Big Lots (BIG.US) estimates its third-quarter earnings will be between 50 cents to 70 cents per share, compared to a analysts' expectations of 21 cents a share due to higher demand for home goods. Chief Executive Bruce Thorn said the company is on track to meet customer demand, "and early reads on Christmas are very encouraging. The discount retailer’s fiscal third-quarter ends Oct. 31.

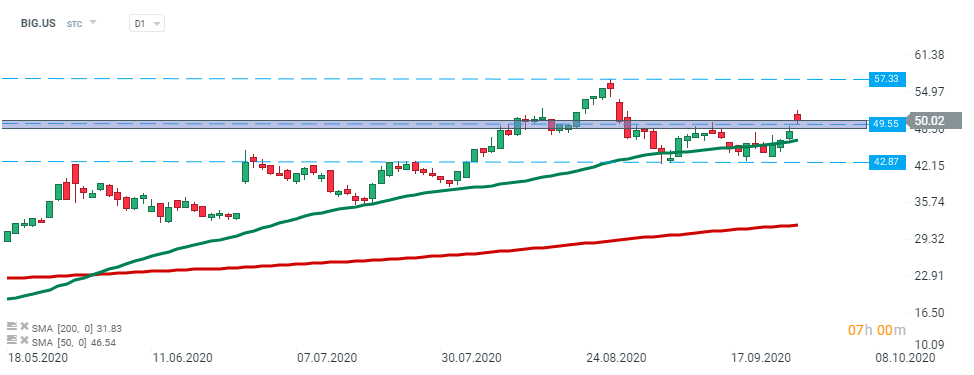

Big Lots (BIG.US) stock rose 66% in the year to date, boosted by pandemic-related demand. Currently price is testing support at $49.55 per share which previously acted as a resistance. Should buyers manage to stay above it, then another upward impulse towards $57.33 per share could be launched. On the other hand, once sellers regain control, the support at $42.87 per share may be at risk. Source: xStation5

Big Lots (BIG.US) stock rose 66% in the year to date, boosted by pandemic-related demand. Currently price is testing support at $49.55 per share which previously acted as a resistance. Should buyers manage to stay above it, then another upward impulse towards $57.33 per share could be launched. On the other hand, once sellers regain control, the support at $42.87 per share may be at risk. Source: xStation5

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment