- Bitcoin remains in consolidation after a >30% Q4 correction, with risk-off sentiment and equity correlation limiting upside.

- Focus has shifted to Davos, where U.S. crypto regulation — especially the CLARITY Act — is under intense debate.

- Coinbase’s withdrawal of support has delayed legislation, but talks continue and a revised bill is still expected.

- Bitcoin remains in consolidation after a >30% Q4 correction, with risk-off sentiment and equity correlation limiting upside.

- Focus has shifted to Davos, where U.S. crypto regulation — especially the CLARITY Act — is under intense debate.

- Coinbase’s withdrawal of support has delayed legislation, but talks continue and a revised bill is still expected.

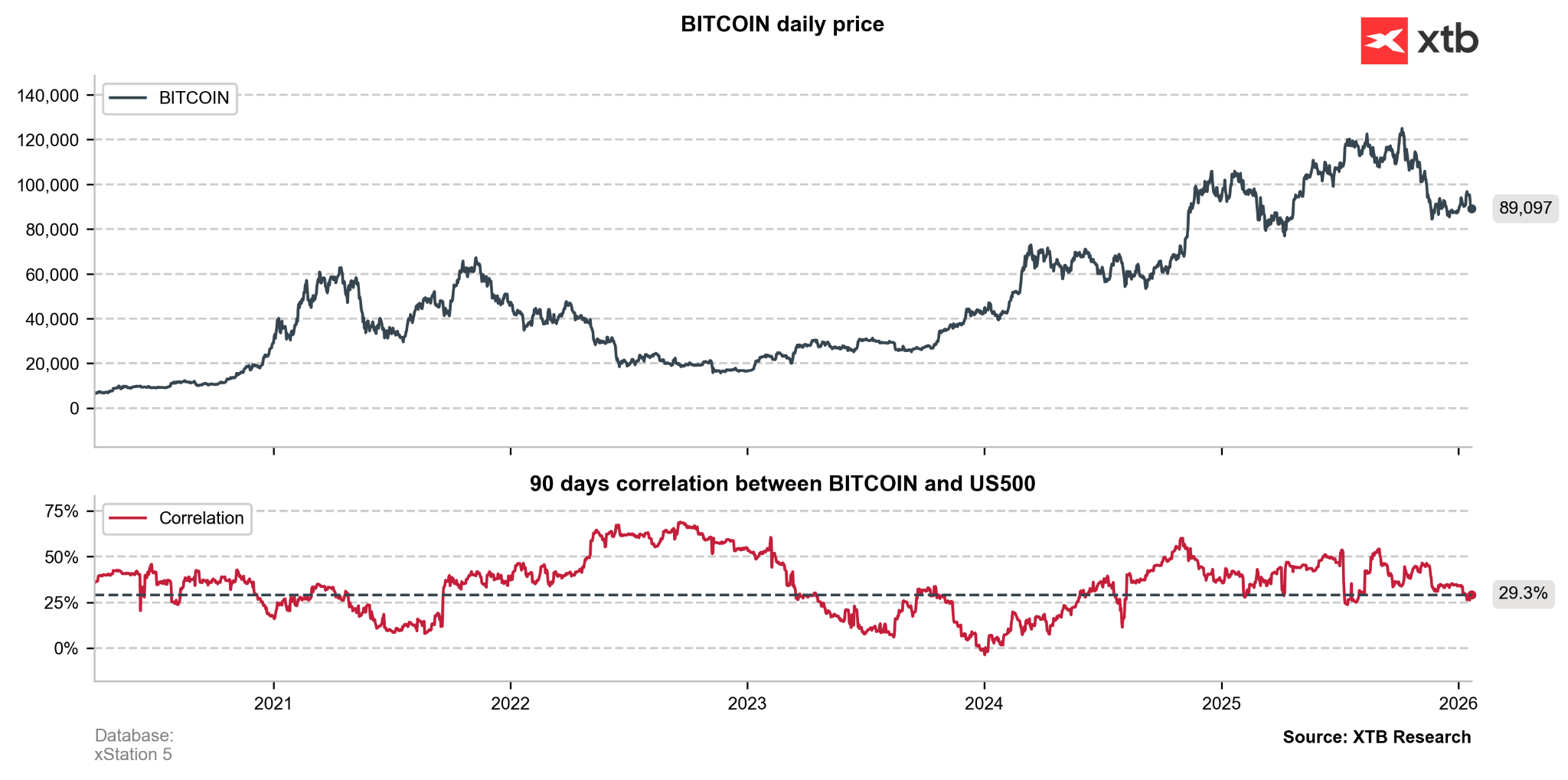

Bitcoin has been going through a difficult period recently. After a correction of more than 30% in Q4 2025, the world’s largest cryptocurrency has remained in consolidation. In recent weeks, Bitcoin even attempted to break higher from this range, but rising international tensions led to a reduction in investors’ risk appetite, pushing Bitcoin back below USD 90,000.

Bitcoin remains more strongly correlated with the US500 index than with gold. The decline in risk appetite is also weighing on demand for cryptocurrencies more broadly.

Market attention has now shifted to Davos, where cryptocurrency regulation—particularly the US CLARITY Act—has become one of the key topics of discussion among policymakers, banks, and leaders from the crypto industry.

Coinbase CEO Brian Armstrong used the opportunity to openly criticize the current version of the CLARITY Act (Crypto Market Structure Act), arguing that it overly favors the traditional financial sector and risks stifling innovation. Coinbase has withdrawn its support for the bill, as it expands the powers of the SEC, restricts DeFi, slows tokenization, and effectively bans interest payments on stablecoins. Armstrong’s stance—“no bill is better than a bad bill”—surprised lawmakers and parts of the industry, leading to delays in the Senate Banking Committee’s work and backlash from some policymakers. At the same time, Armstrong emphasized that discussions remain constructive, the White House is engaged, and a revised bill—more clearly delineating the responsibilities of the SEC and the CFTC—remains likely. Importantly, Davos also highlighted growing institutional acceptance of cryptocurrencies, with major banks and exchanges openly discussing asset tokenization and 24/7 blockchain-based markets, underscoring why clear regulation is now seen as urgent.

Estimated next steps for the CLARITY Act:

- The Senate Banking Committee is expected to review the bill after the legislative pause, addressing the scope of SEC authority, rules on stablecoin yields, and DeFi regulation.

- Continued bipartisan negotiations, with rising pressure from the industry to reach a compromise before legislative momentum fades.

- A possible reintroduction of a revised version of the bill later this month or early next month, featuring a clearer division of responsibilities between the SEC and the CFTC.

Bitcoin is rebounding today by 1.20% to USD 89,300 after yesterday’s nearly 5.00% correction to around USD 88,000.

Source: xStation 5

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

DE40 dips 3% and falls to 2026 lows 🚨📉

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street