ARM Holdings (ARM.US) published fiscal-Q4 2024 earnings report yesterday after close of the market session. While results for the January-March 2024 quarter were better-than-expected, fiscal-2025 guidance offered by the company has been seen as somewhat disappointing. This has triggered a post-earnings share price drop in the after-hours trading yesterday, and stock continues to trade around 8% lower in premarket today.

As we have already said in the opening paragraph, fiscal-Q4 2024 results from ARM Holdings were not bad. In fact, they were better-than-expected. Revenue grew more than expected, driven by significant beat in License revenue. ARM said that licensing business revenue performed well due to multiple high-value license agreements for AI chips being signed. Cost of revenue was higher-than-expected, but it was mostly due to higher-than-expected revenues. Gross margin came more or less in-line with expectations. However, other profit measures, including operating income, EBITDA and net income, beat expectations significantly.

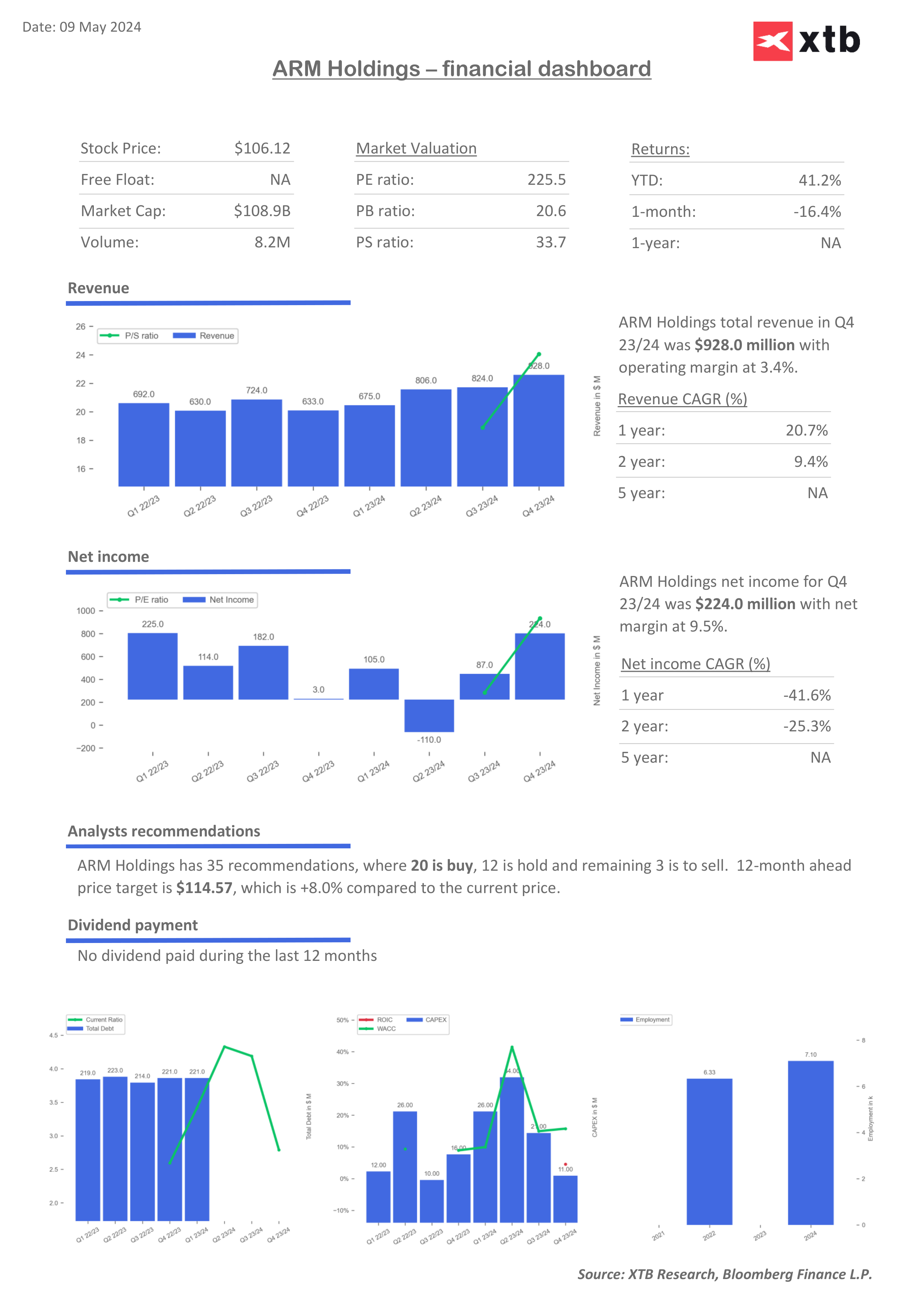

Fiscal-Q4 2024 results

- Revenue: $928 million vs $880.4 million expected (+47% YoY)

- Royalty: $514 million vs $504.2 million expected (+37% YoY)

- License and other: $414 million vs $376 million expected (+60% YoY)

- Cost of revenue: $41 million vs $37 million expected

- Gross profit: $887 million vs $840 million expected

- Gross margin: 95.6% vs 95.7% expected

- Adjusted operating expenses: $511 million vs $490 million expected

- Adjusted operating income: $391 million vs $356 million expected

- Adjusted operating margin: 42.1% vs 40.5% expected

- Adjusted EBITDA: $429 million vs $397 million expected

- Adjusted EBITDA margin: 46.2% vs 45.1% expected

- Adjusted net income: $376 million vs $321 million expected

- Adjusted net margin: 40.5% vs 36.5% expected

- Adjusted EPS: $0.36 vs $0.30 expected

In spite of those better-than-expected results, company's share price dropped in the afterhours trading as guidance offered was seen as disappointing. While fiscal-Q1 2025 forecast (calendar April - June 2024) was better-than-expected with revenue and EPS guidance midpoints exceeding analysts' expectations, a full-year fiscal-2025 guidance disappointed. Full-year revenue guidance midpoint of $3.95 billion was lower than expected, while operating expenses guidance was higher than expected. ARM has a very high valuation - higher P/S ratio than any of the Nasdaq-100 stocks - so the company needed to provide a very outlook not to disappoint investors. However, it looks like it failed to do so.

Fiscal-Q1 2025 guidance

- Revenue: $875-925 million vs $868 million expected

- Adjusted operating expenses: 'about $475 million' vs $478 million expected

- Adjusted EPS: $0.32-0.36 vs $0.31 expected

Full-year fiscal-2025

- Revenue: $3.80-4.10 billion vs $4.01 billion expected

- Adjusted operating expenses: 'about $2.05 billion' vs $2.01 billion expected

- Adjusted EPS: $1.45-1.65 vs $1.53 expected

ARM Holdings (ARM.US) trades 8-9% lower in premarket, following release of fiscal-Q4 2024 earnings report that included disappointed forecasts. Stock is currently trading at around $96.70 in premarket, the lowest level since May 2, 2024. A near-term support zone can be found in the $95 area. Source: xStation5

ARM Holdings (ARM.US) trades 8-9% lower in premarket, following release of fiscal-Q4 2024 earnings report that included disappointed forecasts. Stock is currently trading at around $96.70 in premarket, the lowest level since May 2, 2024. A near-term support zone can be found in the $95 area. Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records