- The negative sentiment stems from earlier declines in regional bank stocks in the US, triggered by news of the need for write-offs of loans granted to customers accused of fraud, including a $50 million write-off by Zions Bank Corp.

- The negative sentiment stems from earlier declines in regional bank stocks in the US, triggered by news of the need for write-offs of loans granted to customers accused of fraud, including a $50 million write-off by Zions Bank Corp.

Friday's session on European stock exchanges is marked by significant declines. Negative sentiment reached the Old Continent after Thursday's declines in regional bank shares in the United States. The series of sell-offs was triggered by announcements from several major institutions about the need to write off loans granted to customers accused of fraud.

Investors' attention was particularly drawn to Zions Bank Corp, which announced a write-off of $50 million, deepening concerns about the health of the regional lending sector. Markets still remember the high-profile collapse of Silicon Valley Bank, and combined with the recent collapse of First Brands and the disclosure of systemic risks in the financial sector, investors have begun to re-evaluate previously unrecognized risks.

The wave of anxiety first swept through Asian markets and then reached Europe, where most major indices are down today. Analysts point out that the current movements are corrective in nature, but at the same time emphasize that the continuing uncertainty surrounding US regional banks may continue to weigh on global stock markets for some time.

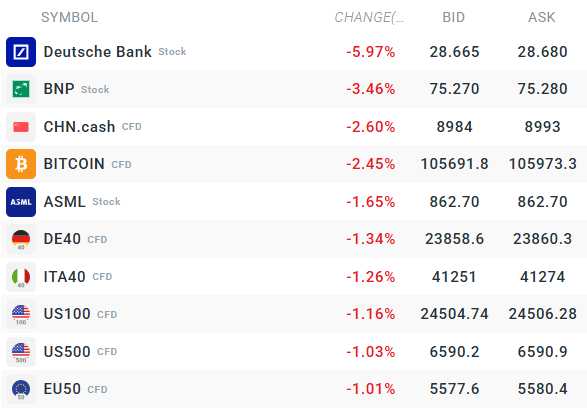

At present, the sell-off on the European market has reached 1.5% on the main indices. The DAX and FTSE MIB are performing the worst, which indicates the particular sensitivity of the local banking system. The situation is slightly better in the UK and Switzerland, where declines are limited to 1%.

Markets are struggling with a significant wave of declines at Friday's opening. European banks are, of course, performing the worst. Source: xStation

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook