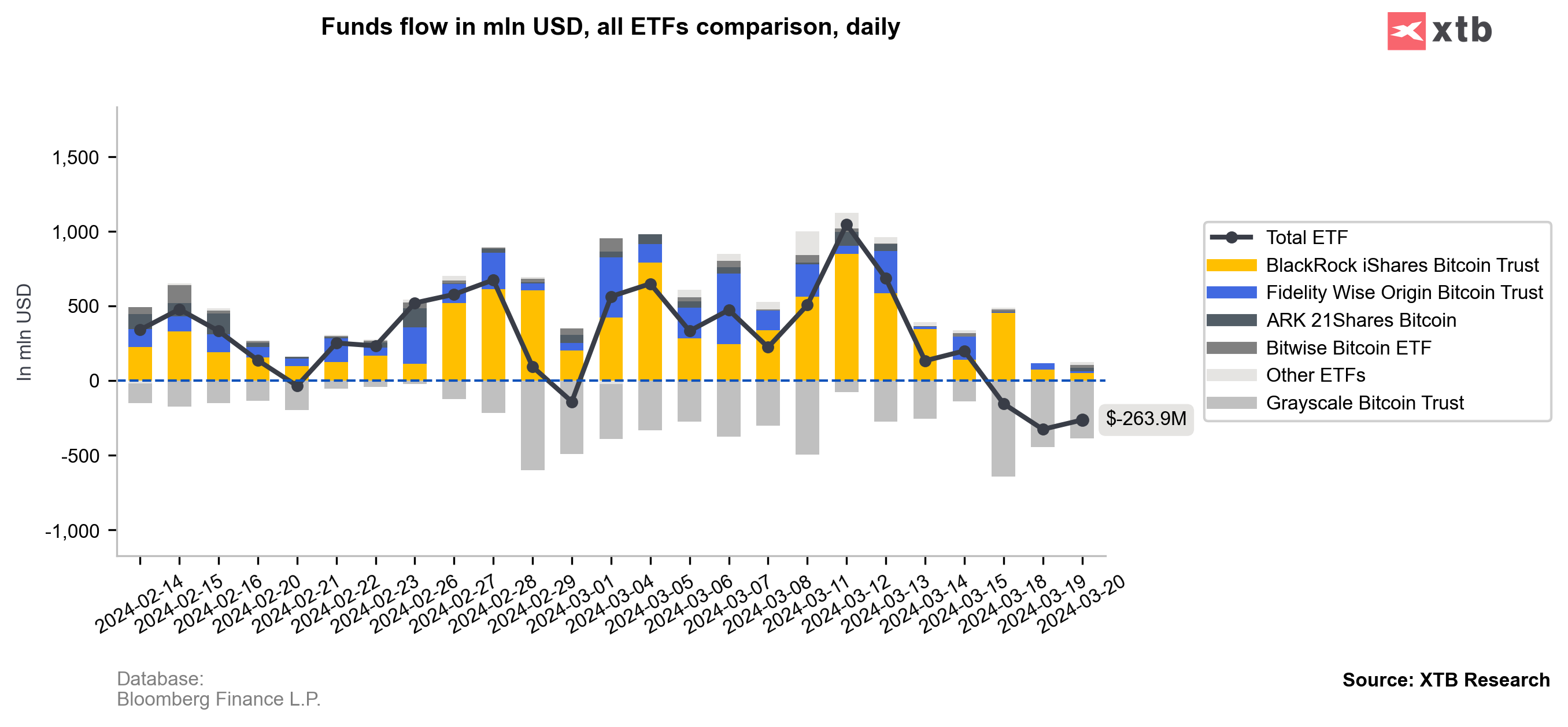

Bitcoin, world's most famous cryptocurrency, drops almost 3% today, breaking below the $66,000 mark. The move looks to be a driven by profit taking following yesterday's post-FOMC surge. The surge yesterday seems to have been just a brief pause in the ongoing correction, that was launched after the coin reached fresh all-time highs above $73,000 mark last week. However, the move lower can also be to a some extent explained with an uptick in US yields and recovery on USD market today. Taking a look at ETF flows data, we can see that inflows into Bitcoin ETFs have been very small recently. Bitcoin funds are experiencing the longest streak of outflows since launched of spot Bitcoin ETFs earlier this year. A net outflow of almost $264 million were recorded yesterday.

Bitcoin funds are experiencing the longest streak of outflows since ETFs were launched in January. Outflows from Monday to Wednesday this week amounted to over $740 million. Source: Bloomberg Finance LP, XTB Research

BITCOIN plunged below $66,000 mark today and is now testing $65,000 support zone, marked with previous price reactions and 50-hour moving average (green line). Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?