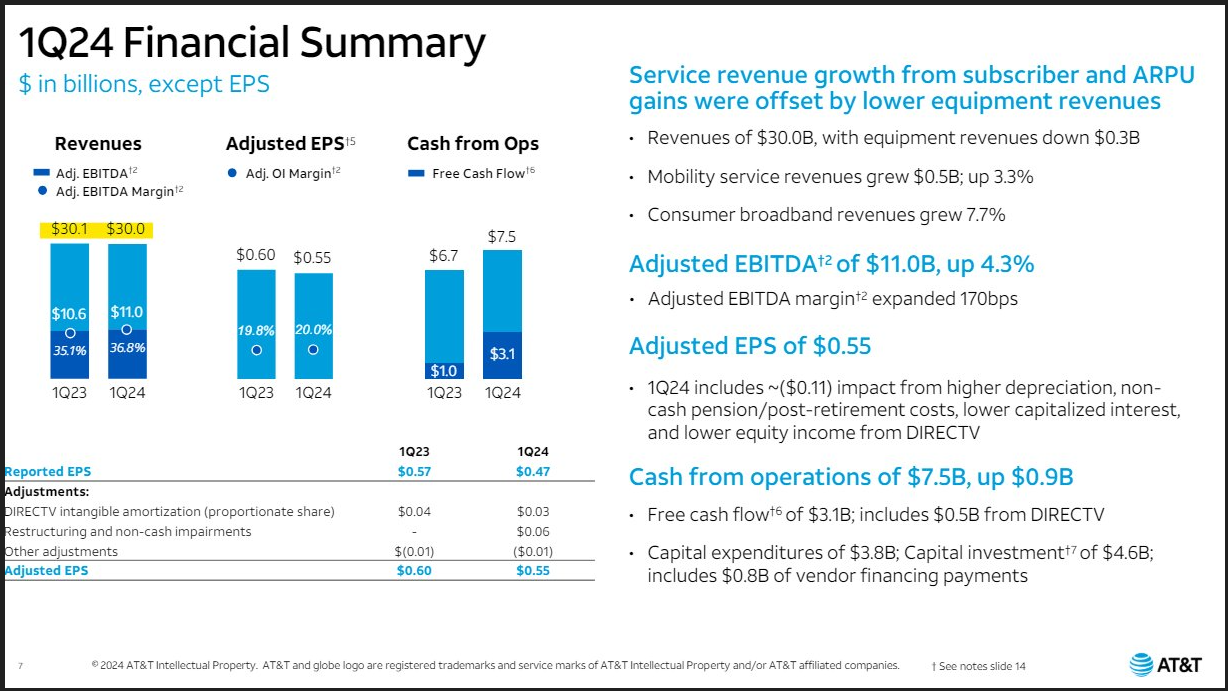

Profits at one of the largest U.S. telecom corporations AT&T (T.US) beat expectations, although sales came in lower than forecast, in a highly competitive environment. As a result, the company's shares are trading up 3.5% today before the open. AT&T reported $30 billion in revenue (down about $100 million YoY), below forecasts of $30.53 billion. However, earnings per share of $0.55 (down 12% YoY, from $0.6 in Q1 2023) for the first quarter of 2024 came in higher than forecast. The market expected $0.53.

- Earnings per share came in $0.11 lower on one-time factors, among which the company cited weakness in DIRECTV's services, pension-related severance costs and lower interest capitalization. At the same time, free cash flow increased significantly to $3.1 billion, compared to $1 billion, in Q1 2023.

- According to the company, results were solid, primarily due to business initiatives in 5G and fiber optics development. Revenues from mobile services rose 3.3% YoY to $20.6 billion ($21.13 billion was expected), but consumer business was 7.7% higher YoY. Adjusted EBITDA rose 4.3% YoY and 170 basis points (1.7%), respectively. Paid wireless subscriptions increased by 389,000 in Q1, compared to nearly 416,000 forecast.

- The company maintained its earnings per share forecast for 2024 in the vicinity of $2.15 to $2.25.

AT&T earnings summary

Source: AT&T

Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records