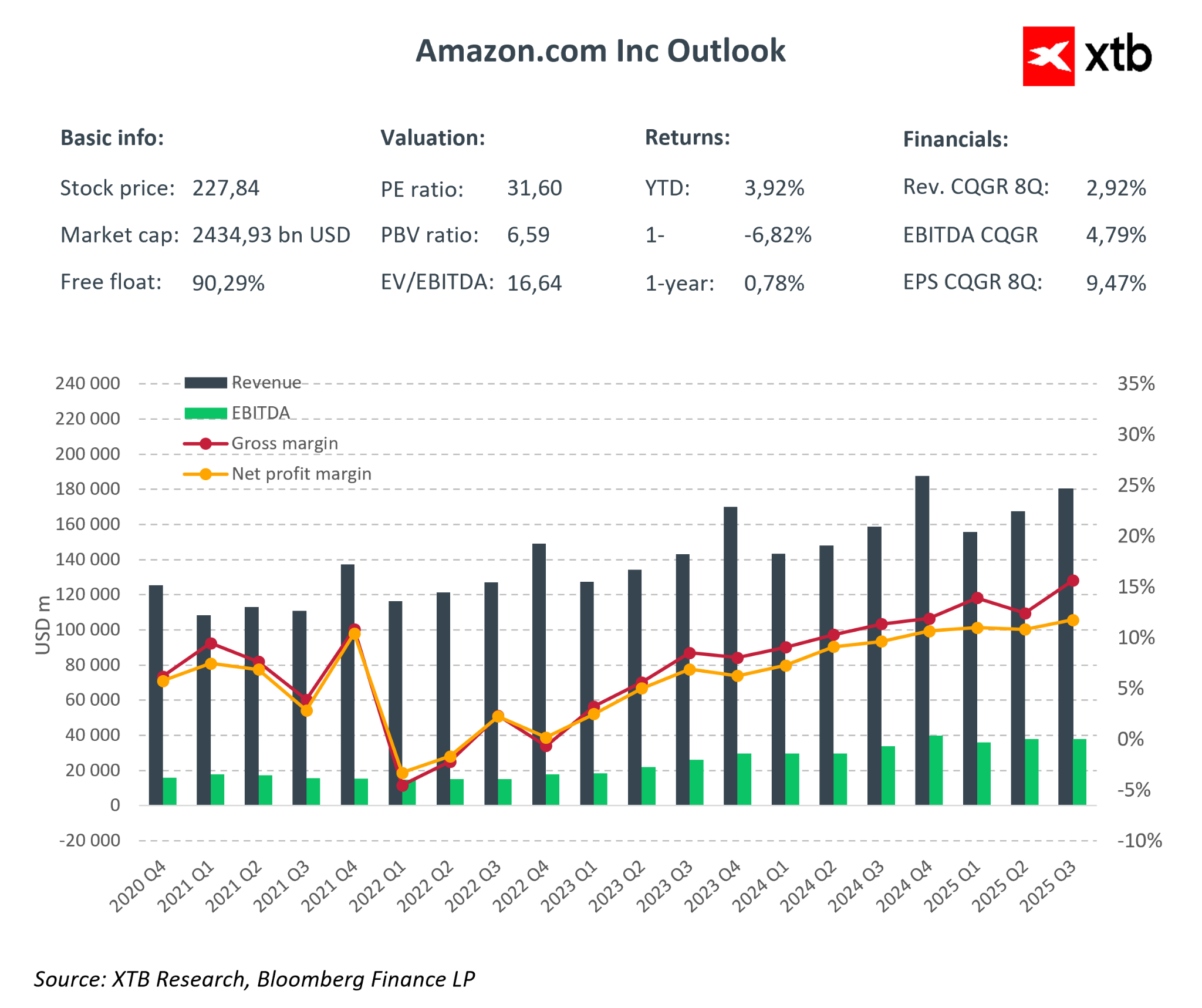

Amazon’s total exposure in India could reach approximately USD 75 billion, covering logistics, data centers, cloud development, and the digitalization of SMEs, which is expected to increase the volume of exports handled through its platform. From a valuation perspective, this supports the case for long-term revenue growth, although it also implies continued high capital expenditures. The market will closely monitor whether these investments translate into improved AWS margins in the region and greater logistical efficiency.

From a geopolitical standpoint, India is becoming a competitive arena for the world’s largest technology companies. Amazon, Microsoft, and Google are investing substantial sums to build a strategic AI and cloud hub. This also sends a clear signal that India is a market of strategic significance, not just a low-cost production base. Local indices such as Nifty and Sensex, as well as companies linked to infrastructure, telecommunications, and data centers, may benefit from this capital inflow.

Currently, Amazon India generates around USD 3 billion in annual revenue, with a 30–35 percent share of the local e-commerce market. The planned investment could multiply revenues by 2030 thanks to a larger base of sellers, improved logistics, expansion of Prime subscriptions, and growing exports.

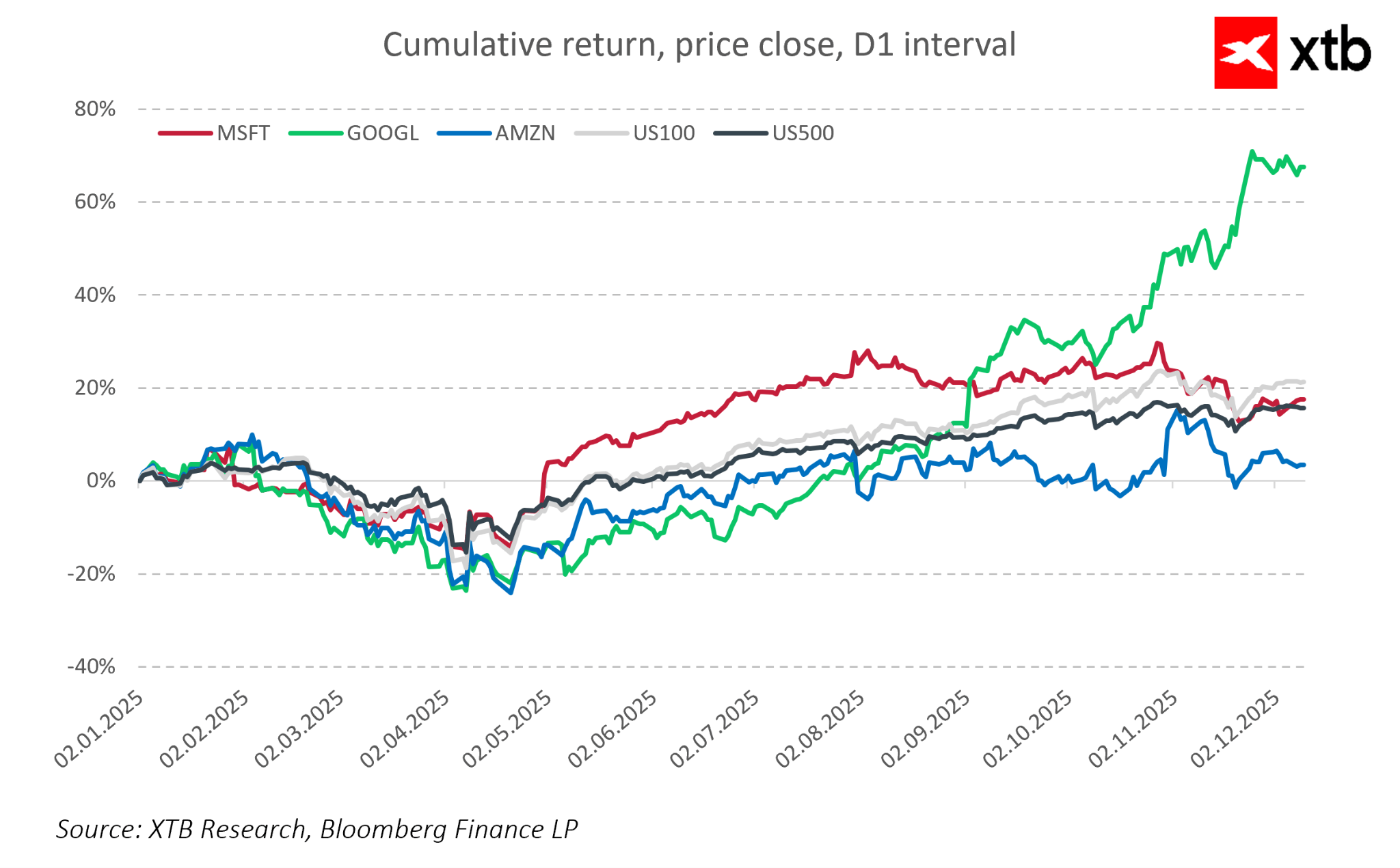

Amazon is significantly increasing its commitment in India, joining Microsoft and Google in building a global AI and cloud hub. This represents a revenue growth catalyst for Amazon, but it also involves high capital expenditures and regulatory risk. It is worth noting that this year the company has recorded a relatively low return compared with other big tech players and major indices such as the S&P 500 and Nasdaq 100.

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks