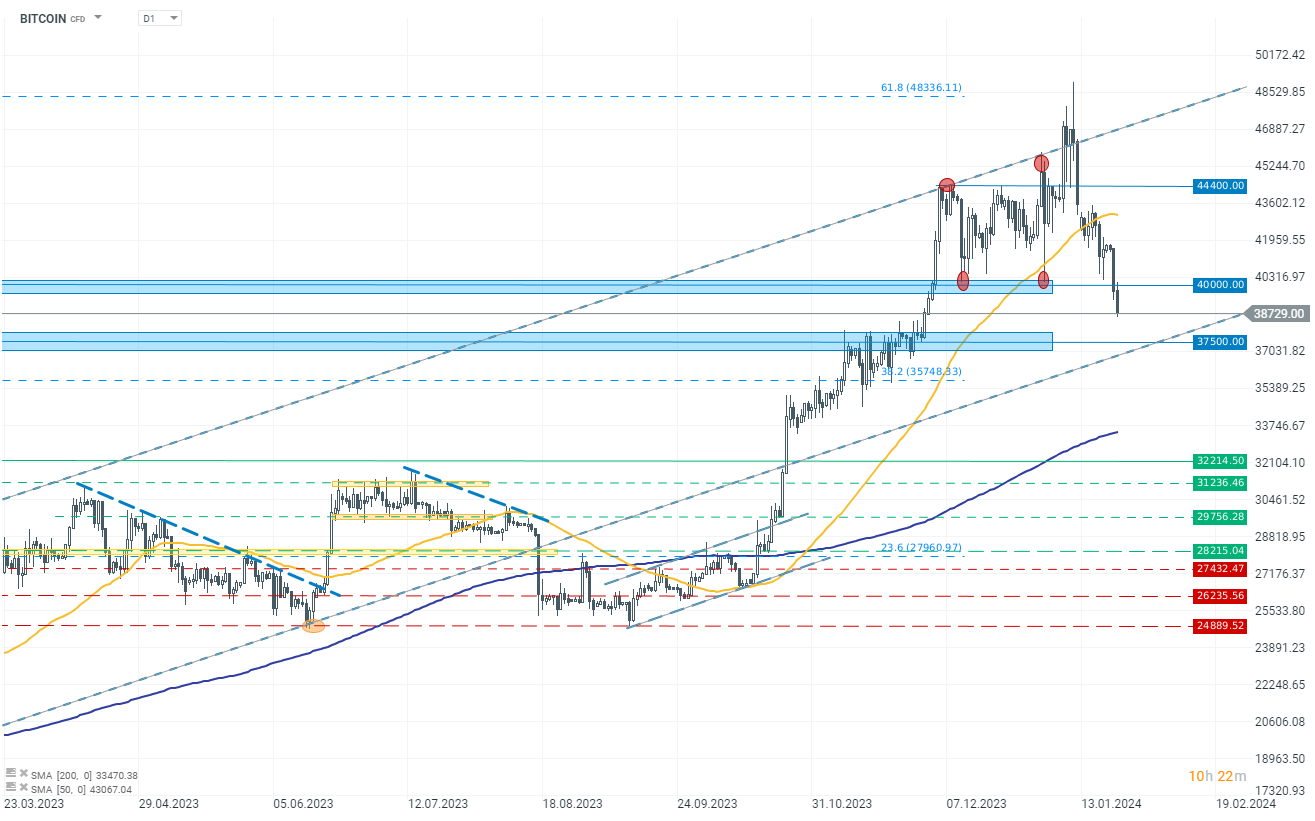

Bitcoin continues to lose value for another consecutive day, with today's decline exceeding 1.60%. Bitcoin's price has broken through two key resistances at 40,000 USD and 39,000 USD, losing over 20% from its peak established shortly after the acceptance of ETFs.

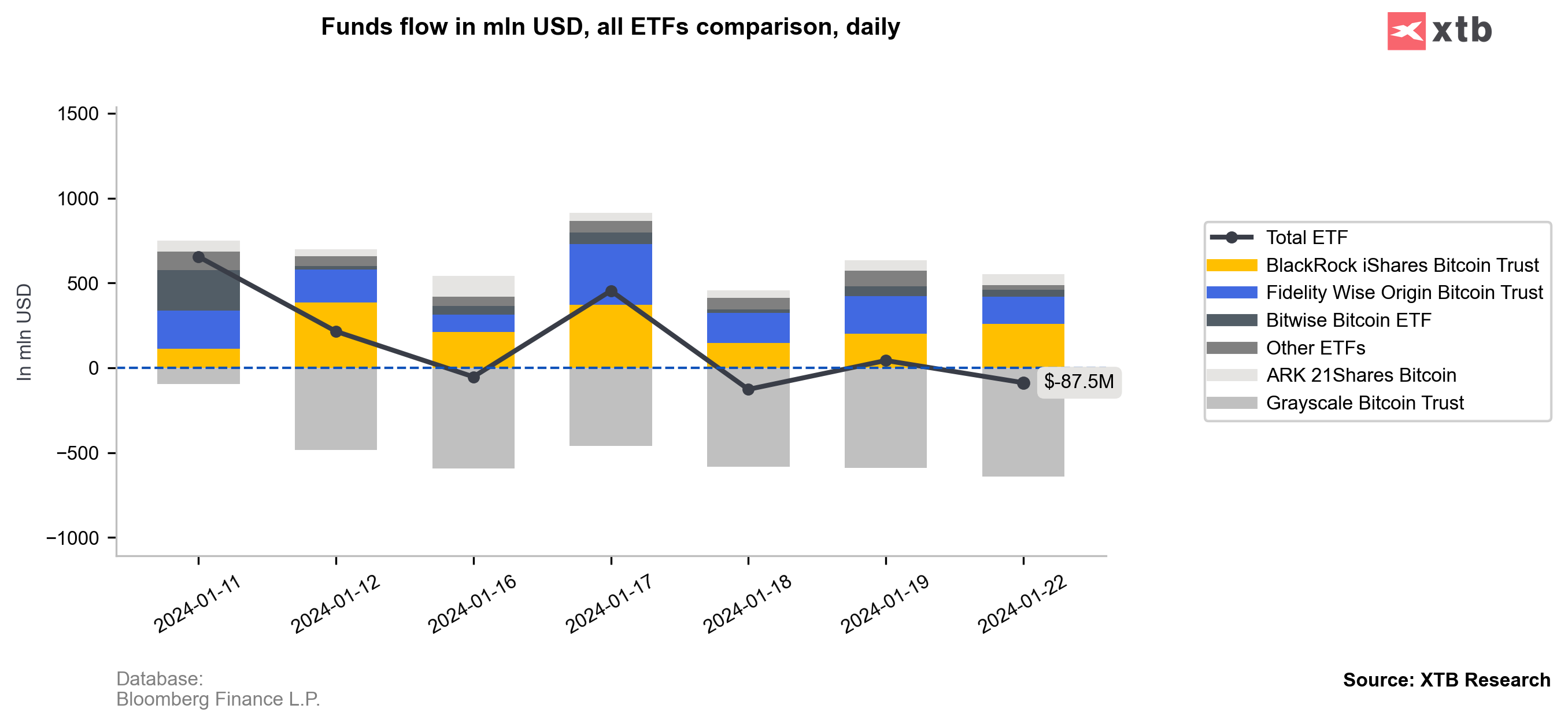

The main factor exerting such significant selling pressure is the sell-off of Grayscale Trust assets, including funds from the collapsed FTX exchange. The scale of outflows is influenced by several factors. Firstly, investors had their capital frozen for several years; secondly, they could buy shares at a significant 40-50% discount; and most importantly, Grayscale introduced management fees in its ETF that are nearly five times higher than its competitors. In such a scenario, it's hard to imagine a rational investor who would choose to keep their funds in the trust. Grayscale has also not yet commented on the issue of fund outflows.

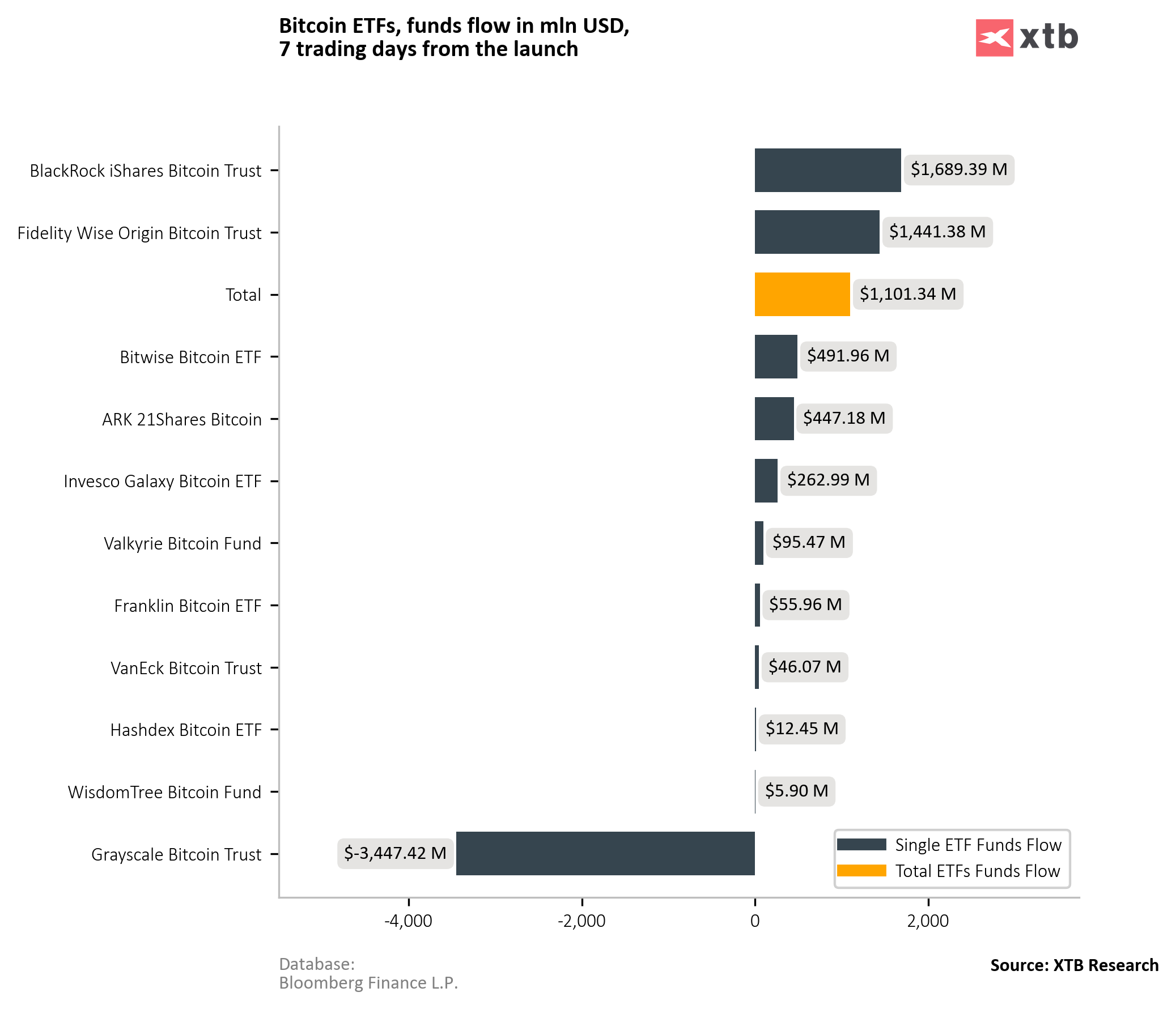

However, it should be noted that there are still net positive capital inflows into all ETFs totaling 1.10 billion USD, despite outflows from Grayscale amounting to nearly 3.45 billion USD. Although the launch of ETFs can be considered disappointing, they still rank high in terms of inflows and turnovers in the first days since their introduction compared to other popular ETFs, and interest remains high.

The sell-off of Grayscale assets may continue for several more weeks. The total assets of the fund have decreased from 28.5 billion USD to 25.9 billion USD currently, which theoretically means the potential for outflows nearly eight times greater than so far. Much also depends on the actions Grayscale takes, as under current conditions, the Grayscale Bitcoin Trust is on a direct path to liquidating all assets.

During today's session, Bitcoin broke below the 39,000 USD barrier and is currently trading above the next support zone around 37,000-38,000 USD.

Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?