The beginning of a new trading week on the global financial markets have been calm so far. Some bigger moves could be spotted on equities from Asia-Pacific earlier today, with Australian and Japanese indices dropping, while stocks from China gained. However, no follow-through could be observed during the European trading session, with major indices from the Old Continent trading little changed today. Wall Street indices are trading lower. However, there is one asset class that is experiencing big moves today in the early afternoon - cryptocurrencies!

Rally on the cryptocurrency markets is not stopping, with Bitcoin adding another 5% today. The most famous cryptocurrency reached fresh record highs today, climbing above the $72,000 mark for the first time in history earlier during the day. Gains can also be spotted on other major coins, with ETHEREUM adding over 5% and trading above $4,000 mark. The biggest moves can be seen on altcoins like AVALANCHE or LITECOIN, which gains over 10%.

BITCOIN jumps above $72,000 for the first time in history. Source: xStation5

ETHEREUM climbs above $4,000 mark for the first time since late-December 2021. Source: xStation5

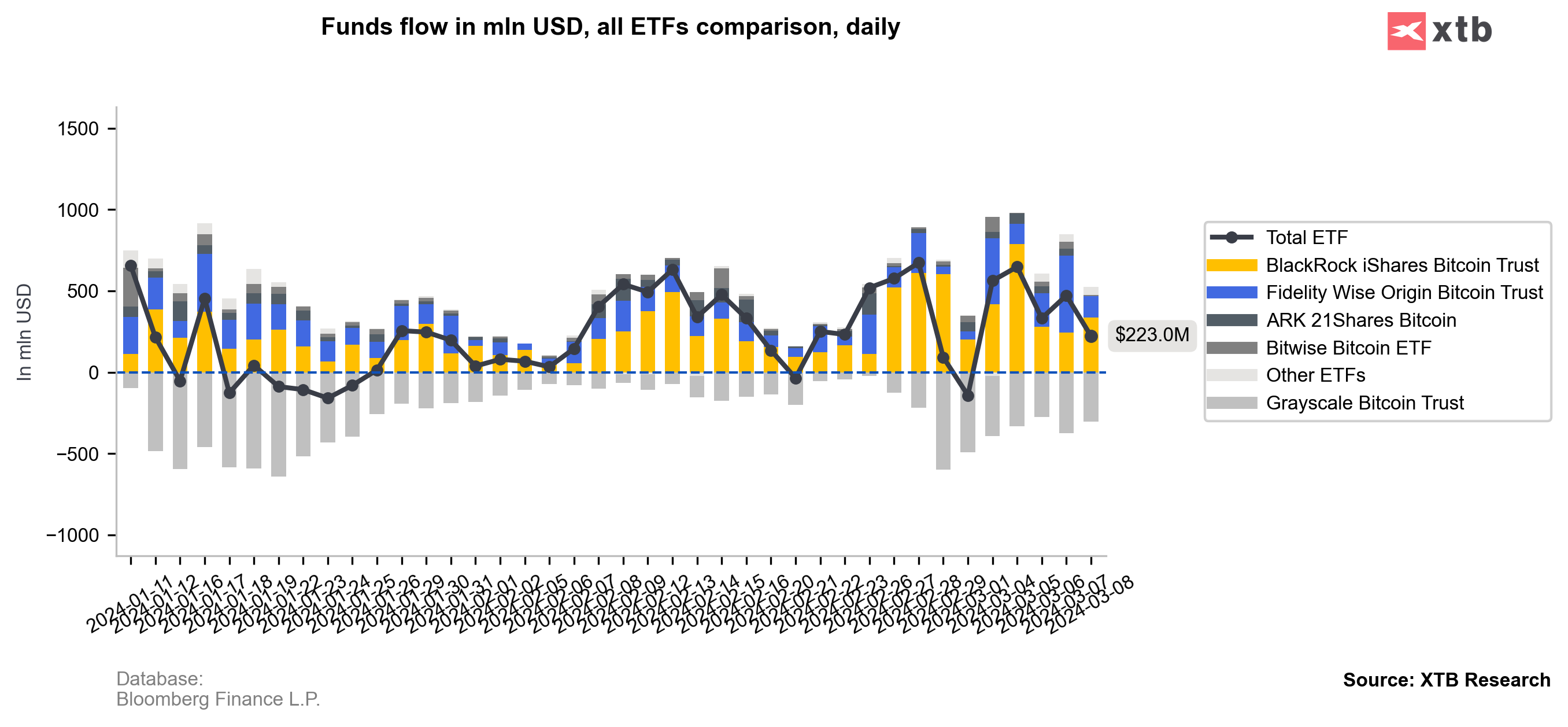

Flows into Bitcoin ETFs have eased recently but remain strong with over $200 million in new net inflows being made on Friday, March 8. Source: Bloomberg Finance LP, XTB

Flows into Bitcoin ETFs have eased recently but remain strong with over $200 million in new net inflows being made on Friday, March 8. Source: Bloomberg Finance LP, XTB

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?