Bitcoin is down 2% and deepens recent lows. The price is currently falling to around $25,400. Nearly 4 days ago, investors in the cryptocurrency market were overtaken by euphoria after Grayscale won against the SEC in court. BTC increased by over 7% that day, and some altcoins gained even double-digit percentages.

However, the euphoria did not last long. Due to low liquidity in the market and a lack of new investors, major cryptocurrencies are struggling to maintain high valuations. As emotions cooled, investors began to realize that winning against the SEC does not unequivocally mean the acceptance of a BTC spot ETF, but only the possibility for Grayscale to reapply, and the need for the SEC to re-examine this application. Additionally, the SEC has 90 days to appeal the decision. The declines accelerated yesterday after the SEC did not accepted all other pending applications, including BlackRock's fund. The next deadline for revision of the applications is in mid-October.

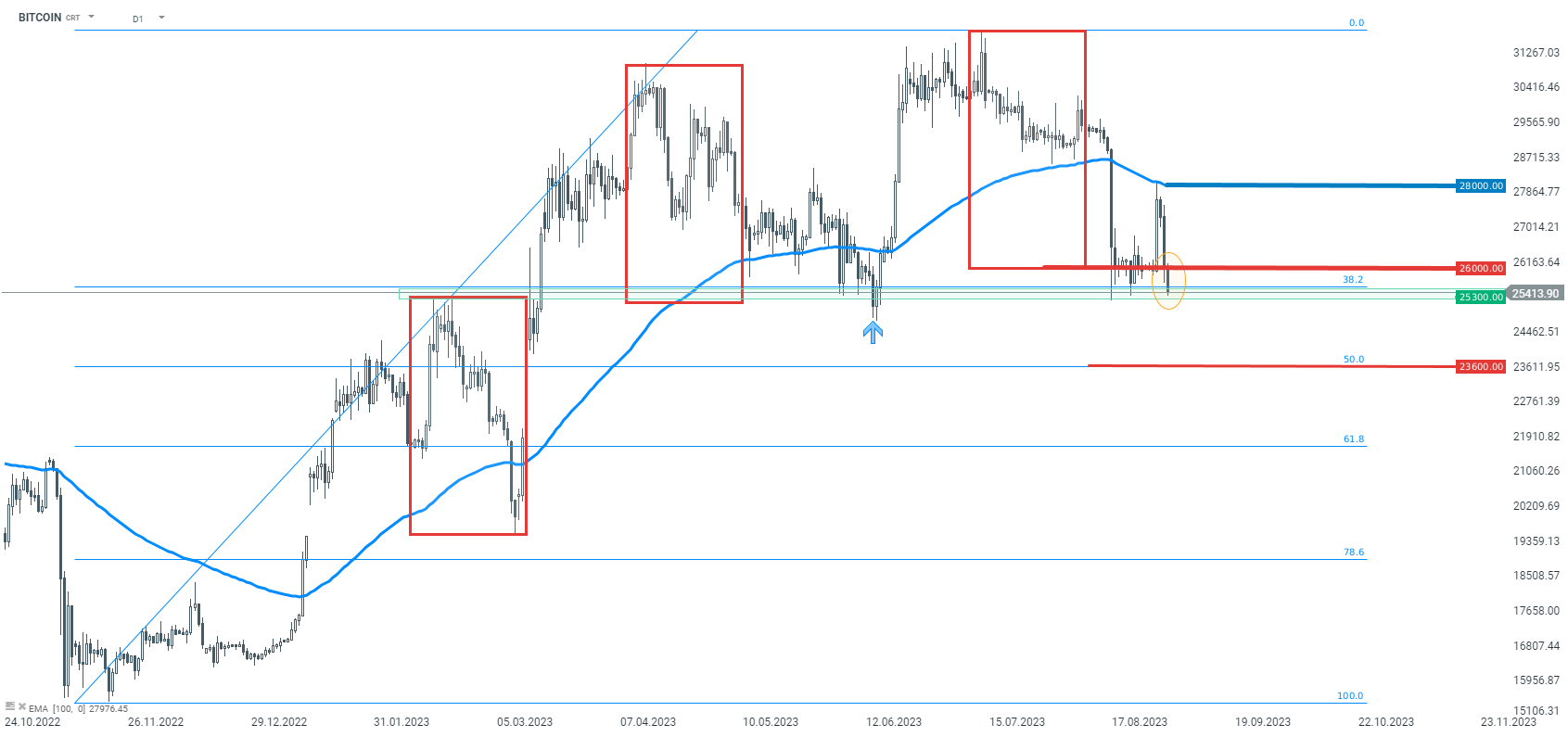

Technically looking at the D1 interval, Bitcoin prices recently reacted at the support level of $26,000 (slightly breaching it earlier). This level stemmed from the lower limit of a broad 1:1 pattern. According to the Overbalance methodology, defending this level could result in a move to new highs. However, the upward movement was halted at the level of the 100-day EMA, after which the price dynamically moved downward. We are currently observing another attempt to negate the 1:1 geometry. Attention should be paid to the horizontal support zone at the level of $25,300, which is currently being tested. If this level is breached, the price drop may intensify. The next noteworthy support level is only at $23,600, which results from a 50% measurement of the last upward wave. Source: xStation5

Technically looking at the D1 interval, Bitcoin prices recently reacted at the support level of $26,000 (slightly breaching it earlier). This level stemmed from the lower limit of a broad 1:1 pattern. According to the Overbalance methodology, defending this level could result in a move to new highs. However, the upward movement was halted at the level of the 100-day EMA, after which the price dynamically moved downward. We are currently observing another attempt to negate the 1:1 geometry. Attention should be paid to the horizontal support zone at the level of $25,300, which is currently being tested. If this level is breached, the price drop may intensify. The next noteworthy support level is only at $23,600, which results from a 50% measurement of the last upward wave. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?